NVE Corporation's (NASDAQ:NVEC) 27% Share Price Surge Not Quite Adding Up

NVE Corporation NVEC | 0.00 |

NVE Corporation (NASDAQ:NVEC) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 3.2% over the last year.

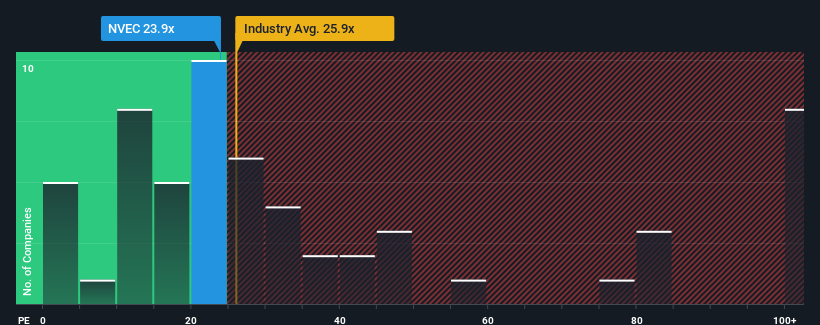

After such a large jump in price, NVE may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 23.9x, since almost half of all companies in the United States have P/E ratios under 17x and even P/E's lower than 10x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

For example, consider that NVE's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Does Growth Match The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like NVE's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 13% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that NVE is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

NVE's P/E is getting right up there since its shares have risen strongly. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of NVE revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with NVE, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on NVE, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

موصى به

- Benzinga News 03/11 09:59

سوق الأسهم اليوم: ارتفاع العقود الآجلة لمؤشري ستاندرد آند بورز 500 وداو جونز بعد مكاسب أكتوبر المذهلة - مايكرون تك، بالانتير، هيمز وهيرز في دائرة الضوء

Benzinga News 03/11 10:02هل ينبغي لتحالف Nvidia التابع لشركة Navitas (NVTS) وتقدمات Power Tech أن يدفعا المستثمرين إلى نظرة جديدة؟

Simply Wall St 03/11 11:22بافيت يبيع أسهمه - هذا ما ينبغي على المستثمرين الحذرين فعله الآن؛ أوبك+ تُغيّر موقفها

Benzinga News 03/11 16:13سيتي جروب تُبقي على توصيتها بشراء سهم مونوليثيك باور سيستمز، وترفع سعره المستهدف إلى 1250 دولارًا

Benzinga News 03/11 20:18اختراق وتراجع | خمسة أسهم تستحق الاهتمام: IDXX وAMKR وغيرهما

Insights 04/11 03:29هل تكتسب شركة Monolithic Power Systems Inc الدعم في السوق أم تخسره؟

Benzinga News 04/11 13:01هل ستؤدي أرباح شركة Skyworks (SWKS) في الربع الرابع وتأكيد توزيع الأرباح إلى تغيير سردية نموها؟

Simply Wall St 04/11 17:29