Please use a PC Browser to access Register-Tadawul

nVent Electric (NVT) Is Up 14.5% After Doubling Half-Year Net Income on Margin Expansion Success

nVent Electric plc Ordinary Shares NVT | 101.11 | -1.46% |

- nVent Electric plc recently reported its second quarter and half-year 2025 earnings, with second quarter sales reaching US$963.1 million, up from US$739.8 million a year earlier, and half-year net income more than doubling to US$470.2 million compared to the same period last year.

- This performance was driven by both organic growth and earnings improvements, while substantial increases in earnings per share highlighted effective cost and operational management alongside expanding revenue streams.

- We'll explore how the strong half-year earnings growth underscores nVent Electric's ongoing margin improvement efforts and evolving investment case.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

nVent Electric Investment Narrative Recap

To be a shareholder in nVent Electric, you need to believe in the company’s ability to capitalize on accelerating demand in sectors like data centers and electrical infrastructure, powered by organic and acquisition-fueled growth. The latest earnings show strong six-month sales and profit expansion, but limited quarterly net income growth highlights that margin management and cost control remain near-term catalysts, while exposure to tariffs and integration risks still loom large. The news is encouraging for near-term momentum but does not materially resolve the biggest risk: sustained pressure on margins from macroeconomic and cost volatility.

nVent’s recent announcement of a US$275 million term loan facility and US$600 million revolving credit facility is directly relevant, as it strengthens the balance sheet and increases the company’s financial flexibility to pursue growth initiatives. This supports nVent’s efforts to manage working capital and invest in high-growth areas, particularly as it integrates recent acquisitions and navigates changing market demand.

But just as strong sales can boost confidence, investors should also be aware that margin pressures tied to global input costs remain a...

nVent Electric's outlook anticipates $4.2 billion revenue and $563.7 million earnings by 2028. This scenario assumes an 11.1% annual revenue growth rate and a $321.1 million increase in earnings from $242.6 million today.

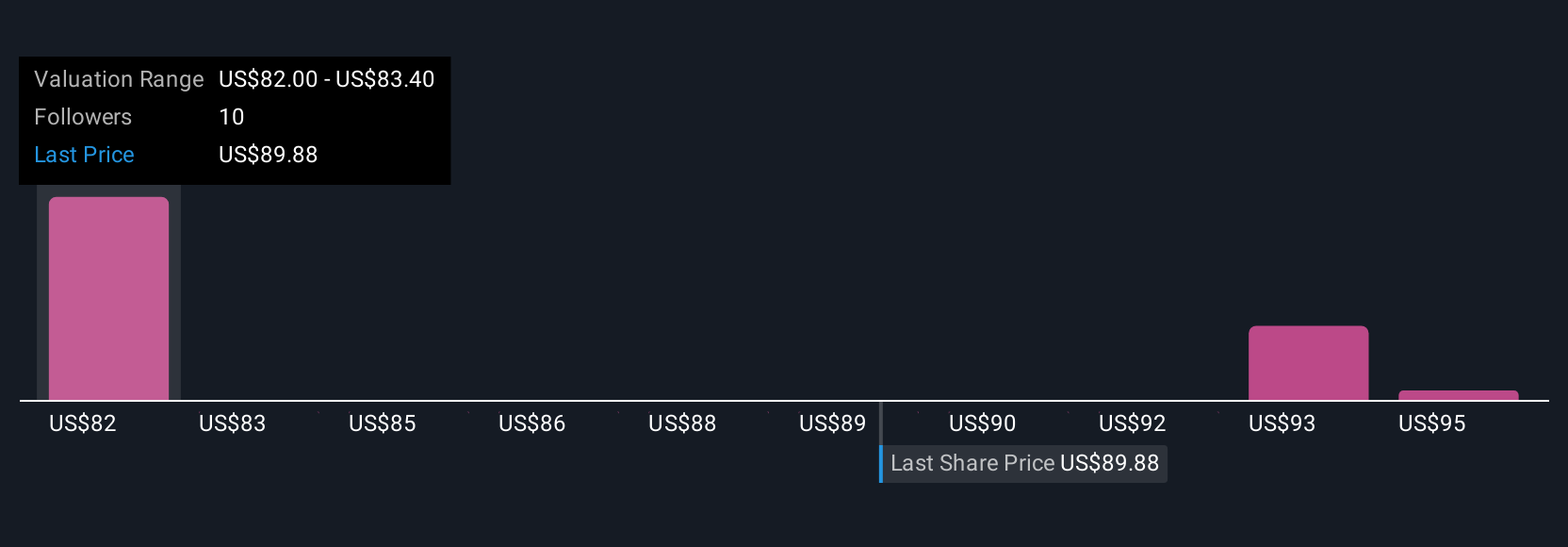

Uncover how nVent Electric's forecasts yield a $82.00 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate nVent’s fair value in a range from US$82.00 to US$96.00, with three distinct investor perspectives. As demand for data solutions accelerates, your view on whether growth can outpace ongoing margin pressures may shape your outlook, see how opinions differ and compare for yourself.

Explore 3 other fair value estimates on nVent Electric - why the stock might be worth 9% less than the current price!

Build Your Own nVent Electric Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nVent Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free nVent Electric research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nVent Electric's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.