Please use a PC Browser to access Register-Tadawul

Nvidia Now Represents 8% Of S&P 500: Highest Market Share For Any Company Since 1974

Apple Inc. AAPL | 259.88 | +0.94% |

General Motors Company GM | 74.69 | -0.69% |

ESS Tech Inc GWH | 1.30 | 0.00% |

IBM Corp IBM | 253.33 | -2.13% |

NVIDIA Corporation NVDA | 182.65 | +2.72% |

Chipmaker NVIDIA Corp. (NASDAQ:NVDA) has surpassed Apple Inc. (NASDAQ:AAPL) as the most dominant company in the S&P 500, with an average weightage that hasn’t been seen for several decades.

NVDA shares are trending higher. See what is happening here.

Unprecedented Market Cap Concentration

On Wednesday, in a post on X, The Kobeissi Letter highlighted that Nvidia “has reflected 8% of the S&P 500’s market cap on average in 2025, the highest percentage of any company in the index.”

See Also: Nvidia CEO Jensen Huang Hails Release of Israeli Engineer Avinatan Or After Two Years in Hamas Captivity: ‘Close Of A Painful Chapter’

“It has surpassed Apple, $AAPL, which held the top spot for the previous 6 consecutive years,” after the chipmaker edged out the Cupertino-based giant to become the most valuable company in the world, around the same period last year.

“Nvidia's market weight is now the largest for any company since 1974,” the post said, highlighting IBM Inc. (NYSE:IBM) as the previous holder of this title, having “dominated the market for 15 years through the 1970s and 1980s,” after General Motors Co. (NYSE:GM) did the same “for 18 years during the 1950s–1970s.”

NVIDIA Leapfrogs Entire Nations

In recent months, NVIDIA’s $4.37 trillion market capitalization has surpassed the GDP of nation-states such as Canada, which stood at $2.24 trillion in 2022.

The company that now makes up 5.04% of the MSCI All Country World Index, is single-handedly ahead of Japan, the world’s third-largest stock market, at 4.78%, alongside China, the U.K. and Canada, at 3.33%, 3.23% and 2.92%, respectively.

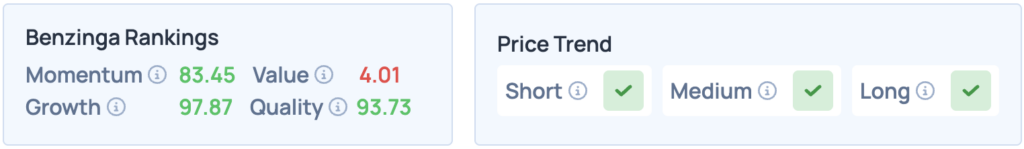

Nvidia shares were down 0.09% on Wednesday, closing at $179.83, but are up 1.05% in overnight trade, and the stock is up 30% year-to-date. It scores well in Benzinga’s Edge Stock Rankings, and has a favorable price trend in the short, medium and long terms. Click here for deeper insights on the stock, its peers and competitors.

Read More:

- Nvidia To Rally Around 76%? Here Are 10 Top Analyst Forecasts For Wednesday

Photo courtesy: Shutterstock