NXP Semiconductors (NasdaqGS:NXPI) and Drive TLV Partner on Autonomous Driving Tech

NXP Semiconductors NV NXPI | 0.00 |

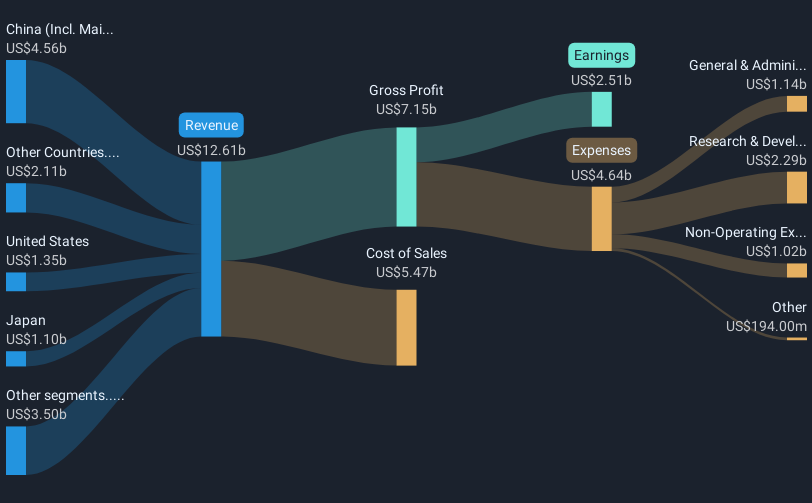

NXP Semiconductors (NasdaqGS:NXPI) recently announced a collaboration with Drive TLV, aimed at advancing technologies in autonomous driving and AI-enabled applications, which likely supported the company's 11% price increase over the past month. This partnership allows the company to tap into innovative solutions within the automotive sector, enhancing its market position. Amid a general market trend where major indices, such as the S&P 500 and Nasdaq Composite, have been rising with investor optimism around potential U.S.-China trade developments, NXP's movements align with the positive momentum seen in broader tech and semiconductor stocks.

The collaboration between NXP Semiconductors and Drive TLV is set to reinforce its prowess in autonomous driving and AI applications, which aligns with the company's strategic focus on enhancing its product differentiation and market position in the automotive sector. This move may bolster NXP's revenue through increased automotive content, aiding revenue stability even amidst global automotive production challenges. The Kinara acquisition further complements this trajectory, potentially enhancing NXP’s edge in AI-enabled edge computing and driving future revenue growth in automotive and industrial segments.

Over the past five years, NXP Semiconductors has delivered a total return of 110.66%, indicating significant value creation for its shareholders. However, recent performance over the last year shows the company underperforming the US Semiconductor industry, which registered a 10.9% return compared to NXP’s lower growth rate. This underperformance highlights the volatile nature of the sector, which NXP must navigate carefully through strategic initiatives like its insider collaborations and acquisitions.

The ongoing partnership with Drive TLV could lead NXP to revise its revenue and earnings forecasts upwards if the anticipated technology advancements translate to increased market share and enhanced margins. Today's share price of US$182.41 remains below the consensus price target of US$234.07, showing a potential upside according to market analysts. This discount suggests that while short-term performance has been below industry averages, there could be room for appreciation if the company's strategies successfully materialize into financial performance improvements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Recommend

- Simply Wall St 23/11 12:42

Revolut valued at $75 billion after secondary share sale

Reuters 24/11 08:44Credo Technology Reaches License Agreement With Siemon Regarding Credo's Patents Covering Its Active Electrical Cable Technology

Benzinga News 24/11 14:05Alibaba, Oscar Health, Ondas Holdings, Lumentum, Tesla And Other Big Stocks Moving Higher On Monday

Benzinga News 24/11 16:06Morgan Stanley Maintains Equal-Weight on ON Semiconductor, Raises Price Target to $56

Benzinga News 24/11 16:32مقدمة 1-بلومبرج نيوز: ترامب يدرس بيع رقائق إنفيديا المتقدمة للصين

Reuters 24/11 16:41Today's Market Focus: The "Big Short" Returns to Battle the "AI King" —— NVIDIA

Insights Today 08:44How Investors May Respond To NXP Semiconductors (NXPI) Q4 2025 Dividend and Acquisition Moves

Simply Wall St 1h