Please use a PC Browser to access Register-Tadawul

Oceaneering International (OII) Is Up 6.9% After Upbeat Subsea Robotics Outlook And Diversification Push

Oceaneering International, Inc. OII | 34.79 | -3.84% |

- In recent days, Oceaneering International has attracted heightened attention as analysts raised earnings estimates and highlighted stronger demand across its subsea robotics and offshore services businesses.

- Investor interest has also been supported by the company’s push into defense and other non-energy applications, which is seen as enhancing diversification away from traditional offshore oil and gas cycles.

- We’ll now examine how this improving analyst sentiment around Oceaneering International’s subsea robotics demand could shape the company’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Oceaneering International's Investment Narrative?

To own Oceaneering International, you have to be comfortable with a business still closely linked to offshore activity, but increasingly defined by its subsea robotics, technology services and a more diversified customer base. The big near term catalyst remains the upcoming Q4 2025 results and any update to 2026 guidance, which will show whether recent earnings momentum and improving margins are holding up. The latest news of stronger subsea demand and higher earnings estimates fits neatly into that story, reinforcing the idea that robotics and non-energy contracts can support profitability even as management has flagged softer Q4 revenue versus last year. That said, the sharp share price move and the stock trading above the current consensus price target suggest expectations are already higher, raising the risk that any earnings disappointment or slower contract awards could have an outsized impact.

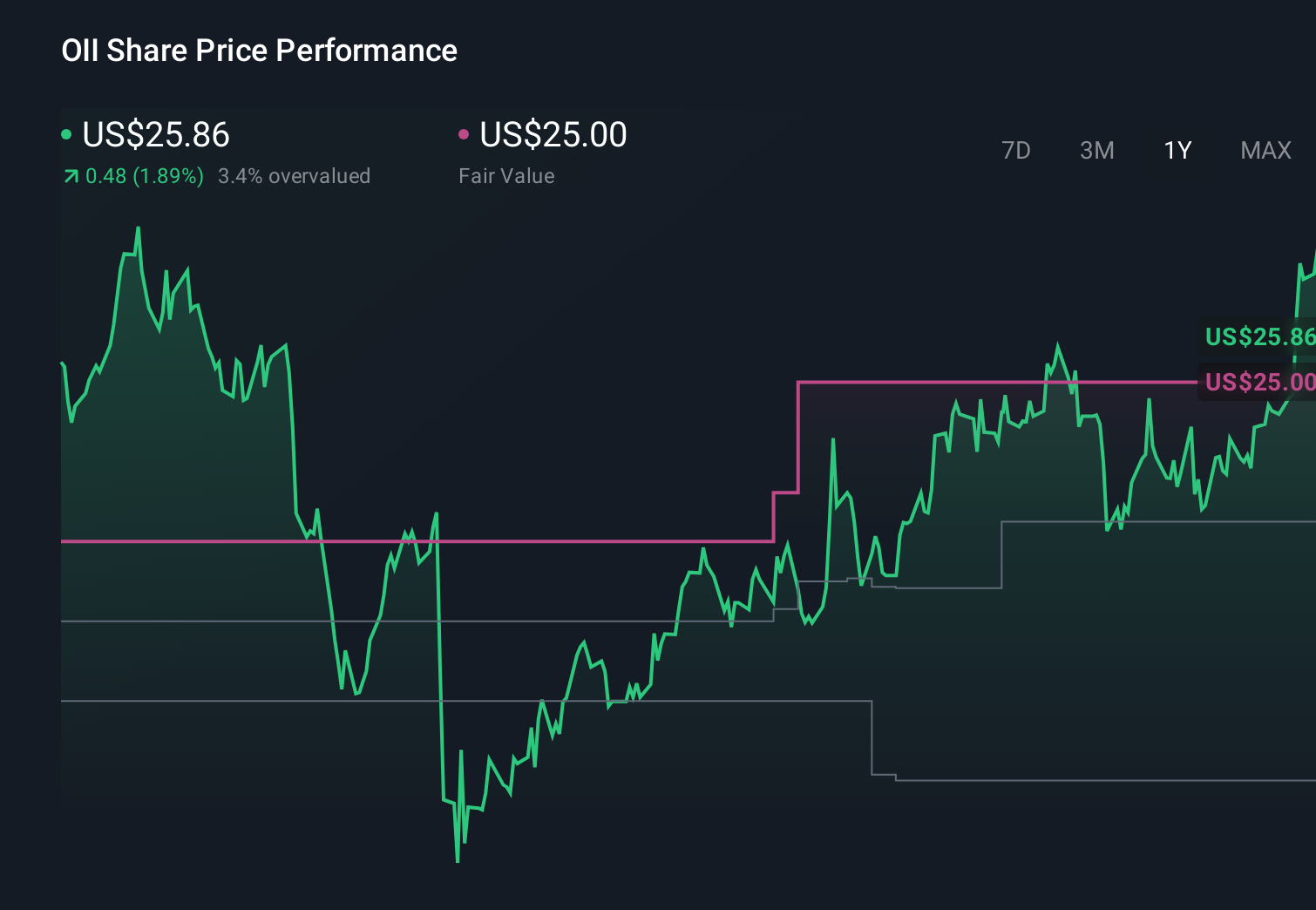

However, one key operational risk tied to offshore and defense contract volatility is easy to overlook. Oceaneering International's shares have been on the rise but are still potentially undervalued by 16%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Oceaneering International - why the stock might be worth as much as 19% more than the current price!

Build Your Own Oceaneering International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oceaneering International research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oceaneering International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oceaneering International's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.