Please use a PC Browser to access Register-Tadawul

Ocular Therapeutix (OCUL): Exploring Valuation as Investor Interest Grows in Biotech Prospects

Ocular Therapeutix Inc OCUL | 14.39 | +1.55% |

Ocular Therapeutix’s share price has bounced around in recent months, reflecting some shifting sentiment after earlier biotech volatility. Over the past twelve months, total shareholder return has landed at 20%, hinting at building momentum under the surface.

If Ocular’s recent moves pique your interest, it could be the perfect moment to check out other up-and-coming healthcare and biotech names with our See the full list for free.

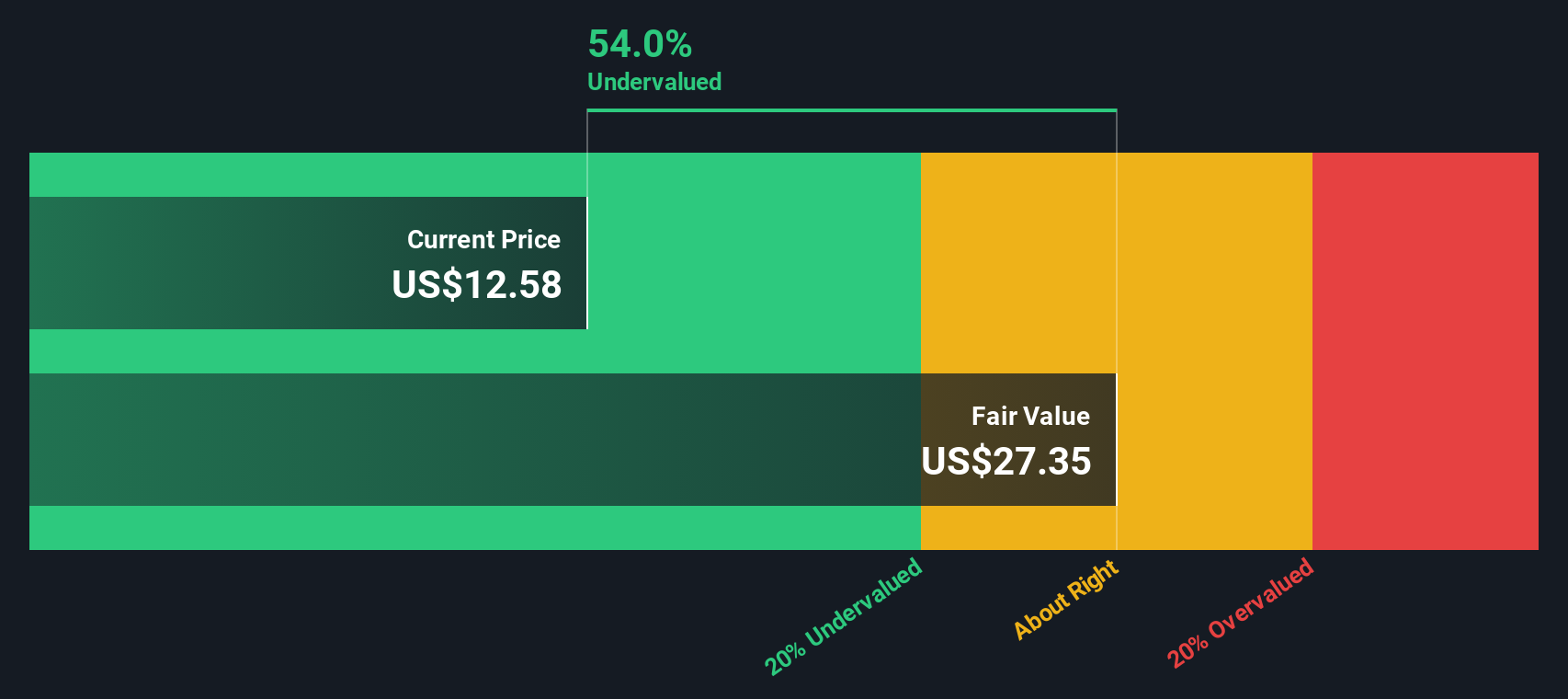

With shares still trading well below analyst targets and recent growth trends coming into focus, the key question becomes clear: is Ocular Therapeutix undervalued at today's levels, or is the market already pricing in its future potential?

Most Popular Narrative: 45% Undervalued

With Ocular Therapeutix closing at $11.06, the most popular narrative pegs fair value dramatically higher, suggesting substantial upside if key assumptions hold. This gap is fueling debate among biotech investors on whether momentum can be sustained as future milestones approach.

The anticipated approval of AXPAXLI, potentially the first wet AMD product with a superiority label and longer dosing intervals (every 6, 12 months), may allow Ocular Therapeutix to capture significant market share in a rapidly growing population of elderly patients with retinal disease, unlocking large revenue growth opportunities as the global prevalence of ophthalmic disorders increases.

Wondering what ambitious projections are driving this aggressive price target? There’s a bold forecast for sky-high revenue growth and a future profit margin on par with industry leaders. Want to discover which blockbuster financial leaps power this call? See the full narrative to uncover the numbers and hidden pressure points behind the valuation.

Result: Fair Value of $20.17 (UNDERVALUED)

However, delays in pivotal trial results or increased competition from established players could quickly challenge the case for substantial upside in the future.

Another View: SWS DCF Model Paints a Different Picture

Switching perspectives, our DCF model estimates Ocular Therapeutix's fair value at $30.73, which is substantially higher than its current share price. This result suggests the market could be missing further upside, especially if growth forecasts pan out. Are investors too cautious or is hidden risk holding shares back?

Build Your Own Ocular Therapeutix Narrative

If you want to form your own conclusions, you can dive into the numbers and build a personalized outlook of Ocular Therapeutix in just a few minutes. Do it your way

A great starting point for your Ocular Therapeutix research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move before the rest of the market catches on. Broaden your search now for opportunities you don’t want to miss out on.

- Boost your portfolio with high-yield picks by checking out these 19 dividend stocks with yields > 3%, featuring companies offering attractive returns above 3%.

- Leap ahead of the curve by seeking breakthroughs in next-generation computing via these 26 quantum computing stocks, and spot pioneers in quantum algorithms and innovative tech.

- Power up your holdings with growth and innovation by exploring these 24 AI penny stocks, where artificial intelligence is reshaping entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.