Please use a PC Browser to access Register-Tadawul

OFG Bancorp (OFG) Net Margin Of 32.9% Reinforces Bullish Quality Narratives

OFG Bancorp OFG | 42.66 | +1.26% |

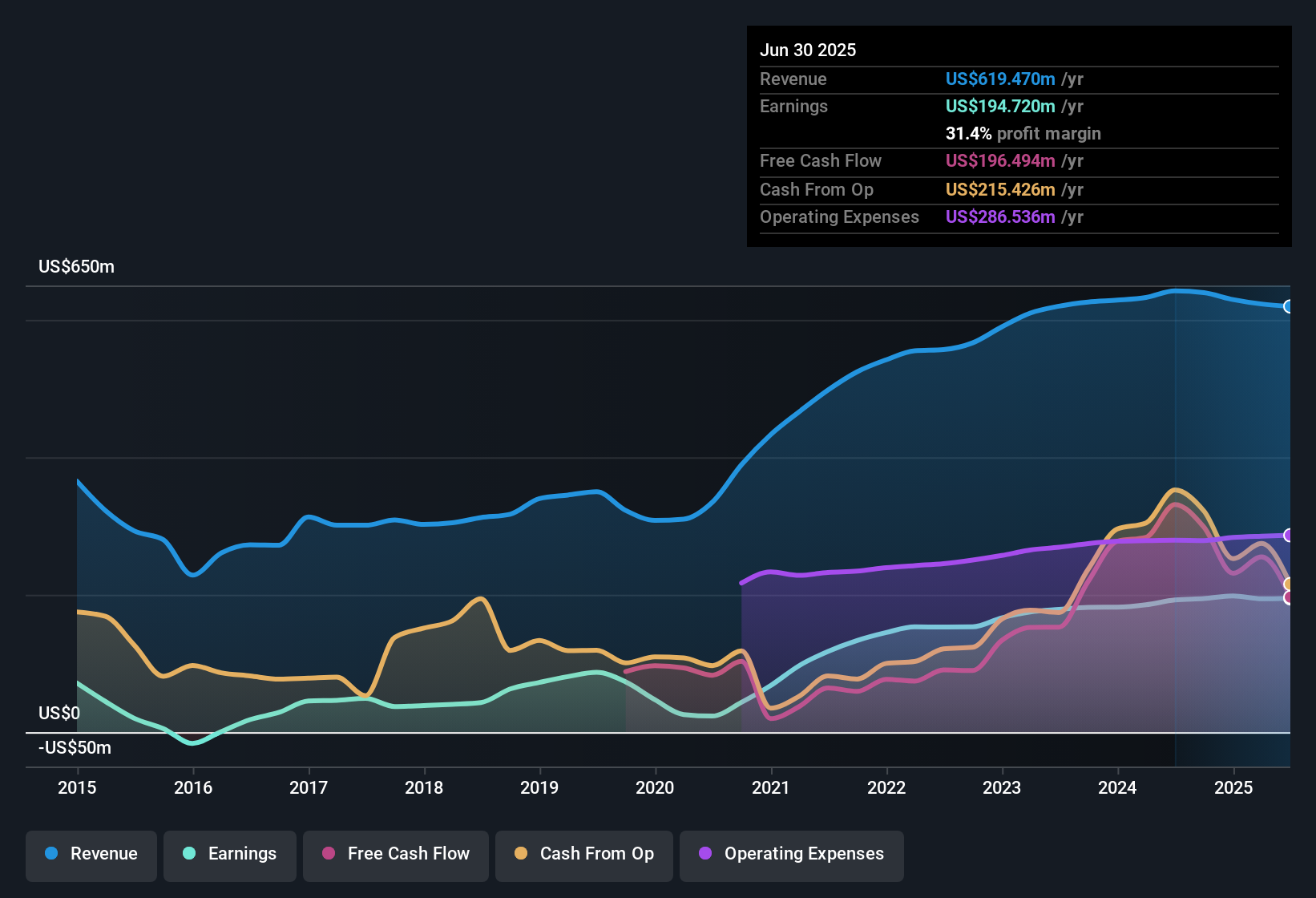

OFG Bancorp (OFG) closed out FY 2025 with fourth quarter revenue of US$152.4 million and EPS of US$1.26, while trailing twelve month revenue came in at US$623.9 million and EPS at US$4.63. Over recent periods, revenue has ranged from US$152.5 million in Q4 2024 to US$160.7 million in Q2 2025, with quarterly EPS moving from US$1.10 in Q4 2024 to US$1.26 in Q4 2025 and trailing net income reaching US$205.1 million. This context frames how investors may look at the bank’s approach to managing profitability and margins through this cycle.

See our full analysis for OFG Bancorp.With the headline numbers on the table, the next step is to see how this earnings profile lines up against the widely followed stories around OFG, highlighting where the data supports the narrative and where it pushes back.

32.9% net margin and what it says about quality

- On a trailing basis, OFG converted US$623.9 million of revenue into US$205.1 million of net income, which works out to a 32.9% net margin compared with 31.5% a year earlier.

- Bulls point to this margin level as support for a quality story, but the data cuts both ways:

- Five year earnings growth of 13.1% per year lines up with that 32.9% margin and suggests the bank has been able to turn revenue into profit consistently, while one year earnings growth of 3.5% sits well below that multi year pace.

- Quarter by quarter in FY 2025, net income excluding extra items ranged from US$45.6 million in Q1 to US$55.9 million in Q4, which backs up the idea that profitability is solid, yet the slower recent growth rate keeps the bullish case grounded in what has actually shown up in the numbers.

Loan book, asset quality and earnings risk

- Total loans in the quarterly data sit in the US$7.8b to US$8.2b range, alongside non performing loans moving from US$79.6 million in Q3 2024 to US$99.0 million in Q3 2025, which gives you a sense of the credit exposure behind those profits.

- Bears focus on the earnings risk in the forecasts and these balance sheet figures:

- The supplied analysis flags that earnings are expected to decline by about 2% per year over the next three years, and the uptick in non performing loans from US$82.98 million in Q4 2024 to US$99.04 million in Q3 2025 fits with that more cautious stance on future profitability.

- At the same time, OFG still produced trailing net income of US$205.1 million on that loan base, so while the risk side of the debate leans on the forward looking 2% annual decline, the recent credit and profit numbers show the bank is entering that phase from a position of currently healthy earnings.

Low 8.4x P/E against growth and forecast slowdown

- The shares trade on a trailing P/E of 8.4x at a US$38.98 price, versus 14x for peers and 12.1x for the wider US Banks group, with a DCF fair value of about US$103.48 and an analyst price target of US$47.60 in the supplied data.

- What stands out for the valuation discussion is how those numbers sit between bullish and bearish talking points:

- On the supportive side, OFG has grown earnings at 13.1% per year over five years, yet the stock trades below both the peer P/E and the US Banks P/E, and the DCF fair value of roughly US$103.48 is well above the current US$38.98 price.

- On the cautious side, the same dataset highlighting that discount also notes forecasts for about a 2% annual earnings decline over the next three years and flags recent insider selling and an unstable dividend record, which are the main pieces bears use to question how much weight investors should put on the low multiple and valuation gap.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on OFG Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

OFG’s story combines a low 8.4x P/E and healthy recent earnings with a forecast 2% annual earnings decline over the next three years and concerns about insider selling.

If that potential slowdown and caution around insider activity give you pause, you can instead focus on stable growth stocks screener (2173 results) to look for companies that have more consistent earnings momentum reflected in their historical results.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.