Please use a PC Browser to access Register-Tadawul

Okta Growth Story Ties PGA Alliance And APJ Leadership Shift

Okta, Inc. Class A OKTA | 87.26 | +2.77% |

- Okta expanded its alliance with the PGA of America to provide AI powered, secure digital identity experiences for golfers and staff.

- The company appointed Dan Mountstephen as Senior VP and GM for Asia Pacific and Japan, strengthening its leadership in that region.

- These updates arrive with Okta (NasdaqGS:OKTA) shares trading at $88.18.

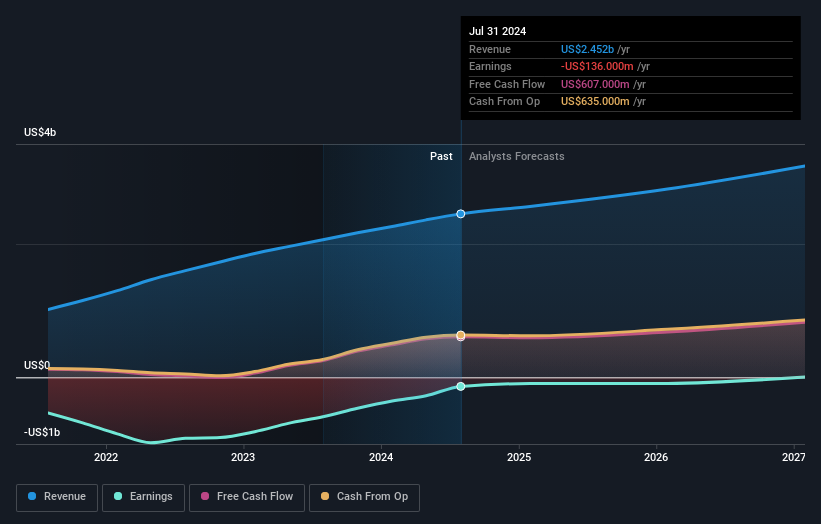

For investors watching Okta, the combination of a deeper relationship with the PGA of America and new leadership in Asia Pacific and Japan gives more color on how the business is positioning itself. The stock is at $88.18, with a 5.7% gain over the past week and a 5.4% return year to date, alongside a 12.4% return over three years and a 10.3% decline over the past year. Over five years, the share price shows a 69.0% decline, which may frame how you think about risk and past volatility.

Okta is putting more emphasis on high visibility partnerships and international expansion at the same time that identity and access management remain central topics for enterprises. As you assess NasdaqGS:OKTA, these moves can help you think about how the business is trying to broaden its customer base and product reach. How those efforts translate into future execution, profitability, and share price behavior will depend on factors that go beyond these announcements.

Stay updated on the most important news stories for Okta by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Okta.

For Okta, this update is really about two levers at once: deepening a high-profile customer use case and tightening execution in a key growth region. The expanded PGA of America alliance shows how Okta’s identity platform and the Auth0 tools can run both workforce and fan-facing access at scale, while starting to address AI-related security risks. That kind of reference customer can be useful when Okta talks to other large sports bodies, media groups, or consumer brands that care about secure, personalized digital experiences. In parallel, putting a seasoned security executive in charge of Asia Pacific and Japan raises the bar for how Okta approaches large enterprises and public sector accounts there, especially as those customers face more complex identity needs.

How This Fits Into The Okta Narrative

- The PGA of America partnership and AI-powered focus line up with the narrative that identity is becoming more central as organizations move deeper into cloud and AI, supporting the idea of larger, multi-year contracts.

- Relying heavily on upsell and cross-sell to existing big customers, rather than visibly broad new-customer wins, could challenge concerns in the narrative about addressable market expansion.

- The push into in-country tenants and APJ growth, plus AI agent use cases, goes further than some older narratives that focus mainly on US and core workforce identity, so you may want to check that those angles are fully reflected.

Knowing what a company is worth starts with understanding its story. Check out one of the top narratives in the Simply Wall St Community for Okta to help decide what it's worth to you.

The Risks and Rewards Investors Should Consider

- ⚠️ Larger security platforms such as Palo Alto Networks, Microsoft, or Cisco also pitch integrated identity solutions, which could pressure Okta when big customers weigh one-vendor security stacks against a focused identity provider.

- ⚠️ Expanding product scope to AI security and new regions adds execution and integration risk, particularly if new features or local data-residency offerings are slower to gain traction than expected.

- 🎁 The PGA of America relationship showcases Okta and Auth0 across both professional users and fans, which can help support Okta’s case for broad, identity-first security in other customer conversations.

- 🎁 Hiring a seasoned APJ leader with experience at Saviynt, Cisco Systems, Motorola, and Siemens may help Okta sharpen its go-to-market plans and partner networks in a region many software peers treat as a growth priority.

What To Watch Going Forward

From here, it is useful to track whether Okta can convert this higher-profile PGA of America work into more large, multi-product deals and whether AI-focused features around identity security show up clearly in customer case studies. In Asia Pacific and Japan, watch for commentary on regional bookings, large enterprise or public sector wins, and adoption of in-country tenants, especially in India. Competitive signals from players like Microsoft, Palo Alto Networks, and other identity specialists will also help you gauge how differentiated Okta’s offer remains as identity and AI security continue to move up the priority list for customers.

To ensure you're always in the loop on how the latest news impacts the investment narrative for Okta, head to the community page for Okta to never miss an update on the top community narratives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.