Please use a PC Browser to access Register-Tadawul

Okta PGA Partnership Highlights Identity Role In AI And Investor Focus

Okta, Inc. Class A OKTA | 74.29 | -9.18% |

- Okta expanded its partnership with the PGA of America to secure AI-driven digital experiences across the PGA ecosystem.

- The collaboration focuses on identity management for fans, players, and partners interacting with PGA digital platforms.

- The news comes with Okta shares at $82.15 under ticker NasdaqGS:OKTA.

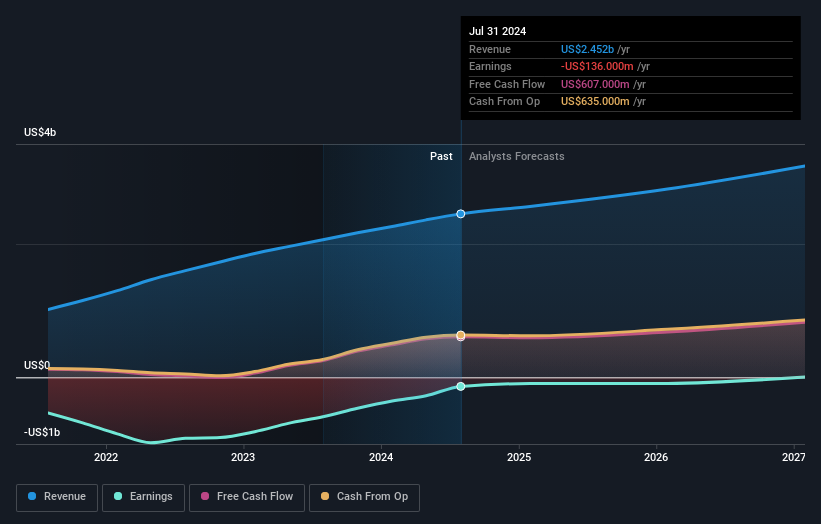

For investors watching NasdaqGS:OKTA, this partnership highlights Okta’s role in securing large, high-profile digital environments. The stock trades at $82.15, with a 3 year return of 6.5% and a 5 year decline of 71.3%. Over the past year, the share price has declined 15.7%, so many holders are likely focused on how real world deployments like this might affect Okta’s long term relevance.

What stands out here is that Okta’s identity tools are positioned at the core of an AI powered experience used by a wide audience, from fans to corporate partners. For investors, the key question is how often Okta can secure these kinds of large scale, branded ecosystems and how deeply its technology becomes embedded. This PGA of America expansion provides another concrete example of Okta’s technology being chosen for security and access in a visible setting.

Stay updated on the most important news stories for Okta by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Okta.

The expanded PGA of America relationship puts Okta’s identity platform in front of a broad mix of enterprise users and consumers, which is useful proof of how its tools handle high-traffic, event-driven environments. For investors, this sits squarely in the story of Okta pitching identity as the control layer for AI-powered interactions, as the PGA uses Okta and Auth0 to tie together staff, golf professionals, and fans in a single, access controlled system while cutting manual IT work.

How this fits into the Okta narrative investors are watching

Recent commentary around Okta has focused on improving margins, guidance that is ahead of sell side expectations, and management’s view that securing AI agents is a key growth area. A high visibility customer like the PGA using Okta to secure AI powered experiences aligns with the idea that identity sits at the center of enterprise AI, and it complements the longer term investor narratives that highlight opportunities in customer identity and cross platform security rather than only workforce logins.

Risks and rewards investors should weigh

- Partnership showcases Okta’s ability to handle large scale, consumer facing identity use cases, which can help when competing with players such as Microsoft and Ping Identity for similar contracts.

- The PGA’s move to an identity first security model, including automation and AI related protections, supports Okta’s pitch that customers can reduce complexity and operational burden by consolidating on its platform.

- High profile environments can attract threat actors, and recent reports of attacks targeting Okta customers highlight ongoing execution risk around security posture and response.

- The identity market remains competitive, with broader security vendors like CrowdStrike and Palo Alto Networks also pushing platform stories that can pressure independent providers on pricing and product breadth.

What to watch next

From here, it is worth watching whether Okta converts similar high profile references into a broader pipeline of AI focused identity deals, and how that shows up in remaining performance obligations and commentary on AI related annual recurring revenue. If you want to see how other investors connect deals like this to their long term view on the business, you can check community narratives on Okta’s dedicated page and compare different risk and valuation angles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.