Please use a PC Browser to access Register-Tadawul

Okta’s India Data Residency Push And What It Could Mean For Investors

Okta, Inc. Class A OKTA | 90.76 | -0.77% |

- Okta has launched India based platform tenants, allowing customers to keep identity data within the country.

- The rollout targets highly regulated sectors such as banking and healthcare that are looking to adopt AI securely.

- The move is designed to support local data residency, compliance needs, and stronger disaster recovery for Indian enterprises.

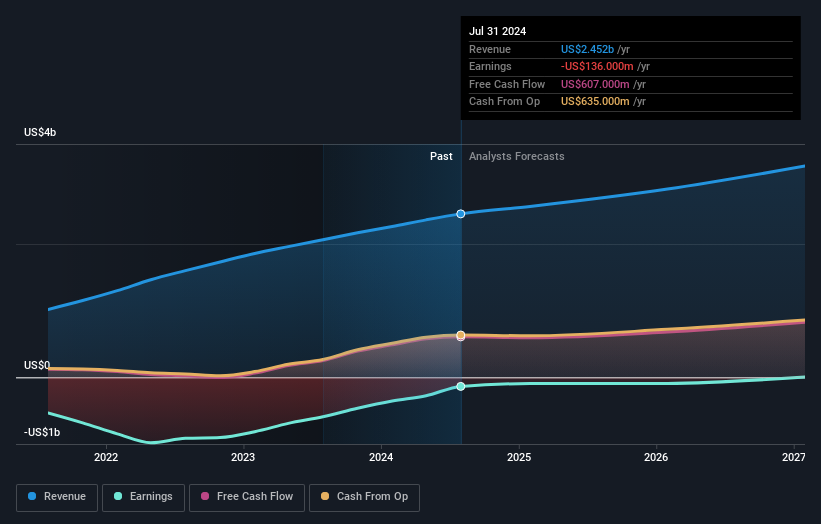

Okta, traded as NasdaqGS:OKTA, is taking a clearer position in India with this local tenant rollout, which ties directly to how banks, hospitals, and other regulated players handle identity and security. The company’s shares last closed at $87.71, with a value score of 2 and a 3 year return of 27.7%, while the 5 year return shows a 65.9% decline, highlighting mixed outcomes for longer term holders.

For you as an investor, this India focused expansion connects directly to real world demand for compliant identity infrastructure as AI tools spread across large organizations. As regulations, cyber requirements, and board level expectations evolve, Okta’s ability to support local hosting, governance, and recovery in markets like India may be an important factor in how customers evaluate identity platforms.

Stay updated on the most important news stories for Okta by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Okta.

Quick Assessment

- ✅ Price vs Analyst Target: At $87.71, Okta trades below the consensus price target of $113.60, with analysts' expectations spanning $75 to $145.

- ✅ Simply Wall St Valuation: Okta is flagged as undervalued, trading about 28.4% below an estimated fair value.

- ❌ Recent Momentum: The share price has seen a 2.8% decline over the past 30 days.

Check out Simply Wall St's in depth valuation analysis for Okta.

Key Considerations

- 📊 India based tenants align Okta with data residency and security needs for banks and healthcare groups that want to use AI within local rules.

- 📊 Monitor how adoption in India affects revenue in highly regulated sectors, and whether identity contracts appear in large enterprise deals.

- ⚠️ A key risk is execution, since rolling out compliant, resilient infrastructure across jurisdictions can be complex and closely scrutinized by regulators.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Okta analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.