Please use a PC Browser to access Register-Tadawul

Ollie's Bargain Outlet (OLLI): Exploring Valuation After Solid Revenue and Profit Growth

Ollie's Bargain Outlet OLLI | 113.91 113.91 | -1.95% 0.00% Pre |

Ollie's Bargain Outlet Holdings (OLLI) stock has been steady lately, trading at $121.18 and gaining 1% so far this year. Investors are watching its value case, especially after annual revenue and profit both grew over 12% and 15% respectively.

Ollie's share price has climbed nearly 12% since the start of the year, and long-term shareholders have enjoyed an impressive 34% total return over five years. This suggests that momentum is steady and the broader investment case remains intact, despite some recent volatility in the last month.

If Ollie's solid run has you thinking about broader opportunities, now is a great time to discover fast growing stocks with high insider ownership.

But with shares still sitting around 21% below average analyst targets and with strong top and bottom-line growth, the big question for investors is whether Ollie’s remains undervalued or if future gains are already factored in.

Most Popular Narrative: 17.3% Undervalued

Ollie’s latest close at $121.18 is well below the most popular narrative’s fair value estimate of $146.60, suggesting strong upside potential if the underlying assumptions hold. This sets the stage for a closer look at what’s driving optimism in the analyst consensus.

The company is benefiting from a growing value-conscious consumer base, amplified by economic uncertainty and inflation. This is driving more customers toward discount retailers like Ollie's and is boosting both store traffic and revenue growth, as seen by accelerated customer acquisition and rising loyalty program membership.

Want to peek behind the curtain of this upbeat valuation? The real story hinges on bold projections for growth, increasing profit margins, and earnings levels that rival retail’s top names. Curious what aggressive assumptions get baked in and which industry shifts drive this rich premium? Find out what really powers this pricing logic.

Result: Fair Value of $146.60 (UNDERVALUED)

However, Ollie's ongoing reliance on closeout inventory and limited e-commerce presence could pose challenges if supply chain dynamics or shopping habits rapidly shift.

Another View: A Multiples-Based Gut Check

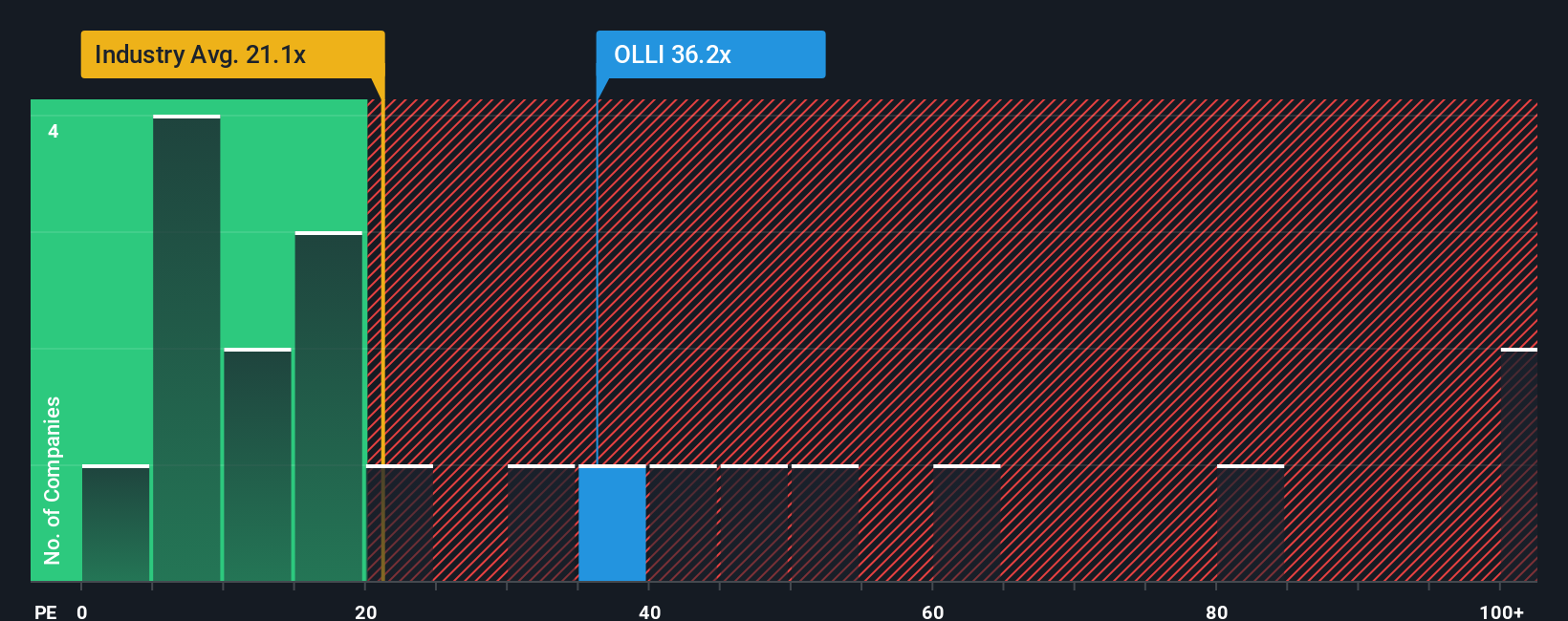

Looking through the lens of price-to-earnings, Ollie’s trades at 34.8x earnings. That's far above both the global industry average of 22.1x and its own fair ratio of 19.5x. This raises a key question: is the market pricing in too much optimism and heightening the risk of a pullback if expectations slip?

Build Your Own Ollie's Bargain Outlet Holdings Narrative

If these perspectives don't fully align with your views, or you're more of a hands-on researcher, crafting your own narrative from the data is quick and intuitive. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ollie's Bargain Outlet Holdings.

Looking for more investment ideas?

Smart investors never put all their eggs in one basket. Broaden your opportunities and get inspired by hand-picked stocks that match the strategies top performers use.

- Capitalize on cash flow potential by assessing these 875 undervalued stocks based on cash flows identified as trading below their intrinsic worth, before everyone else spots them.

- Tap into the healthcare revolution by reviewing these 33 healthcare AI stocks that blend medical innovation with artificial intelligence for outsized growth potential.

- Supercharge your portfolio’s income stream with these 17 dividend stocks with yields > 3% that pay high yields and reward patient investors quarter after quarter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.