Please use a PC Browser to access Register-Tadawul

Omega Healthcare Investors Breakout Highlights Undervalued Healthcare REIT Opportunity

Omega Healthcare Investors, Inc. OHI | 46.57 | +0.09% |

- Omega Healthcare Investors (NYSE:OHI) is showing a strong technical breakout pattern, pointing to renewed investor interest in the healthcare REIT space.

- The breakout aligns with a confirmed uptrend and a solid technical setup that traders may use as a rule-based entry signal.

- With shares last closing at $45.04, the move is drawing fresh attention from investors watching healthcare focused real estate names.

For context, Omega Healthcare Investors has delivered a 28.1% return over the past year and an 86.8% return over the past 5 years, which puts recent price action into a longer term frame. The 98.0% return over 3 years highlights how the stock has already rewarded patience, while the current share price of $45.04 and a value score of 5 may keep it on the radar of investors comparing opportunities across REITs.

With the breakout pattern now in place, some traders may see NYSE:OHI as a candidate for rule based strategies that focus on confirmed uptrends. Longer term investors might treat this as a cue to reassess how healthcare REIT exposure fits with their risk tolerance, income needs and broader portfolio objectives.

Stay updated on the most important news stories for Omega Healthcare Investors by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Omega Healthcare Investors.

Investor Checklist

Quick Assessment

- ✅ Price vs Analyst Target: At US$45.04, the price sits below the US$47.13 analyst target range midpoint, with targets spanning US$40 to US$54.

- ✅ Simply Wall St Valuation: The shares are flagged as undervalued, trading 46.6% below one estimate of fair value.

- ✅ Recent Momentum: A 30 day return of 2.4% lines up with the technical breakout signal and renewed interest in healthcare REITs.

Check out Simply Wall St's in depth valuation analysis for Omega Healthcare Investors.

Key Considerations

- 📊 The breakout pattern, paired with an undervalued flag, may catch the eye of both income and price focused investors.

- 📊 Keep an eye on the P/E of 25.5 versus the health care REITs average of 32.8, the analyst target band, and whether price holds above recent breakout levels.

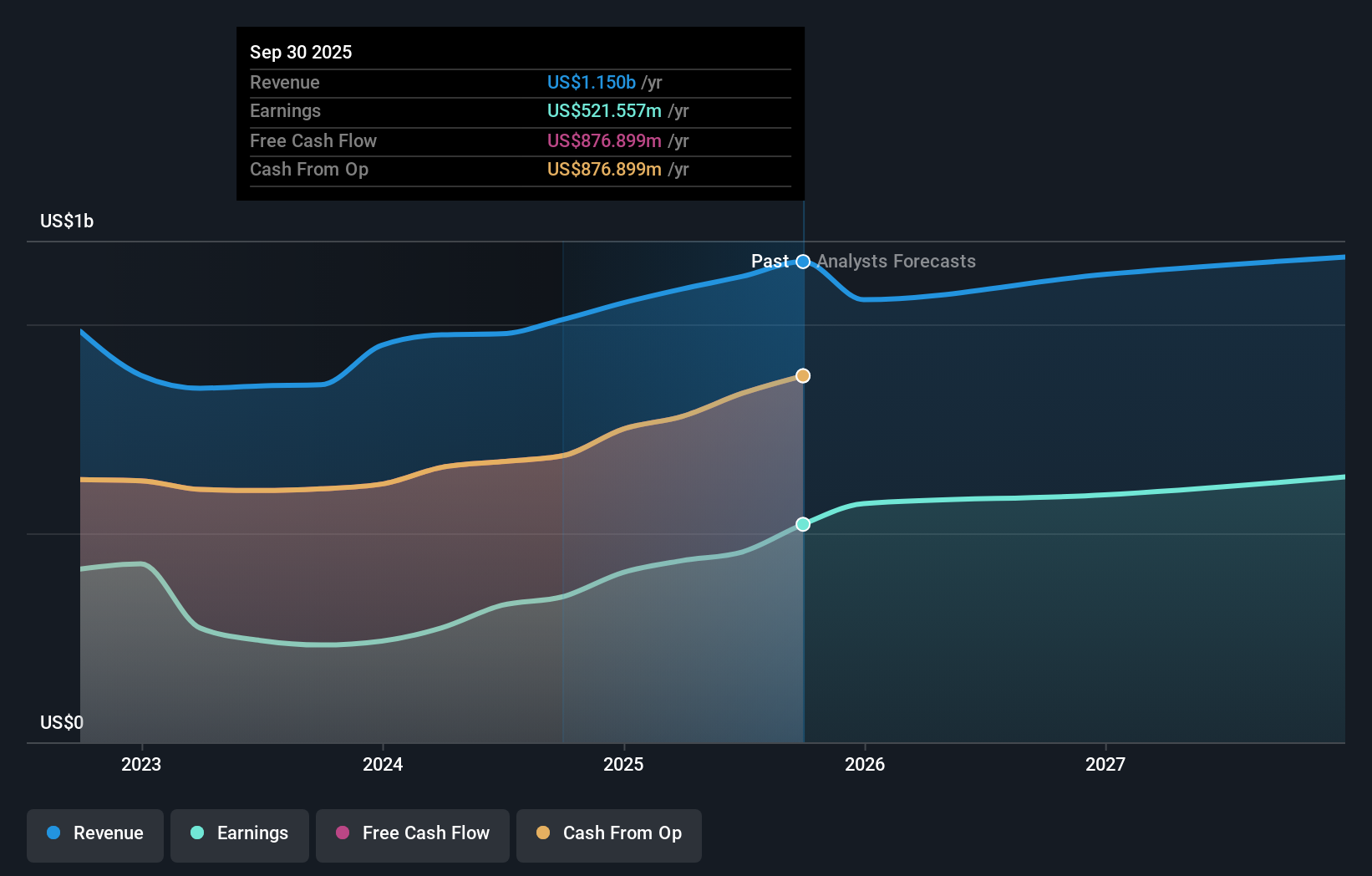

- ⚠️ The main flagged risk is that debt is not well covered by operating cash flow, which matters if sentiment around the breakout cools.

Dig Deeper

For the full picture including more risks and rewards, check out the complete Omega Healthcare Investors analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.