Please use a PC Browser to access Register-Tadawul

Omnicell (OMCL) Is Up 10.2% After Reporting Q2 Revenue Growth and Updated 2025 Guidance - What's Changed

Omnicell, Inc. OMCL | 43.86 | +1.32% |

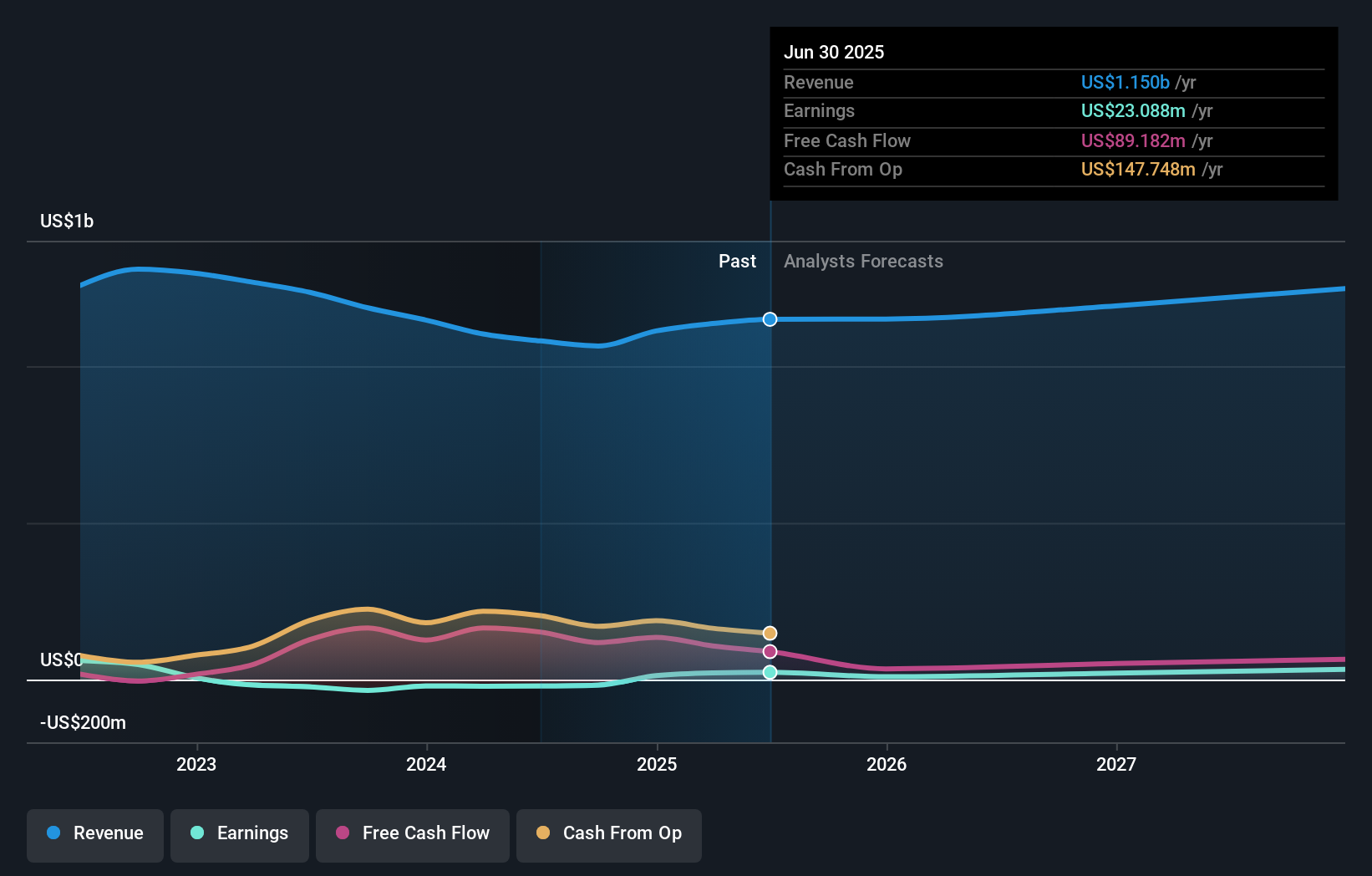

- Omnicell recently announced its second quarter results, reporting year-over-year revenue growth to US$290.56 million and a rise in net income to US$5.64 million, along with updated third quarter and full-year 2025 guidance.

- This update highlights Omnicell's progress in growing revenues and narrowing losses, signaling operational improvements during a period of industry-wide cost pressures.

- We'll explore how Omnicell’s third quarter and full-year guidance shapes the investment narrative and expectations for margin recovery.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Omnicell Investment Narrative Recap

Owning Omnicell stock relies on the belief that healthcare systems will continue prioritizing automation and medication management, fueling steady growth in high-margin recurring revenues. The latest Q2 results, featuring higher revenues and improved net income, do help ease concern over profitability, but tariff risks and margin pressures from supply chain shifts remain the dominant short-term catalyst and risk; the outlined guidance does not meaningfully change that assessment.

Among recent announcements, the new share buyback program stands out, reflecting the company’s focus on shareholder value during an ongoing period of margin volatility. While buybacks can help support the share price or offset dilution, their significance is mostly symbolic when weighed against underlying operating hurdles and earnings unpredictability tied to tariffs and hardware market cycles.

However, investors should be aware that behind these financial improvements, the risk from ongoing US-China tariffs and Omnicell’s heavy China supply chain exposure remains...

Omnicell's outlook forecasts $1.2 billion in revenue and $10.5 million in earnings by 2028. This is based on a 2.9% annual revenue growth rate and a $10.7 million decrease in earnings from the current $21.2 million.

Uncover how Omnicell's forecasts yield a $43.83 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community all set Omnicell’s fair value at US$43.83, well above the recent market price. With tariff-related cost headwinds still at the forefront, opinions can differ widely, explore multiple viewpoints before making up your mind.

Explore another fair value estimate on Omnicell - why the stock might be worth just $43.83!

Build Your Own Omnicell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Omnicell research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Omnicell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Omnicell's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.