Please use a PC Browser to access Register-Tadawul

Omnicell XT Amplify Puts Medication Management And Growth Story To Test

Omnicell, Inc. OMCL | 40.26 | +4.22% |

- Omnicell (NasdaqGS:OMCL) is highlighting its role in digital healthcare with a focus on medication management technology.

- The company has launched its XT Amplify program, aimed at expanding the reach and impact of its automated medication management offerings.

- The XT Amplify program is gaining traction in the market as healthcare providers look for more robust digital tools.

For investors watching digital healthcare, Omnicell sits at the intersection of software, automation, and hospital workflows, with a current share price of $51.32. The stock is up 12.6% over the past 30 days, 13.7% year to date, and 18.9% over the past year, while longer term 3-year and 5-year returns of 8.0% and 56.9% declines show a more mixed picture. This backdrop helps frame how meaningful new programs like XT Amplify could be for sentiment around NasdaqGS:OMCL.

Looking ahead, the key question for you as an investor is how far Omnicell can scale its digital and medication management offerings as hospitals and health systems keep prioritizing automation. The XT Amplify program will likely be an important proof point for customer adoption and the breadth of real world use cases the company can support across different care settings.

Stay updated on the most important news stories for Omnicell by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Omnicell.

XT Amplify looks like Omnicell leaning harder into its core strength of automating medication workflows for hospitals, which sits squarely within broader demand for digital healthcare tools such as cloud, AI, robotics and analytics. For you as an investor, the key angle is that deeper penetration of automated dispensing and software subscriptions could help Omnicell tap into that wider demand for digital support in healthcare rather than relying only on hardware refresh cycles.

Omnicell Narrative: Can Digital Healthcare Support a New Chapter?

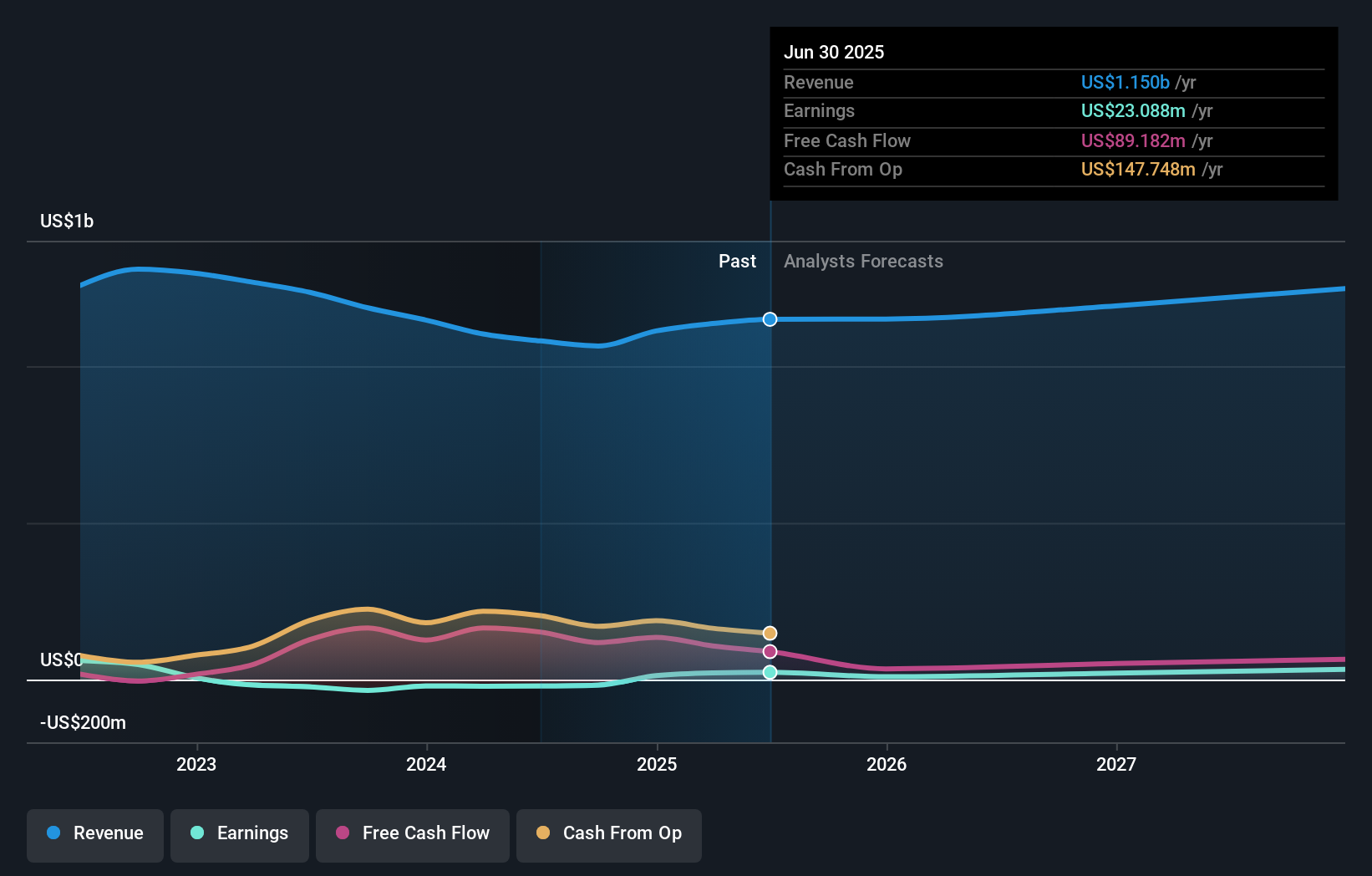

Recent share price strength and interest in digital healthcare have supported a view of Omnicell as a software and automation story, even though long term sales growth of 5.7% a year and declining earnings per share over five years point to past execution challenges. XT Amplify, with its focus on outcome centric medication management, may test whether the company can shift the narrative toward more consistent growth driven by software rich offerings rather than one off equipment sales.

Risks and Rewards Around XT Amplify

- XT Amplify targets a broad need for medication management in hospitals, which could broaden Omnicell’s addressable market for connected hardware and software.

- The program aligns with rising demand for telehealth, cloud and analytics, giving Omnicell a clearer role in wider digital healthcare workflows.

- Long term sales growth of 5.7% a year and a 5.4% annual decline in earnings per share show that stronger demand in digital healthcare does not automatically translate into higher profitability.

- A 9.5 percentage point drop in adjusted operating margin over five years highlights execution and cost pressures that XT Amplify alone may not resolve.

What to Watch Next

From here, it is worth watching whether management links XT Amplify to clearer revenue visibility, margin discipline and concrete adoption metrics across health systems, and how that feeds into future quarters. If you want to keep up with how different investors interpret this shift toward digital healthcare, you can follow fresh viewpoints through our community narratives hub.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.