Please use a PC Browser to access Register-Tadawul

On Holding (NYSE:ONON) Slides 11% Despite Strong Earnings Guidance

On Holding AG ONON | 48.76 | -1.49% |

On Holding (NYSE:ONON) recently provided robust earnings guidance and announced a significant uptick in both quarterly and yearly sales figures, signaling financial strength and growth potential. Despite this positive outlook, the company's shares moved down by 11% last week, a decline that stands in contrast to its reported improved financial performance. This downturn occurred amid a broader market decline of 4% due to heightened economic concerns, particularly regarding tariffs and recession risks. While technology stocks rallied following an encouraging inflation report, driving major indexes like the Nasdaq upward, On Holding diverged from this trend. The juxtaposition of strong corporate performance and negative share movement highlights ongoing market volatility and investor uncertainty, possibly outweighing the positive news from the company.

Over the past three years, On Holding has experienced a remarkable total return, comprising both share price appreciation and dividends, of 111.77%. Looking at its performance relative to the past year, On Holding has outpaced the broader US market, which returned 8.8%, and has significantly exceeded its industry benchmark, the US Luxury industry, which saw a 15.7% decline. Several key developments over this period help illuminate the company's enduring results. Notably, On Holding has grown its profits substantially, with earnings climbing by a substantial percentage over the past year alone, reflecting the company's strong financial health.

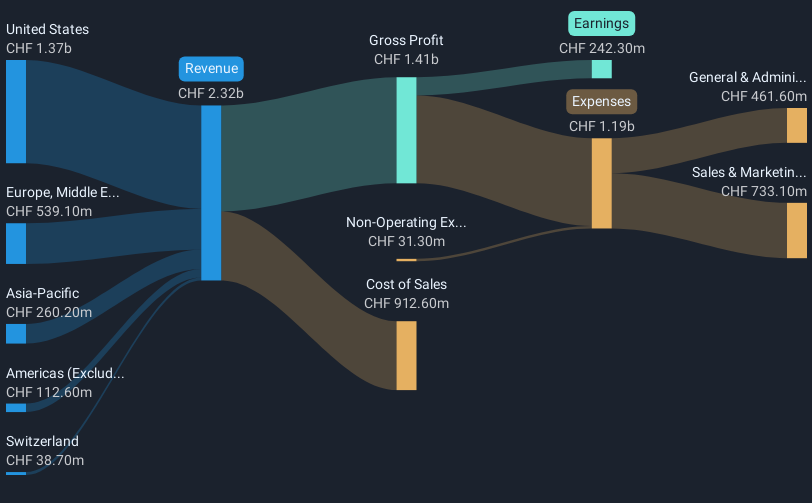

Additionally, On Holding's strategic expansion was underscored by repeated upgrades to its financial guidance throughout 2024, including a raise in projected net sales growth of at least 32% for the full year. Earnings announcements consistently demonstrated impressive revenue increases, notably in the full year ending December 31, 2024, with sales reaching CHF 2.32 billion, an improvement from CHF 1.79 billion the previous year. The stock also gained visibility and credibility within the market by being added to the S&P Global BMI Index in late 2023, possibly contributing to enhanced investor confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.