Please use a PC Browser to access Register-Tadawul

Ooma's Earnings Outlook

Ooma Inc OOMA | 11.88 | +4.12% |

Ooma (NYSE:OOMA) is preparing to release its quarterly earnings on Wednesday, 2025-05-28. Here's a brief overview of what investors should keep in mind before the announcement.

Analysts expect Ooma to report an earnings per share (EPS) of $0.18.

The announcement from Ooma is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

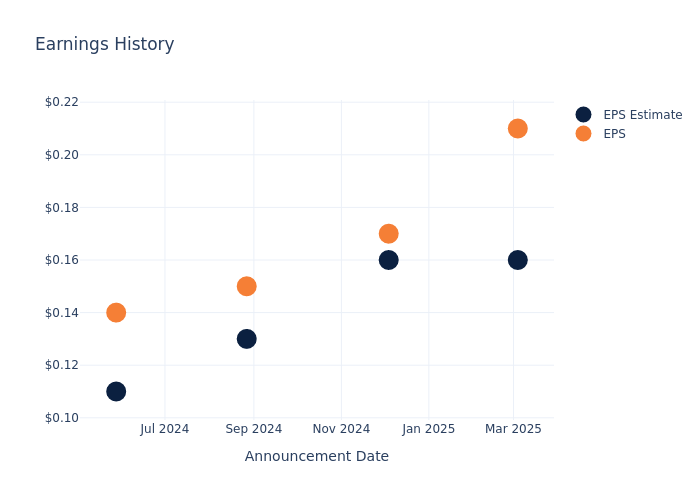

Earnings Track Record

Last quarter the company beat EPS by $0.05, which was followed by a 2.25% increase in the share price the next day.

Here's a look at Ooma's past performance and the resulting price change:

| Quarter | Q4 2025 | Q3 2025 | Q2 2025 | Q1 2025 |

|---|---|---|---|---|

| EPS Estimate | 0.16 | 0.16 | 0.13 | 0.11 |

| EPS Actual | 0.21 | 0.17 | 0.15 | 0.14 |

| Price Change % | 2.0% | 4.0% | 25.0% | 8.0% |

Performance of Ooma Shares

Shares of Ooma were trading at $12.97 as of May 26. Over the last 52-week period, shares are up 58.25%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Insights Shared by Analysts on Ooma

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Ooma.

Analysts have given Ooma a total of 2 ratings, with the consensus rating being Buy. The average one-year price target is $18.5, indicating a potential 42.64% upside.

Comparing Ratings with Competitors

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Ooma, three key industry players, offering insights into their relative performance expectations and market positioning.

Summary of Peers Analysis

The peer analysis summary offers a detailed examination of key metrics for and Ooma, providing valuable insights into their respective standings within the industry and their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Ooma | Buy | 5.55% | $39.93M | -0.31% |

Key Takeaway:

Ooma ranks at the bottom for Revenue Growth among its peers, with a growth rate of 5.55%. In terms of Gross Profit, Ooma is also at the bottom with $39.93M. Additionally, Ooma has a negative Return on Equity of -0.31%, placing it at the bottom compared to its peers.

Discovering Ooma: A Closer Look

Ooma Inc is a communications services company. It is a smart software-as-a-service (SaaS) and unified communications platform that deliver voice and collaboration features including messaging, intelligent virtual attendants and video conferencing, and residential phone service provides PureVoice high-definition voice quality, advanced functionality and integration with mobile devices. Its services rely upon the following main elements: multi-tenant cloud service, on-premise devices, desktop and mobile applications, and calling platforms. It generates revenues from the sale of subscriptions and other services.

A Deep Dive into Ooma's Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Ooma's revenue growth over a period of 3 months has been noteworthy. As of 31 January, 2025, the company achieved a revenue growth rate of approximately 5.55%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: Ooma's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -0.4%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Ooma's ROE stands out, surpassing industry averages. With an impressive ROE of -0.31%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Ooma's ROA stands out, surpassing industry averages. With an impressive ROA of -0.17%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 0.19, Ooma adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Ooma visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.