Please use a PC Browser to access Register-Tadawul

Opendoor (OPEN) Faces Index Removals as AI Turnaround Strategy Tests Management’s Credibility

OpenDoor Technologies OPEN | 6.43 | +5.07% |

- In the past week, Opendoor Technologies underwent several significant index changes, being dropped from both the S&P Global BMI and the S&P TMI Index shortly after a brief inclusion under multiple listings.

- The rapid index removal followed news of a major leadership shift, an AI-focused strategy, and operational restructuring aimed at addressing persistent challenges in an uncertain housing market.

- We'll examine how Opendoor's renewed emphasis on an AI-first turnaround under its new CEO could influence its investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Opendoor Technologies Investment Narrative Recap

To be a shareholder in Opendoor Technologies, an investor needs confidence in the company’s ability to transition toward an AI-driven, asset-light business while withstanding the volatility of the housing market and high interest rates. The recent index removals do not materially impact the near-term catalyst, which remains Opendoor’s focus on improving contribution margins and operational efficiency; however, the primary risk continues to be its inventory exposure and ability to manage capital in a turbulent real estate market.

Among recent announcements, the company’s partnership with Roam to offer assumable mortgages stands out, as it seeks to address affordability and stimulate buyer demand. This move directly ties to Opendoor’s need to support transaction volume and potentially reduce the risk of prolonged inventory turnover, aligning with the key short-term catalyst: improving home clearance rates and margins.

But in contrast, investors should be aware that Opendoor’s high inventory levels and prolonged days on market could still present...

Opendoor Technologies' outlook anticipates $4.7 billion in revenue and $239.7 million in earnings by 2028. This scenario reflects a 2.9% annual revenue decline and an earnings improvement of $544.7 million from current earnings of -$305.0 million.

Uncover how Opendoor Technologies' forecasts yield a $2.86 fair value, a 63% downside to its current price.

Exploring Other Perspectives

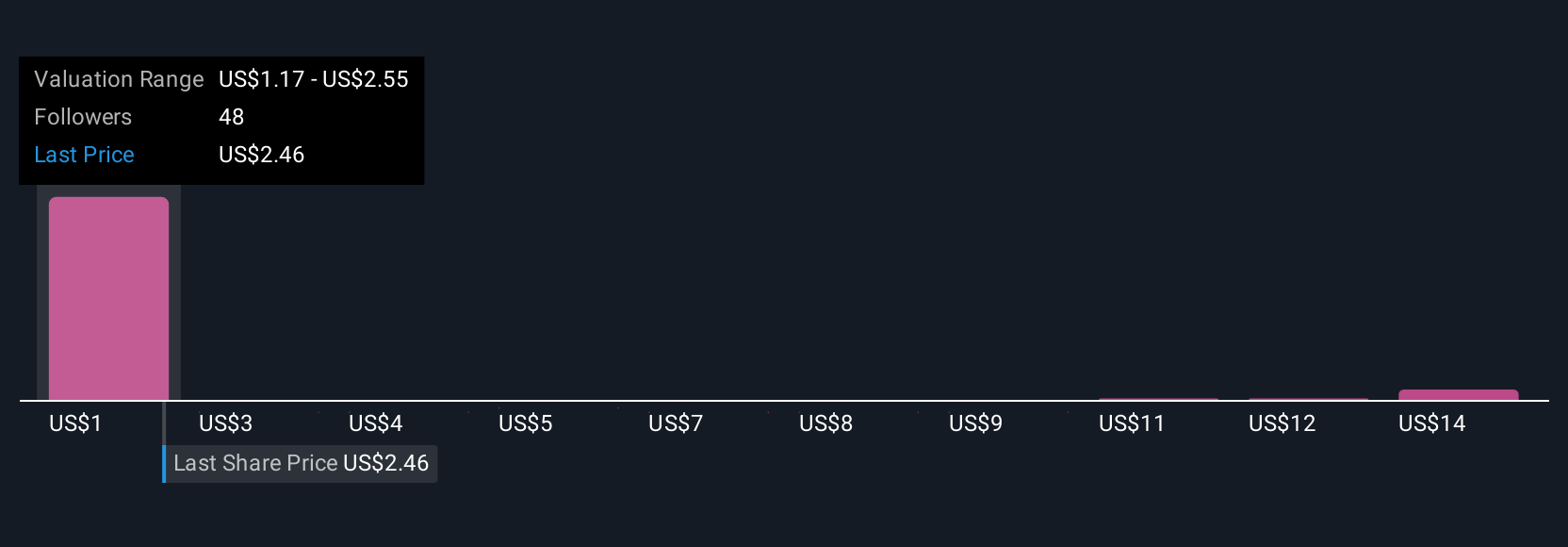

Fair value estimates from 23 Simply Wall St Community members range between US$0.70 and US$30.94, pointing to both optimism and deep caution. Many highlight the company’s continued exposure to inventory risk, showing that views on Opendoor’s future performance can differ widely, explore several perspectives before deciding.

Explore 23 other fair value estimates on Opendoor Technologies - why the stock might be worth over 4x more than the current price!

Build Your Own Opendoor Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opendoor Technologies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Opendoor Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opendoor Technologies' overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.