Please use a PC Browser to access Register-Tadawul

OpenText (NasdaqGS:OTEX): Valuation Insights After Core42 Partnership, Gartner Leadership Nod, and New AI Product Launches

Open Text Corporation OTEX | 33.20 | -0.63% |

Open Text (NasdaqGS:OTEX) is making headlines after announcing a strategic Memorandum of Understanding with Core42 to accelerate AI and cloud solutions for the UAE’s public sector. The move highlights Open Text’s expanding global reach and technology leadership.

Momentum has been building for Open Text, with the stock posting a 6.35% share price return over the past month and a standout 38.16% gain year-to-date. Alongside major partnerships like the Core42 deal and a recent tech leadership nod from Gartner, Open Text’s one-year total shareholder return of nearly 19% and three-year total return topping 53% show that both short- and long-term performance have been strong.

If recent tech leadership moves interest you, it is a good time to discover other technology and AI-driven companies making waves. See the full list at See the full list for free.

With major partnership wins, product innovation, and robust stock gains in the spotlight, investors now face a key question: does Open Text remain undervalued, or has recent momentum already factored in its future growth?

Most Popular Narrative: Fairly Valued

The most closely watched narrative suggests Open Text’s fair value aligns closely with the recent share price, hinting at a finely balanced outlook. Market participants appear split, as the consensus view signals neither a clear bargain nor looming overvaluation at current levels.

"Analysts are assuming Open Text's revenue will grow by 1.4% annually over the next 3 years. Analysts assume that profit margins will increase from 8.4% today to 16.0% in 3 years time."

Curious what hidden assumptions justify this fair value? The most popular narrative leans on a rare combination of margin expansion and steady profit growth. It is the bold expectations for future scaling, however, that could upend the outlook. See which aggressive forecasts truly tip the scales in this valuation story.

Result: Fair Value of $37.66 (ABOUT RIGHT)

However, significant leadership changes and lingering uncertainty over cloud growth momentum could still challenge the expectations that support Open Text’s current valuation.

Another View: A Closer Look at Market Comparisons

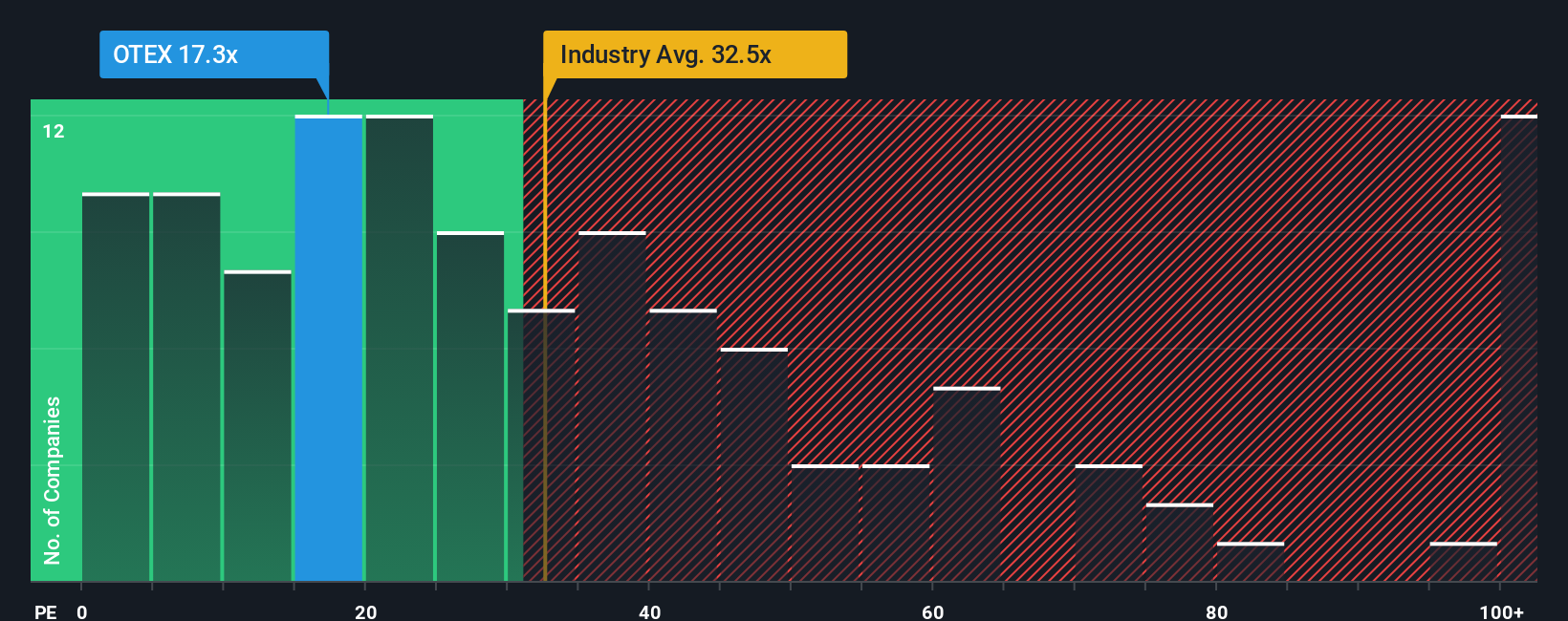

While fair value estimates suggest Open Text is about right, market-based metrics hint at something different. The company’s price-to-earnings ratio of 22.4x sharply undercuts both peer averages (39.3x) and the industry (34.9x), as well as sitting well below the fair ratio of 36.5x. This strong discount could mean investors are underpricing future growth or being cautious for good reason. Could the market be missing a hidden opportunity, or is skepticism warranted?

Build Your Own Open Text Narrative

If you want to take a hands-on approach or challenge the current story, you can quickly analyze the numbers and craft your own perspective in just minutes. Do it your way

A great starting point for your Open Text research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Broaden your watchlist and catch the next big trend by using these favorite stock ideas from the Simply Wall Street community:

- Fuel your portfolio with growth by tapping into these 878 undervalued stocks based on cash flows, which is packed with stocks priced below their true value and positioned for potential upside.

- Secure regular income by accessing these 18 dividend stocks with yields > 3%, a list featuring companies with yields over 3% and strong track records of rewarding shareholders.

- Stay ahead of the curve and gain an edge in innovation by reviewing these 24 AI penny stocks, which includes companies shaping the future with advanced artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.