Please use a PC Browser to access Register-Tadawul

Options Corner: How to Build a Nvidia Bull Call Spread with a Max Profit of $516?

NVDA 020525 C 97 |

| |

NVDA 020525 C 107 |

| |

S&P 500 index SPX | 6827.41 | -1.07% |

NVIDIA Corporation NVDA | 175.02 | -3.27% |

Hey everyone!

So, the Trump administration has just thrown another curveball by slapping tariffs on several countries and regions, causing a bit of a market freakout.

The S&P 500 index(SPX.US) took a nosedive, tech stocks are feeling the heat, and NVIDIA Corporation(NVDA.US)’s stock price isn’t looking too hot, either.

But here’s the kicker: the semiconductor industry, which Nvidia is a big part of, isn’t on the tariff hit list. This means Nvidia’s core business should be safe from direct impact in the near term.

The market's overreaction seems more about general uncertainty than any real issues with Nvidia itself.

From a valuation standpoint, Nvidia’s EV/EBITDA is around 26x, the lowest it’s been in five years. So, there’s some silver lining here!

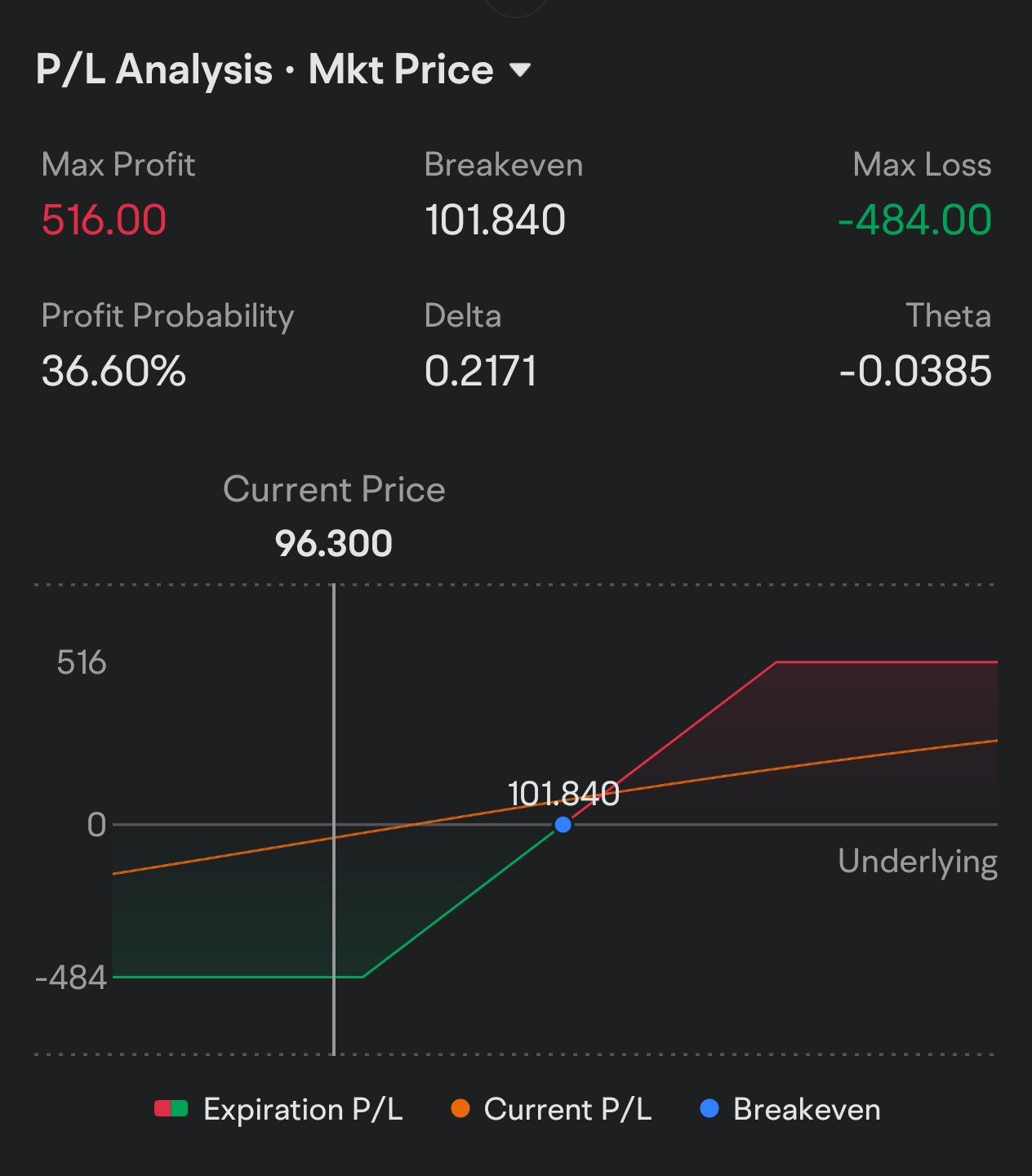

Here’s the game plan: Nvidia Bull Call Spread。

- Buy the May 2nd Call with a $97 strike price (NVDA 020525 C 97), costing $7.70.

- Sell the May 2nd Call with a $107 strike price (NVDA 020525 C 107), pocketing $2.86.

Net Cost:

7.70 (buy)−2.86 (sell)=4.84 USD/share

Max Profit:

107−97−4.84=5.16 USD/share (if stock hits≥107 USD)

Max Loss:

4.84 USD/share (if stock is≤97 USD)

Breakeven Point:

97+4.84=101.84 USD97+4.84=101.84USD

✅ Why This is Cool::

- Risk is capped: Your max loss is just the net cost (4.84 USD), which is great if you’re cautiously optimistic and don’t want to risk too much.

- High Volatility Perks: The current implied volatility (IV) is super high, so you can get a nice premium from selling the call. If the IV drops or the stock climbs steadily, you could see some sweet gains.

⚠️ Heads Up on the Risks::

- Price Needs to Move: Nvidia’s stock has to get past 101.84 USD and stay below 107 USD. Considering it’s already down over 28% this year, a quick rebound might be a stretch.

- Time is Ticking: With only three weeks to expiration, time decay (Theta) isn’t on your side. You need the stock to move up quickly.

- Volatility Can Bite Back: If the IV drops a lot, the premium from selling the call might shrink, possibly eating into your profits.

Options Trading Risk Disclaimer:

Remember, options trading comes with its own set of risks. The value of options can be highly volatile, and you can lose your entire investment. It’s crucial to understand the mechanics of options and have a well-thought-out strategy. If you’re new to options, consider consulting with a financial advisor to ensure this strategy aligns with your risk tolerance and investment goals.