Please use a PC Browser to access Register-Tadawul

Options Corner: Is It Time to Buy Berkshire at a Discount?

Berkshire Hathaway Inc. Class A BRK.A | 748886.97 748886.97 | +0.85% 0.00% Pre |

American Express Company AXP | 382.56 382.56 | -0.61% 0.00% Pre |

Apple Inc. AAPL | 278.28 278.99 | +0.09% +0.26% Pre |

Bank of America Corporation BAC | 55.14 55.40 | +1.06% +0.47% Pre |

Coca-Cola Company KO | 70.52 70.59 | +2.04% +0.10% Pre |

Hey everyone,

Let's chat about Berkshire Hathaway Inc. Class A(BRK.A.US) / Berkshire Hathaway Inc. Class B(BRK.B.US)'s recent stock performance. 📉 Back on May 2nd, Berkshire Hathaway Inc. Class A(BRK.A.US) shares hit an all-time high of $812,900. Fast-forward to August 14th, and we're looking at $715,400 per share. That's nearly a 15% drop in just over three months.

So, what's going on? 🤔 Some analysts think the dip reflects worries about the "Buffett premium" fading. Investors are concerned about Berkshire's future without the legendary Warren Buffett at the helm.

Another factor in the mix is their latest quarterly earnings. 📊 In Q2 2025, Berkshire reported total revenue of $92.515 billion, down 1.2% from $93.653 billion in the same period last year. Net income took a big hit, dropping 59% to $12.37 billion.

But let's not forget the powerhouse that is Berkshire Hathaway. 💪 Buffett has built a diverse empire that's still incredibly appealing. Their top five holdings are a who's who of industry leaders:

- American Express Company(AXP.US): The undisputed king of the high-end credit card market. 💳

- Apple Inc.(AAPL.US): Even after some selling, it's still a money-printing machine in the tech world. 🍏

- Bank of America Corporation(BAC.US): A major force in the U.S. banking sector. 🏦

- Coca-Cola Company(KO.US): The global beverage giant with an unmatched brand and distribution network. 🥤

- Chevron Corporation(CVX.US): An energy titan with 38 consecutive years of dividend increases. ⛽️

These companies have strong moats, generate free cash flow, and have proven business models.

Beyond investments, Berkshire owns a slew of businesses, including Geico, General Re, BNSF Railway, and significant energy interests. 🚂 From food and beverages to construction materials, Buffett and Charlie Munger have consistently acquired companies with outstanding qualities and management teams.

Beyond investments, Berkshire owns a slew of businesses, including Geico, General Re, BNSF Railway, and significant energy interests. 🚂 From food and beverages to construction materials, Buffett and Charlie Munger have consistently acquired companies with outstanding qualities and management teams.

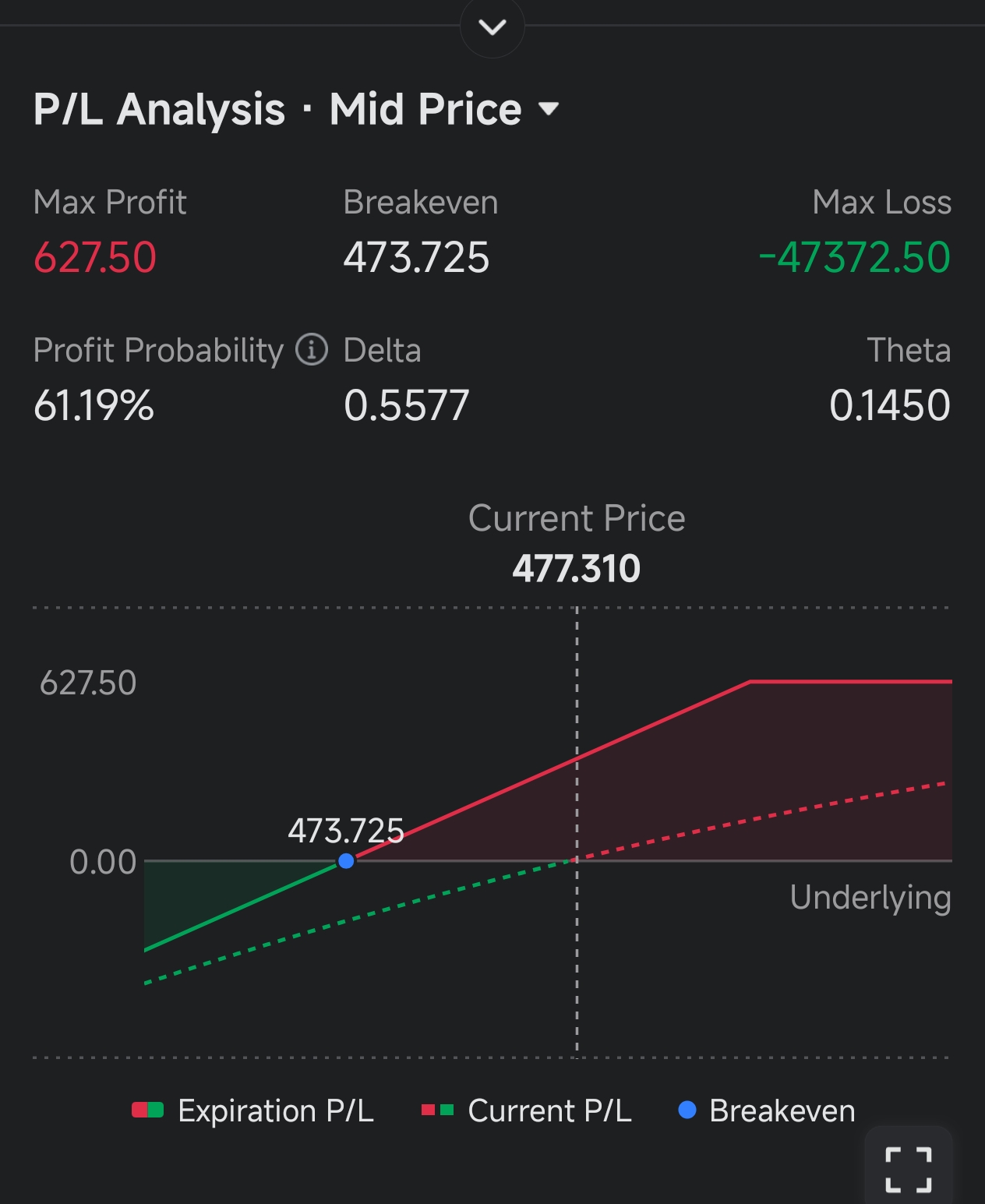

Now, for options enthusiasts, selling puts might be a smart move. 💼 For example, selling a Berkshire Hathaway Inc. Class B(BRK.B.US) 290825 put at $480 (BRKB 290825 P 480) could be appealing. The breakeven point is $473.725.

Here's the deal: If BRKB is above $480 on August 29th, you pocket $627.50 in premium. 💰 If it's below, you'll buy 100 shares of BRKB, but with that premium, it's like getting a discount. 📉

The catch? The margin requirement is high, so this strategy suits more conservative investors. ⚖️

Remember, options carry risks, so make sure to evaluate carefully before diving in. 🚨

Stay savvy, folks! 🌟