Please use a PC Browser to access Register-Tadawul

Options Corner: Two Option Strategies to Watch as Tesla Earnings Near

Tesla Motors, Inc. TSLA | 477.35 | +0.43% |

TSLA 150825 C 330 |

| |

TSLA 150825 P 330 |

| |

TSLA 150825 C 320 |

| |

TSLA 150825 C 340 |

|

Hey there! 🚗✨ Tesla Motors, Inc.(TSLA.US) is gearing up for a big earnings report this Wednesday after the market closes.

So, Musk and Trump had a bit of a rollercoaster relationship. From Musk backing Trump in July 2024 to their fallout over the "Big and Beautiful" bill, things got messy. Musk’s recent political moves, like starting the "American Party," have left investors feeling a bit worn out. As of last Friday, Tesla’s stock has dipped over 18.37% this year. 😅

But for the Tesla fans out there, if Musk can hype things up during the earnings call—especially with cool updates on Tesla’s AI, FSD, Robotaxi tests, or the “Optimus” robot—there might be a sweet rebound despite the political drama.

Tesla delivered 384,122 cars in Q2, down 13.5% from last year but pretty close to what Wall Street expected. 📉 It’s the biggest quarterly drop ever, but hey, it’s better than Q1’s 337,000.

What’s up with Options? 🤔

Looking at Tesla’s last eight quarters, only two beat expectations. The average stock move post-earnings is ±10.72%, with a 50% chance of rising the next day.

Last Friday, there were big bets on calls at $330 and puts at $325. 📈📉

With implied volatility at a low, options are cheap, and the market’s feeling bullish.

| Option Metrics | Value | Meaning |

|---|---|---|

| Implied Volatility (IV) | 61.23% | Near one-year low, options are cheap |

| IV/HV Ratio | 1.08 | Future volatility expectations higher than historical |

| Call/Put Ratio | 1.3 | Strong bullish vibes |

Strategy Talk:

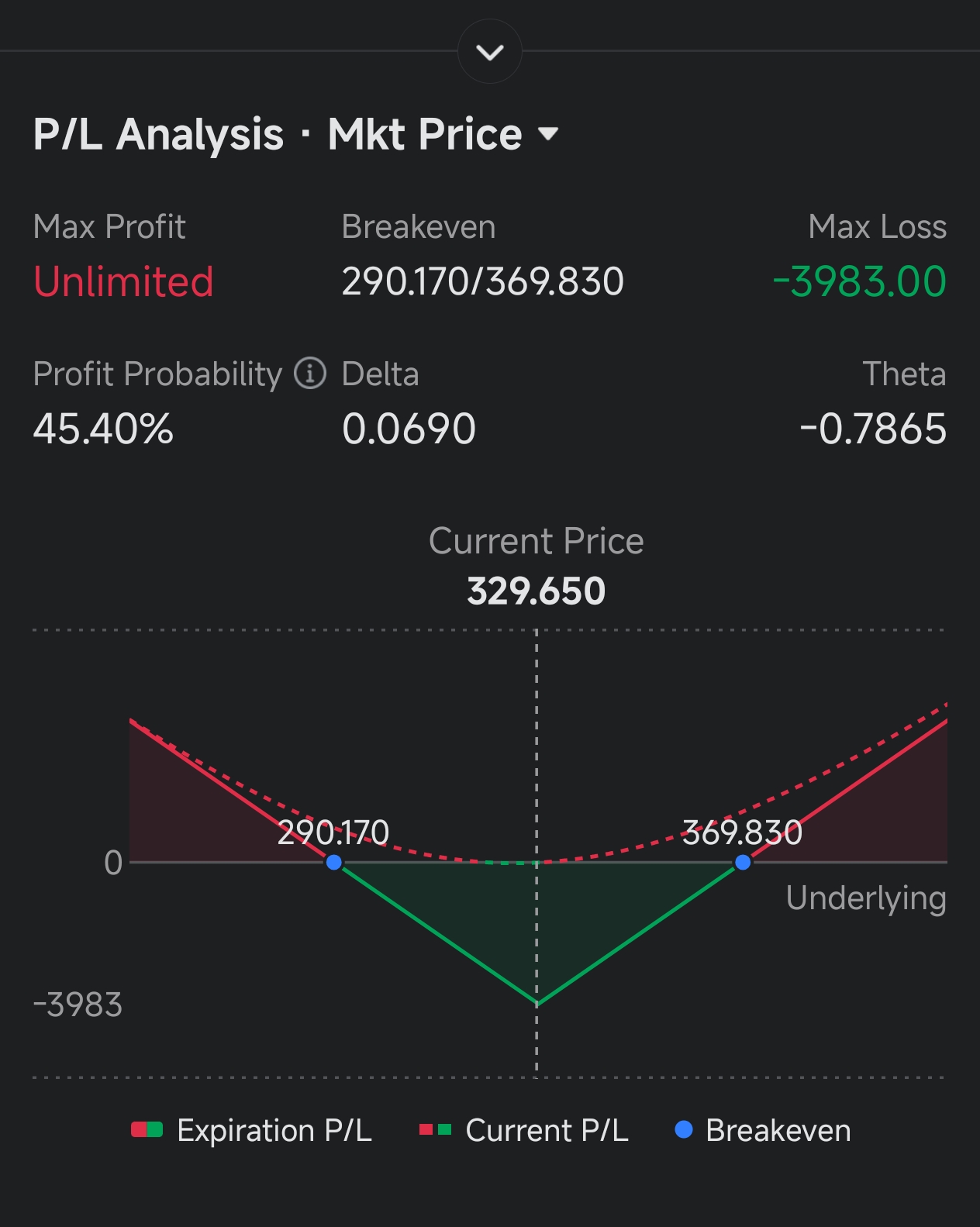

Long Straddle Strategy

Tesla’s known for wild post-earnings swings. If you’re feeling bold, this might be your jam.

- Setup: Buy calls and puts at $330, expiring August 15.

- Call Price: $20.15

- Put Price: $19.5

- Total Cost: ~$3,965 per combo

- Pros: Profit if the stock moves beyond $369.83 or below $290.17.

- Cons: You might lose if the stock doesn’t move much or if implied volatility drops.

| Action | Option Code | Stock | Strike Price | Quantity | Expiration Date |

|---|---|---|---|---|---|

| Buy Call Option 1 | TSLA 150825 C 330 | Tesla | $330 | Same | August 15 |

| Buy Put Option 2 | TSLA 150825 P 330 | Tesla | $330 | Same | August 15 |

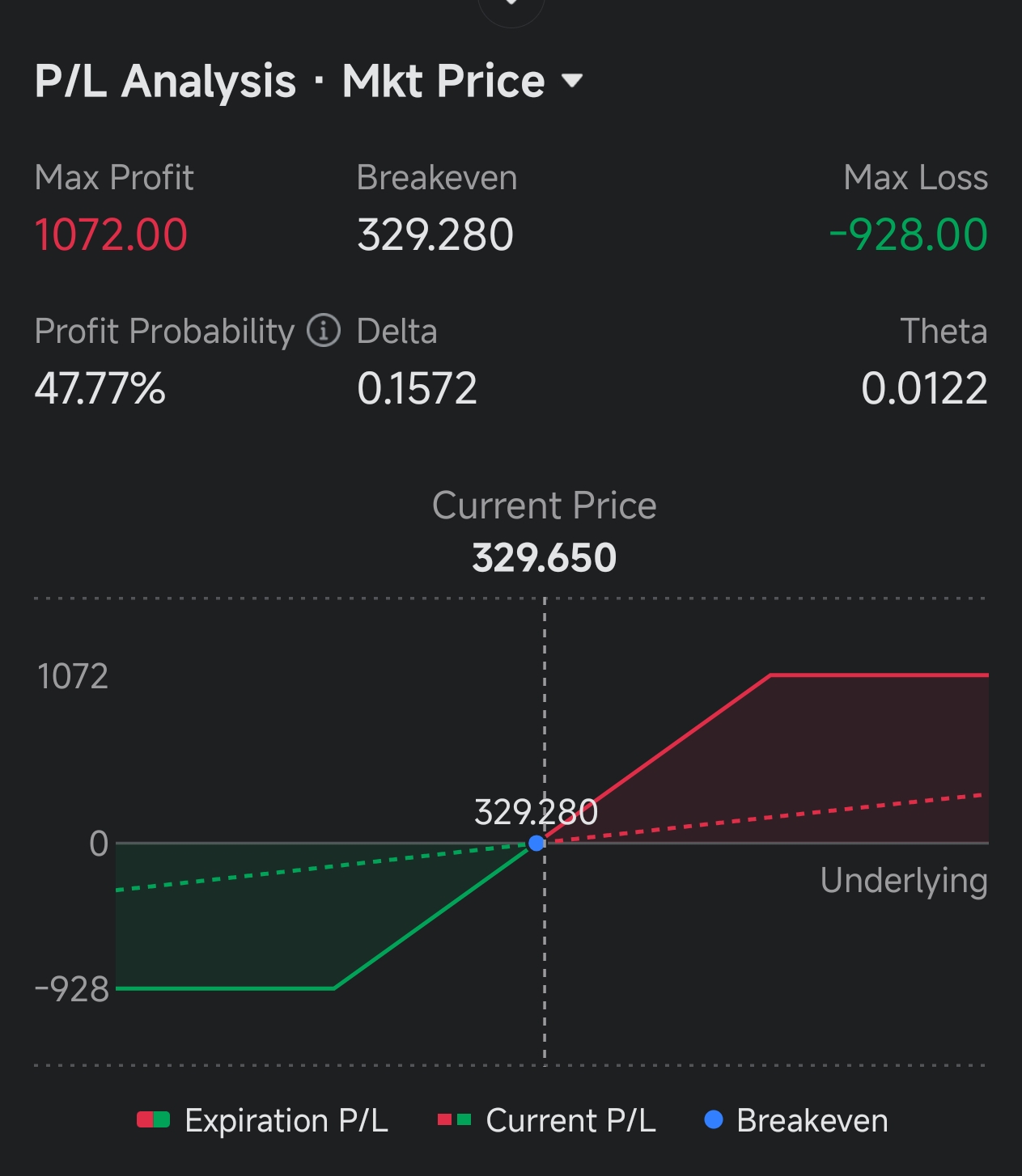

Bull Call Spread Strategy

If you’re playing it safe but still want some action, this spread could work.

- Setup: Buy a call at $320, sell a call at $340.

- Call Price: $25.35

- Put Price: $16.07

- Total Income: ~$1,067.5 per combo

- Max Loss: $928 per combo

- Pros: Profit if the stock stays between $329.3 and $340. Lower cost, max loss capped, great for risk-averse folks.

- Cons: No extra profit if the stock goes over $340; bought options might lose value faster if IV drops.

| Action | Option Code | Stock | Strike Price | Quantity | Expiration Date |

|---|---|---|---|---|---|

| Buy Call Option 1 | TSLA 150825 C 320 | Tesla | $320 | Same | August 15 |

| Sell Call Option 2 | TSLA 150825 C 340 | Tesla | $340 | Same | August 15 |

What to do? 🤷♂️

With the market’s "high volatility + bullish" mood, think about the bull call spread for a balanced approach. If you’re feeling adventurous, maybe try a small straddle position. Keep an eye on management’s guidance after earnings to make smart moves.

Just remember, these strategies are for learning and fun, not investment advice. 📈🔍