Please use a PC Browser to access Register-Tadawul

Options Corner: U.S. Treasury Bonds Hit Again! Time to Use Options for "Widowmaker Trade" on TLT

20+ Year Trsy Bond Ishares TLT | 87.88 | +0.55% |

TLT 310725 P 84 |

|

🌟 Hey Traders! Let's Dive into a Bold Strategy: TLT Put Sale 🌟

📈 Market Buzz:

U.S. Treasury yields are making waves again, with the 30-year yield hitting a hefty 5.02%! This is the highest since May, driven by inflation concerns. Remember, when yields soar past 5%, it often spells trouble for equities due to higher borrowing costs for everyone.

💼 Why TLT?

Our favorite ETF, 20+ Year Trsy Bond Ishares(TLT.US)—often called the "widow-maker" —tracks long-term U.S. Treasury bonds and is flirting with the $85 support level. It's down 3.67% in July, but with a juicy 4.42% dividend yield, it's time to consider a strategic play.

🔧 Here's the Plan: Selling TLT Puts

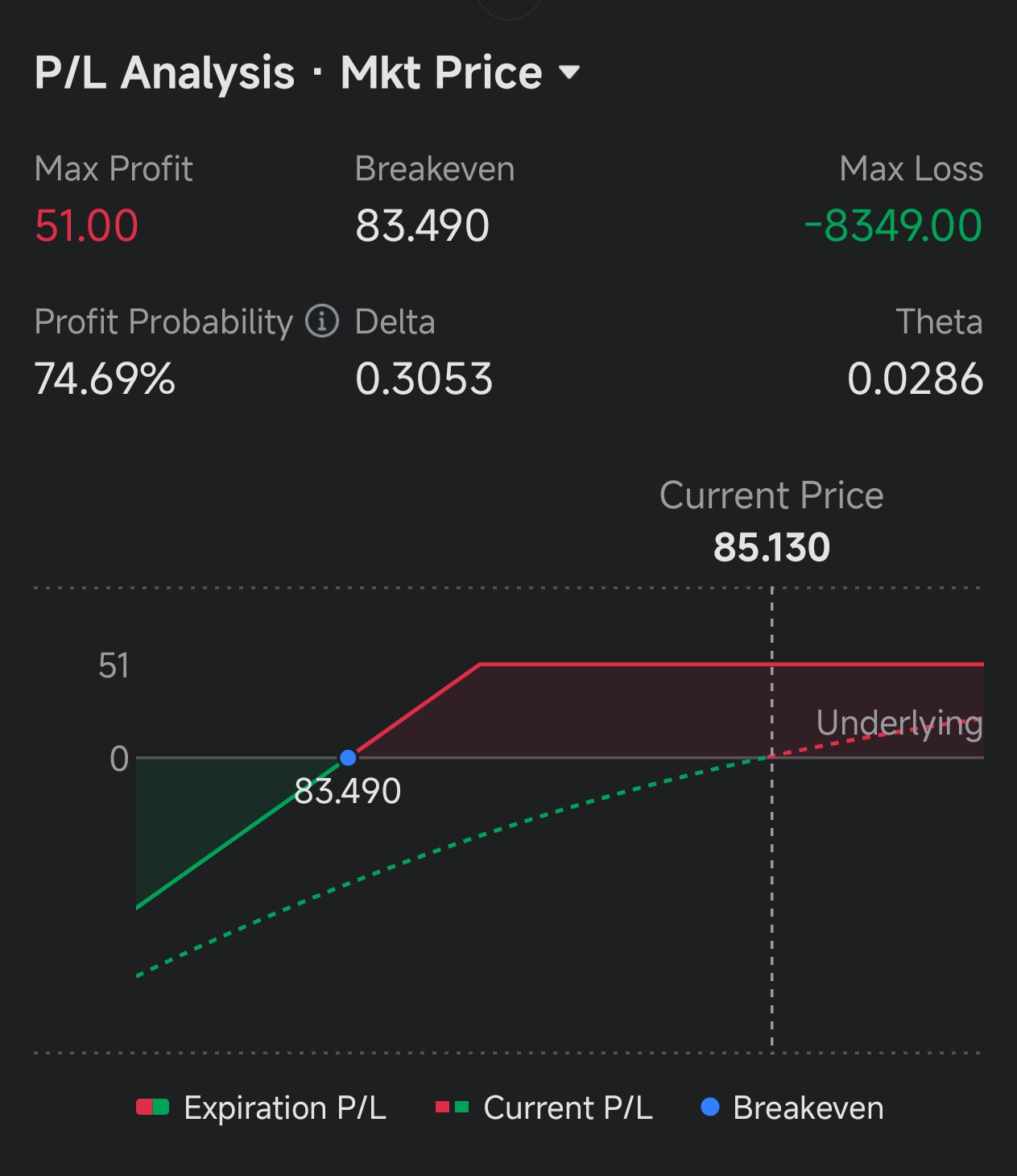

- Move: Sell a put option (TLT 310725 P 84) on TLT expiring July 31st with a strike price of $84.

- Cash In: Pocket a $51 premium upfront.

💡 What's the Deal?

- Max Gain: That $51 premium is all yours.

- Breakeven: At $83.49, you're covered (Strike $84 - Premium $0.51).

- Safety Net: With TLT at $85.01, you've got a 1.35% cushion above the strike.

- If Things Go South: If TLT dips below $84, you might end up with 100 shares. But hey, that dividend yield is still looking sweet!

⚠️ Heads Up: Options trading can be risky, especially with "widow-maker" assets. Make sure you're comfortable with the potential outcomes. Trade smart, trade safe! 🚀