Please use a PC Browser to access Register-Tadawul

Orrstown Financial Services (ORRF) Net Margin Surge Reinforces Bullish Profitability Narratives

Orrstown Financial Services, Inc. ORRF | 38.08 | +0.82% |

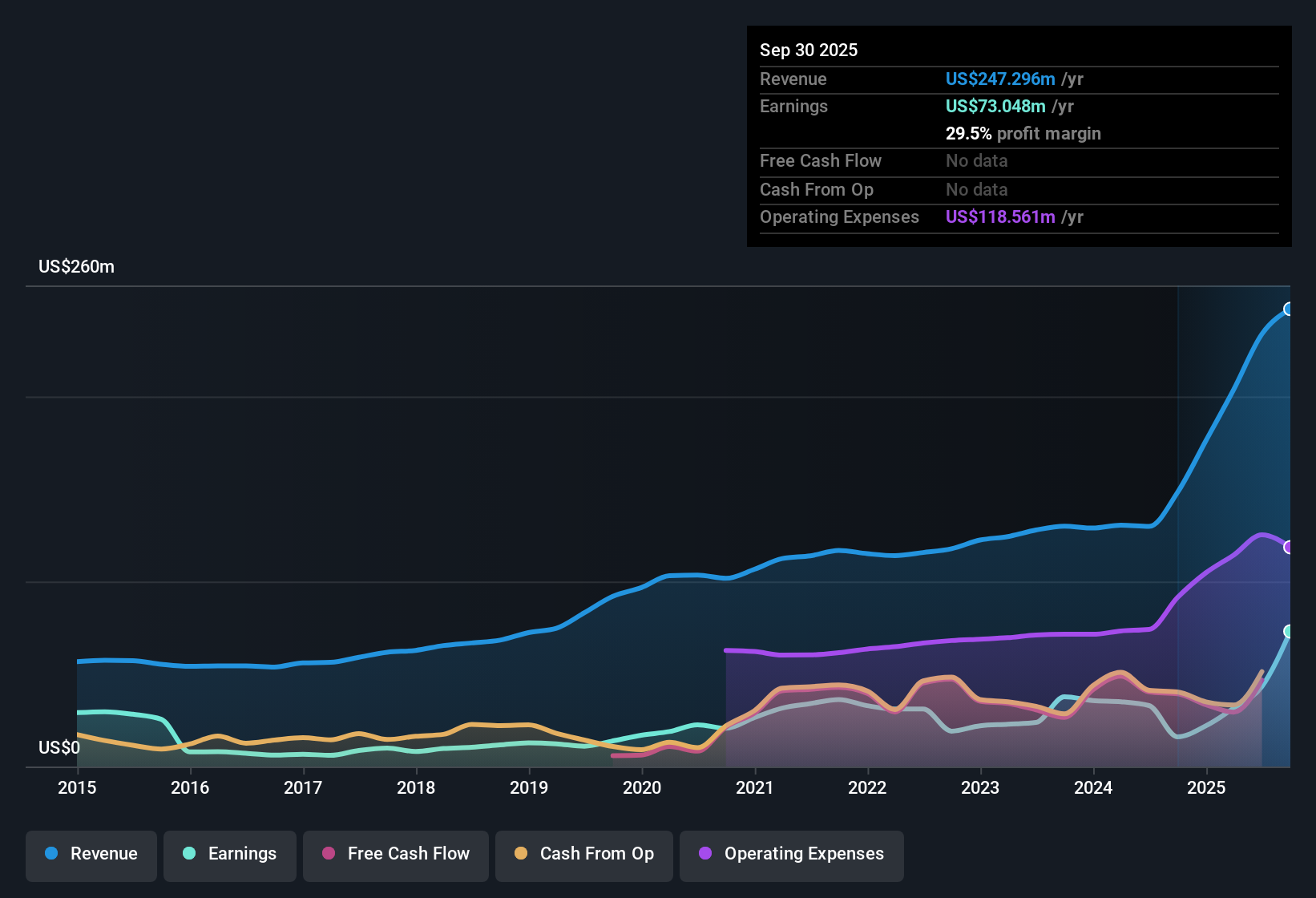

Orrstown Financial Services (ORRF) has rounded out FY 2025 with fourth quarter revenue of US$64.8 million and basic EPS of US$1.12, alongside trailing twelve month revenue of US$252.1 million and EPS of US$4.21. Over the last few quarters, revenue has moved from US$60.1 million in Q4 2024 to US$64.8 million in Q4 2025, while quarterly basic EPS has shifted from US$0.72 to US$1.12 over the same period. This frames a year in which trailing net income reached US$80.9 million. With a trailing net margin of 32.1% and a cost to income ratio of 57.5% in the latest quarter, the story for investors focuses on how these margins frame the quality of the current earnings run rate.

See our full analysis for Orrstown Financial Services.With the latest results on the table, the next step is to see how these numbers line up against the widely followed narratives around Orrstown Financial Services, highlighting where the data supports the story and where it pushes back.

Net margin at 32.1% with cost ratio at 57.5%

- For FY 2025, trailing net profit margin sits at 32.1% while the latest quarter shows a cost to income ratio of 57.5%. Together, these figures give a quick feel for how much of each revenue dollar is turning into profit versus being spent on running the bank.

- What stands out for a bullish view is how these profitability figures line up with the rest of the year, as quarterly net income excluding extra items stayed in a fairly tight range from US$18.1 million in Q1 2025 to US$21.5 million in Q4 2025, and net interest margin hovered around 4% to 4.11%. This supports the idea of consistent earnings power rather than just a single strong quarter.

- Supporters who point to improved efficiency can also reference the shift in the reported cost to income ratio from 62.3% in Q4 2024 to 57.5% in Q4 2025, suggesting more revenue is getting through to the bottom line.

- At the same time, trailing twelve month net income of US$80.9 million gives bulls a concrete earnings base to compare against the current share price of US$34.57 and reported P/E of 8.3x.

Earnings growth very large versus 5 year trend

- Trailing twelve month earnings growth is described as very large at about 2.7x the prior level, compared with a 5 year average earnings growth rate of 13.9% per year, so the latest year looks quite different from the longer term pattern.

- Bears who question how durable that jump is point to the forward view that earnings are expected to grow at about 1.9% per year versus a 16.1% forecast for the broader US market. This challenges the idea that the recent very strong trailing growth rate will keep repeating.

- This contrast between a very large one year earnings move and much lower projected growth makes it important to separate one off strength from what might be more typical over time.

- It also means investors may weigh the current earnings base of US$80.9 million against those slower growth expectations when thinking about how much they want to pay for the stock.

Valuation, DCF fair value and revenue trend

- The shares trade on a trailing P/E of 8.3x versus 11.8x for the US Banks industry and 10.3x for peers. The current price of US$34.57 sits well below the stated DCF fair value of US$79.74, at the same time as revenue is expected to decline about 8.4% per year over the next three years.

- Supporters of a bullish valuation angle highlight the combination of this lower P/E, the DCF fair value that is materially above the share price, and a 3.12% dividend yield. However, the expectation of an 8.4% annual revenue decline means the strong trailing net margin of 32.1% is being set against a weaker top line outlook.

- That mix of a valuation that looks inexpensive on traditional metrics with a softer revenue projection creates a clear tension that each investor needs to weigh for themselves.

- The trailing twelve month revenue base of US$252.1 million and the forecast revenue decline together frame the question of whether the current pricing already reflects that pressure on the top line.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Orrstown Financial Services's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Orrstown Financial Services has a strong recent earnings base, the expectation of slower earnings growth and an 8.4% annual revenue decline sets a cautionary tone.

If you would rather focus on companies with steadier top line and earnings profiles, use our stable growth stocks screener (2169 results) to quickly zero in on businesses that are built around more consistent growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.