Please use a PC Browser to access Register-Tadawul

Oscar Health (NYSE:OSCR) Sees 35% Price Move Over Last Month

Oscar Health, Inc. Class A OSCR | 15.71 15.73 | -2.66% +0.16% Pre |

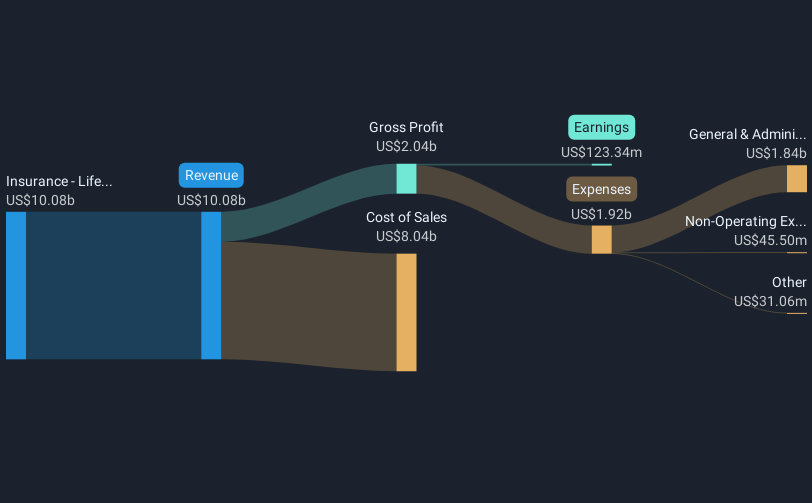

Oscar Health (NYSE:OSCR) recently reported impressive financial results for the first quarter of 2025, showcasing a robust year-over-year growth in revenue and net income with earnings per share also on the rise. These strong financial indicators have been accompanied by a significant price move of 35% over the past month. Oscar Health's performance might have added weight to broader market trends, as the market itself has risen by approximately 4% over the past week. In this context, Oscar Health's significant price movement highlights investor enthusiasm in response to the company's operational success.

The recent impressive financial results from Oscar Health have been a catalyst for its significant short-term share price movement, reflecting investor optimism. However, over the past three years, Oscar Health's total return, inclusive of share price appreciation and dividends, reached 181.06%. This positive performance highlights the company's potential to weather challenges and maintain growth, despite its underperformance relative to the US insurance industry and market over the past year.

The news of strong Q1 performance, underscored by year-over-year growth in revenue and net income, might bolster confidence in future revenue and earnings forecasts. The integration of AI and expansion into new markets could maintain a positive trajectory in Oscar Health's long-term efficiency and success. Despite these opportunities, uncertainties such as regulatory changes and market conditions remain potential risks to forecasts.

The current share price movement appears promising when compared to the consensus analyst price target of US$19.36. With the shares currently trading at US$13.07, there exists a potential upside relative to the price target. Investors will have to weigh existing growth prospects against projected risks to decide if the current valuation aligns with future performance expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.