Please use a PC Browser to access Register-Tadawul

Oscar Health (OSCR): Reassessing Valuation as Regulatory and Competitive Pressures Intensify in Georgia

Oscar Health, Inc. Class A OSCR | 13.23 | -3.64% |

Oscar Health (OSCR) is back in focus after fresh analysis flagged rising regulatory and competitive risks, especially in Georgia, where shifting enrollment patterns could pressure margins and reshape how investors think about the stock.

The latest regulatory jitters have landed just as Oscar’s 1 month share price return of 11.50 percent and year to date share price return of 10.92 percent signal a tentative recovery, while its 3 year total shareholder return of 580.09 percent still reflects how dramatically sentiment has swung in the company’s favor over the longer run.

If this kind of healthcare volatility has your attention, it may be worth scanning other opportunities across healthcare stocks to see which insurers and health names the market is rewarding right now.

With shares now trading slightly above Wall Street’s target despite regulatory overhangs and Georgia specific pressure, investors have to ask: is Oscar Health mispriced on near term fear, or fairly valued for the growth already expected?

Most Popular Narrative Narrative: 2.5% Overvalued

With Oscar Health last closing at $15.03 against a narrative fair value near $14.67, the story tilts toward modest overvaluation driven by long term optimism.

The analysts have a consensus price target of $11.143 for Oscar Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.0, and the most bearish reporting a price target of just $8.0.

Curious how restrained revenue growth assumptions still support rising margins and a richer earnings multiple than the broader insurance sector? The narrative leans on a bold profitability pivot, steady top line expansion, and a future valuation profile usually reserved for established compounders. Want to see the exact growth and margin path that underpins that premium fair value call?

Result: Fair Value of $14.67 (OVERVALUED)

However, robust digital adoption and AI driven efficiencies, alongside aggressive repricing, could accelerate margin recovery faster than these cautious fair value assumptions imply.

Another View: Market Multiples Still Point to Value

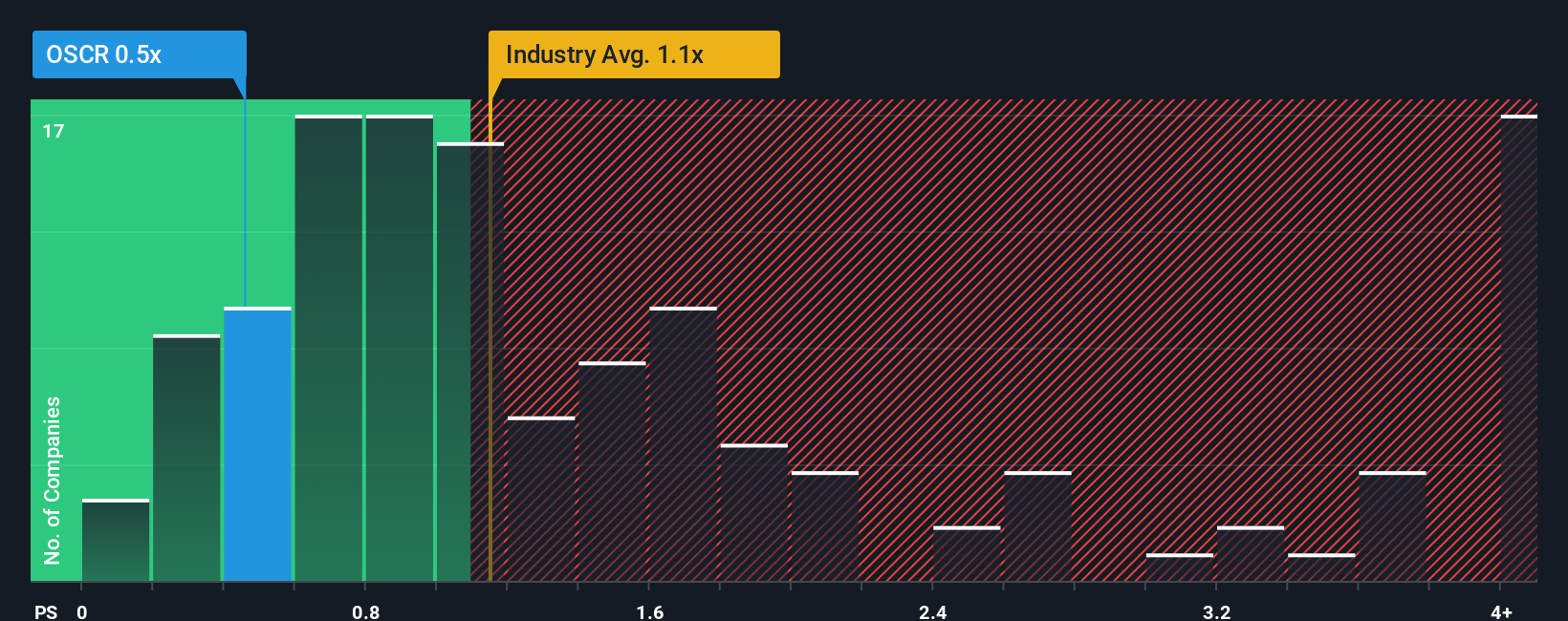

While the narrative fair value suggests Oscar Health is about 2.5 percent overvalued, its 0.4 times price to sales ratio looks cheap next to the US Insurance industry at 1.1 times, peers at 0.7 times, and even a 0.6 times fair ratio. Is sentiment discounting the very profitability shift analysts expect?

Build Your Own Oscar Health Narrative

If this perspective does not fully resonate, or you prefer digging into the numbers yourself, you can quickly craft a tailored view in minutes with Do it your way.

A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Before you move on, consider scanning a few targeted ideas from the Simply Wall Street Screener so you are not leaving potential opportunities on the table.

- Position yourself early in potential turnaround stories by reviewing these 3635 penny stocks with strong financials that already show real substance behind their low share prices.

- Explore the AI theme by targeting these 24 AI penny stocks that may be translating breakthrough technology into revenue and earnings growth.

- Strengthen your portfolio’s foundation with these 902 undervalued stocks based on cash flows that the market has not fully appreciated based on their estimated future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.