Please use a PC Browser to access Register-Tadawul

PACCAR (PCAR): Evaluating Valuation After Mixed Q3 Results and Margin Pressures

PACCAR Inc PCAR | 111.56 | -1.09% |

PACCAR (PCAR) just reported its third-quarter earnings, showing lower sales and net income than last year. However, the company slightly beat revenue expectations. Margin pressures from tariffs remain an issue, even as some divisions showed real strength.

Despite delivering results that were a mixed bag, with strong revenue from key divisions but softer earnings, PACCAR’s recent share price showed some resilience and finished the past week with a 4.8% gain. Momentum, however, has leveled out year to date, with the 12-month total shareholder return essentially flat at 0.14%. Over the longer term, PACCAR’s three-year total shareholder return of 83% and five-year return of 111% both point to significant value creation for patient investors.

If you’re following shifts in the industrial sector and want to see how other manufacturers are performing, this is a great moment to discover See the full list for free.

With mixed signals from PACCAR’s latest quarter, the key question is whether the current valuation now offers investors a window of opportunity, or if the stock’s price already reflects its future growth prospects.

Most Popular Narrative: 6.7% Undervalued

With a fair value estimate of $107 from the most popular narrative and the last close at $99.80, PACCAR’s fundamentals are regarded as supportive of a higher share price. However, the room for upside is not dramatic. The narrative bases its assessment on factors well beyond short-term swings, taking into account the company’s embedded cost advantages and industry demand shifts.

Recent Section 232 tariff changes will alleviate cost pressures. This is expected to provide a structural cost advantage due to PACCAR’s significant domestic manufacturing footprint in Texas, Ohio, and Washington. The company is expected to benefit from improved market share opportunities in heavy- and medium-duty trucks as competitors with more international manufacturing operations face ongoing tariff headwinds.

There is a bold assumption driving this valuation: record-breaking earnings expansion and a profit margin boost that would make most industry peers jealous. Want to know what kind of top-line growth and margin trajectory analysts believe PACCAR can deliver? The full narrative reveals the precise profit blueprint that justifies this fair value.

Result: Fair Value of $107 (UNDERVALUED)

However, persistent tariff uncertainties and potential weakness in underlying truck demand could challenge these upbeat margin and growth projections in the near term.

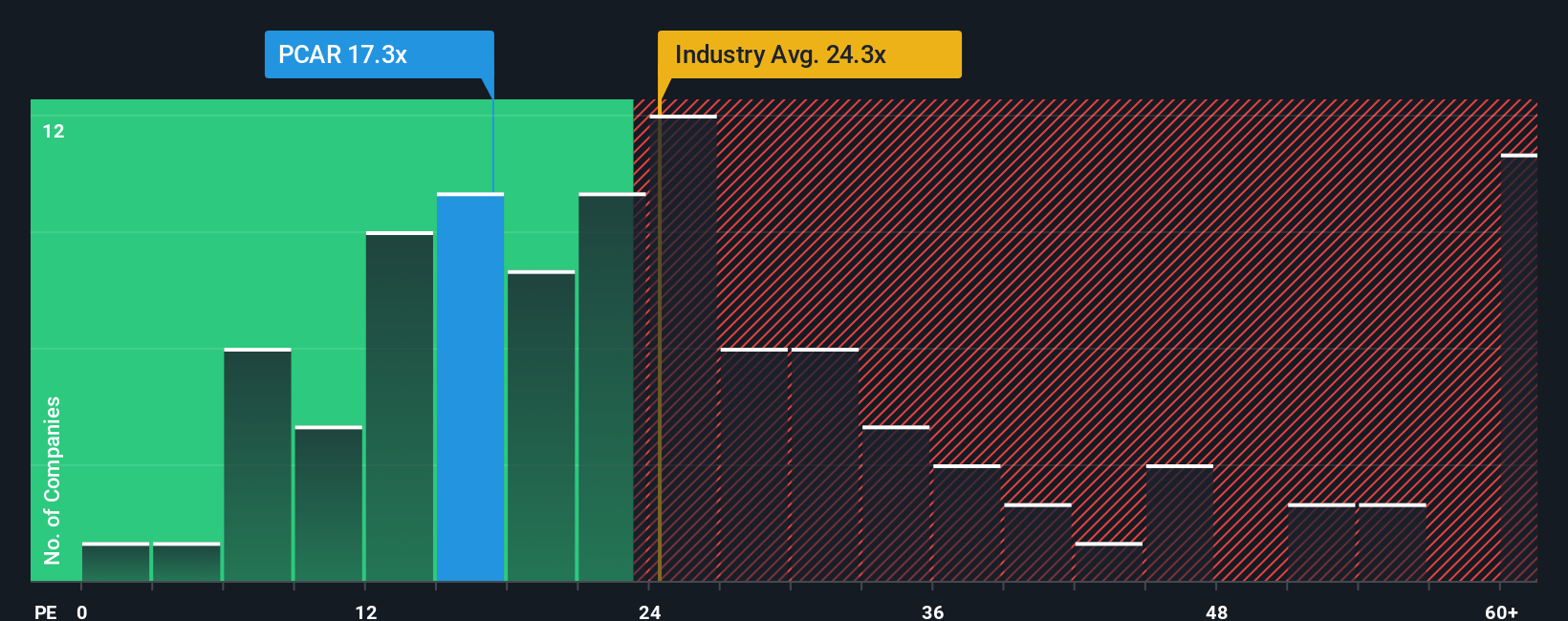

Another View: Multiples Point to Good Value

Taking a different approach, PACCAR’s price-to-earnings ratio of 19.5 is noticeably lower than both the US Machinery industry average of 24.6 and the peer average of 21.6. Even compared to a fair ratio estimate of 31.4, the gap suggests PACCAR might offer investors a margin of safety. But could the market be missing something, or is there a hidden risk?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PACCAR for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PACCAR Narrative

If the narrative above doesn't match your perspective, or you'd rather dig into the numbers yourself, you can easily assemble your own view in under three minutes, starting here: Do it your way

A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't let your next winning stock slip by. Make your research count and uncover unique companies that could reshape your portfolio and boost your returns.

- Accelerate your search for robust payouts by browsing these 17 dividend stocks with yields > 3% with consistent yields above 3% and resilient cash flows.

- Capitalize on emerging AI trends by scanning these 26 AI penny stocks making advances in areas such as automation and personalized medicine.

- Spot exceptional value opportunities by investigating these 875 undervalued stocks based on cash flows positioned for upside based on future cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.