Please use a PC Browser to access Register-Tadawul

Pagaya Technologies (PGY) Is Down 10.7% After Analyst Optimism Despite Strong Forecasts Has The Bull Case Changed?

Pagaya Technologies PGY | 22.70 | -9.05% |

- In the past week, Pagaya Technologies reported a significant year-over-year increase in forecasted earnings and revenue, paired with renewed analyst optimism regarding its business outlook.

- Despite this positive outlook, the company saw its stock underperform the broader market, highlighting an interesting disconnect between business fundamentals and investor sentiment.

- We'll examine how analyst optimism, despite recent share price weakness, may influence Pagaya's evolving investment narrative and outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Pagaya Technologies Investment Narrative Recap

To be a shareholder in Pagaya Technologies, you need to believe in the company's future as an AI-driven credit network, where its ability to attract new lending partners and optimize credit underwriting drives long-term growth. The recent rise in revenue and earnings forecasts, despite the stock's sharp pullback, hasn't changed the fundamental catalyst, the pace at which Pagaya can successfully onboard new partners and integrate advanced technology. Downside risk remains tied to competition and regulatory scrutiny, neither of which has been immediately impacted by the latest results.

One of Pagaya's most relevant recent announcements is the expansion and refinancing of its revolving credit facility to US$132 million, which significantly lowers the company’s cost of debt. This move gives Pagaya added flexibility to fund ongoing growth initiatives, an important support for its ambitions to bring new bank and fintech partners onto its network, aligning closely with the company's short-term revenue and onboarding catalysts.

However, even with this improved financial position, investors should be mindful of what could happen if...

Pagaya Technologies' narrative projects $1.8 billion in revenue and $311.7 million in earnings by 2028. This requires 17.0% yearly revenue growth and a $594.1 million earnings increase from current earnings of -$282.4 million.

Uncover how Pagaya Technologies' forecasts yield a $40.50 fair value, a 30% upside to its current price.

Exploring Other Perspectives

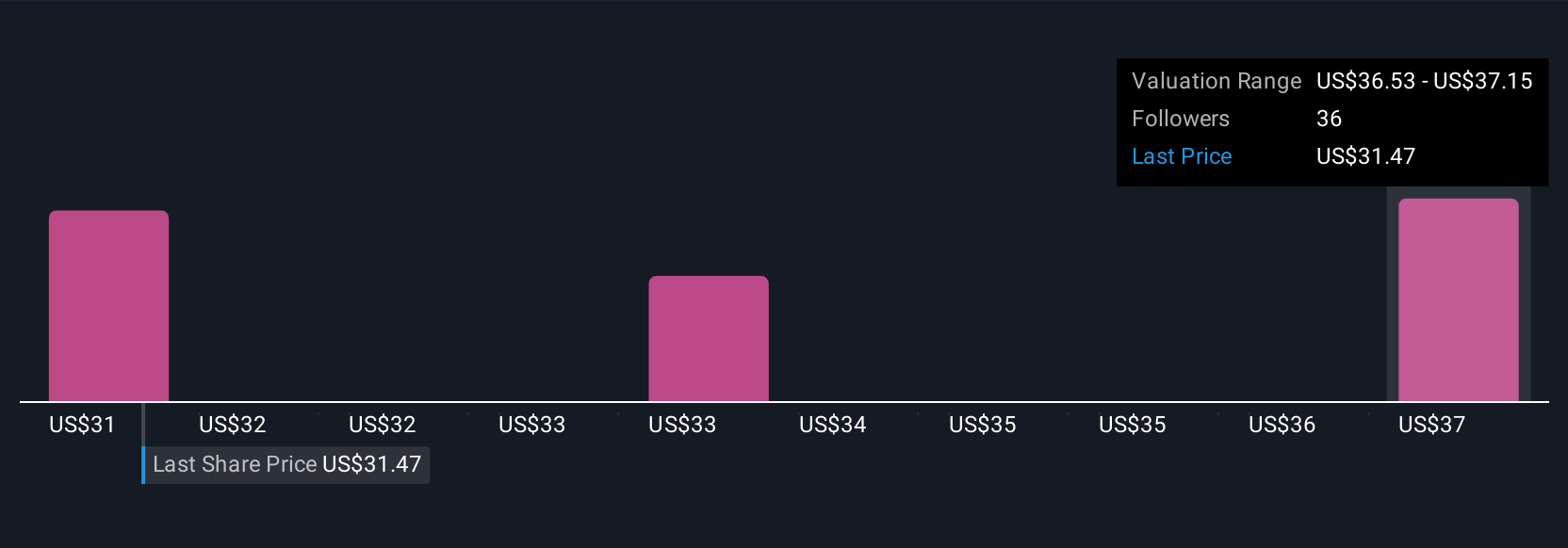

Fair value estimates from seven Simply Wall St Community members span a wide US$34.05 to US$85.98 range. While perspectives differ, the focus on scaling banking partnerships may determine how quickly Pagaya's business outlook develops over the next year.

Explore 7 other fair value estimates on Pagaya Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own Pagaya Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pagaya Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pagaya Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pagaya Technologies' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.