Please use a PC Browser to access Register-Tadawul

Palantir Technologies (NasdaqGS:PLTR) Partners With Ondas To Enhance Autonomous Drone Platforms

Palantir PLTR | 183.57 | -2.12% |

Palantir Technologies (NasdaqGS:PLTR) experienced a 7.6% price increase over the last quarter, potentially influenced by a series of new partnerships and market trends. The recent partnership with Ondas Holdings, which focuses on utilizing Palantir's Foundry platform to enhance the capabilities of Ondas's autonomous drone systems, aligns with the company's broader strategy of expanding its presence in real-time data analytics across multiple sectors. Other significant events during this period include the deployment of technological solutions at Societe Generale and a joint venture with TWG Global to drive AI deployment in financial services. On a broader market level, the tech rally led by companies like Tesla and Nvidia, driven in part by an encouraging CPI inflation report, has buoyed technology stocks, including Palantir. Despite broader market volatility, with indices fluctuating amid economic concerns, Palantir's focus on innovation and strategic alliances has supported its share price performance.

Over the past three years, Palantir Technologies has delivered a very large total return of 624.70%. This impressive performance comes in contrast to market volatility and industry fluctuations. In the last year, Palantir outpaced the broader US market, which returned 8.8%, and the US Software industry, which decreased by 0.7%. The period saw strong earnings growth, reaching 120.3% over the past year, far exceeding the industry's 32.2%. This growth was supported by successful strategic partnerships, such as the collaboration with Voyager Technologies in March 2025 to bolster AI-powered solutions for space awareness.

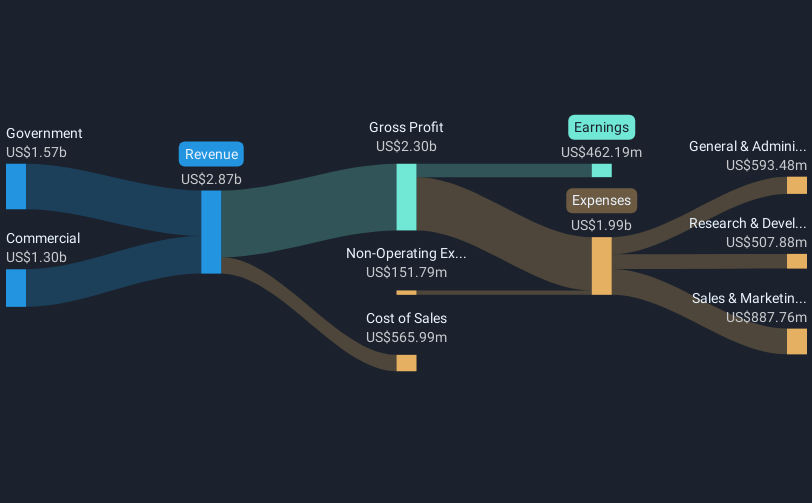

Additionally, corporate actions, including a share buyback totaling 2.12 million shares for US$64.2 million, played a role in Palantir’s robust longer-term performance. Key financial milestones, like the company's rise in annual revenue from US$2.23 billion to US$2.87 billion by 2024, highlight the operational success underpinning this return. Despite management changes and market challenges, Palantir's focus on AI and data-driven solutions continues to drive its performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.