Please use a PC Browser to access Register-Tadawul

Palantir Technologies (PLTR) Q2 2025 Revenue Surges To US$1,004 Million

Palantir PLTR | 183.57 | -2.12% |

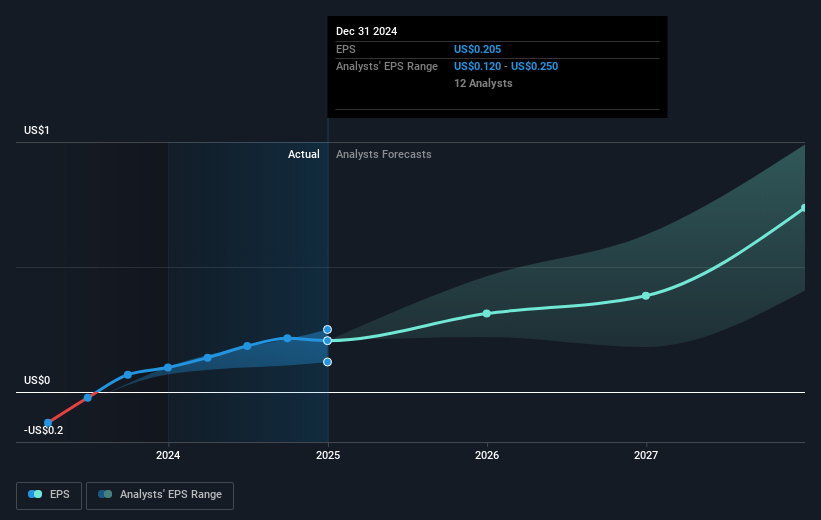

Palantir Technologies (PLTR) recently reported significant financial achievements, including Q2 2025 sales surging to $1,004 million and net income reaching $327 million, reflecting strong year-over-year growth. Complementing this positive news, the company raised its full-year revenue guidance, projecting an ambitious 45% growth, alongside forming key alliances, such as with Velocity Clinical Research and Tomorrow.io. These developments likely contributed to Palantir's stock price climbing 51% over the last quarter, a move that aligns with broader market trends, where pertinent organizations also reported robust earnings amidst evolving trade scenarios.

Over the last three years, Palantir Technologies' shares have experienced a very large total return, highlighting the company's robust growth trajectory. In contrast, over the past year, Palantir's shares not only surpassed the US market's rise of 22.4% but also outperformed the US software industry, which posted a 39.8% increase. This indicates Palantir's exceptional positioning within its sector.

Palantir's significant financial achievements and strategic partnerships in recent times are likely influencing its optimistic revenue and earnings forecasts. The projected 45% year-over-year revenue growth underscores this positive outlook. Share prices climbed by 51% in the last quarter. However, it is important to note that the current share price of US$179.54 is above the consensus analyst price target of US$146.54, suggesting a potential reevaluation in market sentiment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.