Please use a PC Browser to access Register-Tadawul

Patria Investments (PAX): Evaluating Valuation After Leadership Reshuffle and New Global COO Appointment

Patria Investments Ltd. Class A PAX | 17.40 | +1.28% |

Patria Investments (PAX) just reshuffled key leadership, naming a new Global COO and planning a CFO transition for 2026, with these moves aimed at tightening execution as the stock rides solid recent momentum.

Those leadership upgrades come as Patria’s 1 month share price return of 9.81% and 37.10% share price return year to date, alongside a 43.04% 1 year total shareholder return, signal that momentum is still building rather than fading around the $15.67 level.

If this kind of leadership driven story has your attention, it could also be a good moment to explore fast growing stocks with high insider ownership as you hunt for the next under the radar compounder.

Strong momentum, upbeat earnings revisions and a small discount to analyst targets hint at further upside. However, with intrinsic value screens flashing overvaluation, is Patria still a buy, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 5.4% Undervalued

With Patria closing at $15.67 against a most popular narrative fair value of $16.57, the story focuses on upgraded growth and profitability expectations.

The company's ongoing expansion into new strategies, products, and geographies (including recent acquisitive moves in Brazilian and Mexican real estate and GPMS European platforms) further diversifies fee revenues and enhances operating leverage, thus supporting higher sustainable margins and earnings compounding as scale advantages take hold.

If you want to see the profit engine behind that higher fair value and understand why future margins and earnings multiples are expected to look so different, you can review the full narrative.

Result: Fair Value of $16.57 (UNDERVALUED)

However, Patria still faces fee compression and Latin American macro volatility, which could pressure margins and test investor conviction in the growth story.

Another View on Valuation

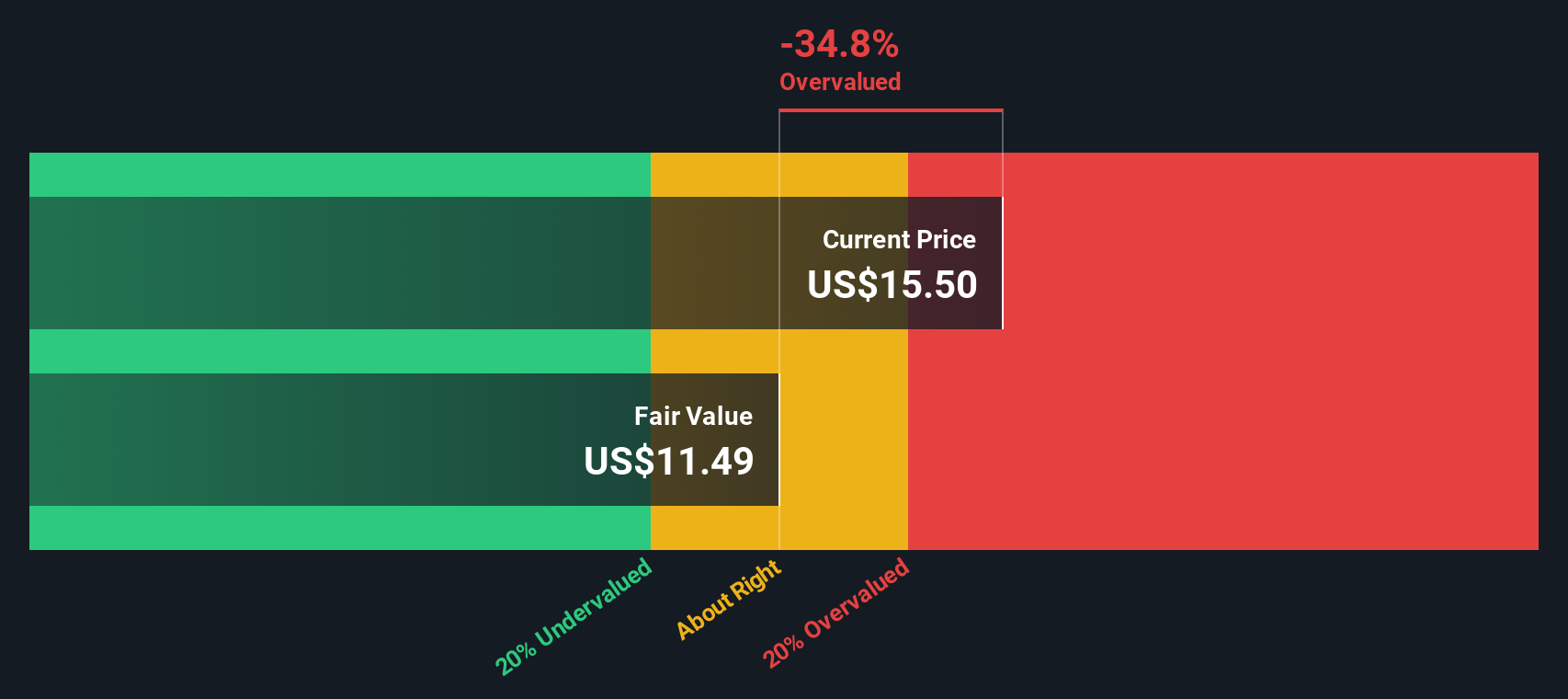

While the popular narrative sees Patria as 5.4% undervalued, our SWS DCF model points the other way and suggests fair value closer to $11.49, meaning the shares look overvalued at current levels. Is the market rightly betting on a structurally higher growth and margin profile, or is it getting ahead of itself?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Patria Investments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Patria Investments Narrative

If you are not fully aligned with this view or would rather dive into the numbers yourself, you can build a tailored narrative in minutes: Do it your way.

A great starting point for your Patria Investments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop upgrading their watchlist, so before momentum shifts elsewhere, use the Simply Wall St Screener to spot what others are still overlooking.

- Capitalize on mispriced opportunities by targeting these 913 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Position yourself ahead of the next tech wave by focusing on these 24 AI penny stocks shaping software, automation, and intelligent infrastructure across multiple industries.

- Strengthen your income stream by zeroing in on these 12 dividend stocks with yields > 3% that can potentially boost returns while smoothing out portfolio volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.