Please use a PC Browser to access Register-Tadawul

Patria Investments (PAX) Net Margin Strength Challenges Concerns Over Earnings Quality

Patria Investments Ltd. Class A PAX | 14.00 | +1.08% |

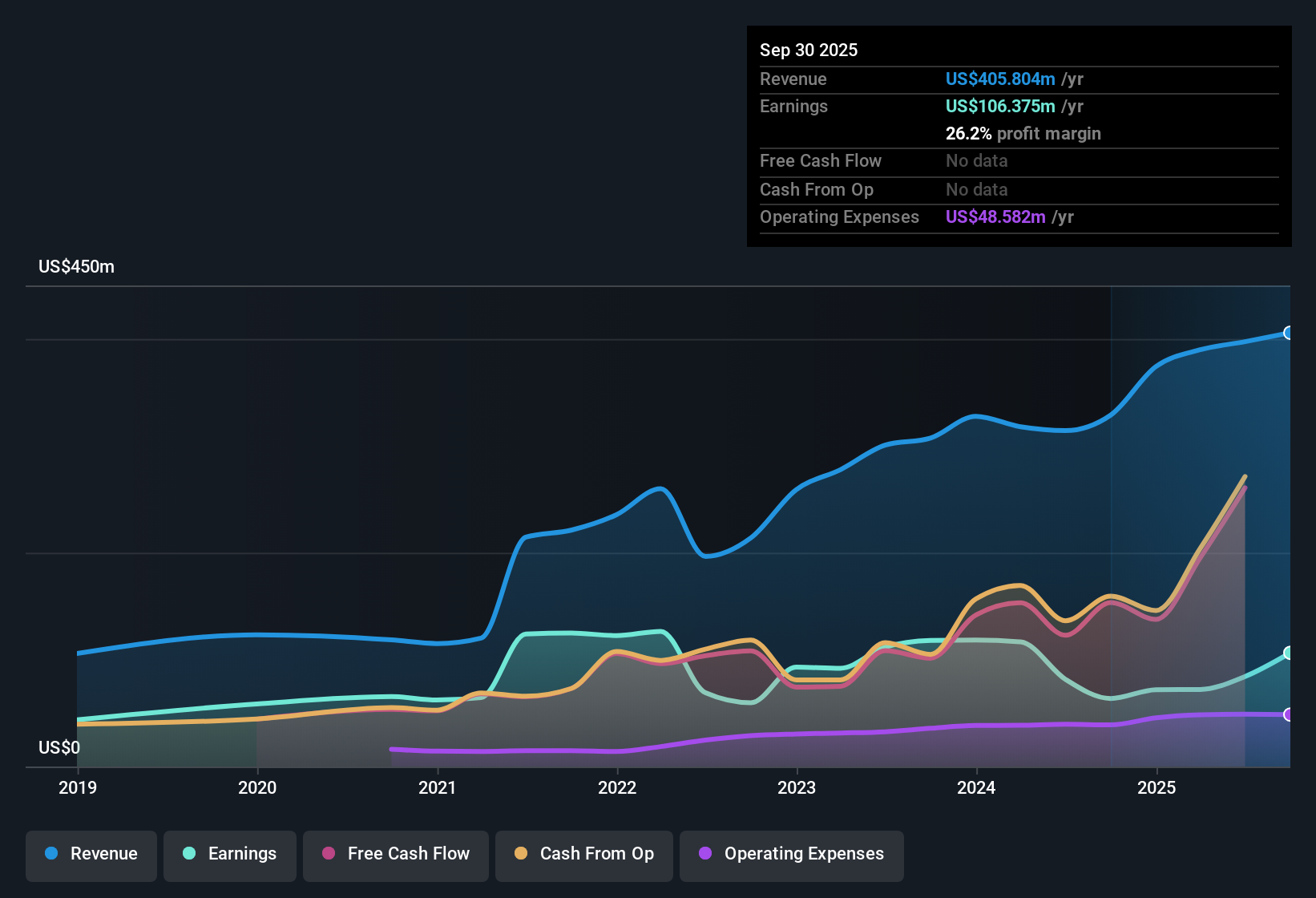

Patria Investments (NasdaqGS:PAX) has reported third quarter FY 2025 results with revenue of US$86.5 million and basic EPS of US$0.14, setting the tone for a year where trailing 12 month revenue sits at US$405.8 million and EPS at US$0.67. The company has seen quarterly revenue run from US$74.9 million in Q2 2024 to US$86.5 million in Q3 2025, while basic EPS over that stretch has moved between roughly US$0.00 and US$0.35 per quarter, backed by trailing 12 month net income of US$106.3 million and a reported net margin of 26.2%. With earnings growth forecasts in the data and a 4.2% dividend yield set against a one off US$61.3 million loss, investors are likely to focus closely on how sustainable these margins look through the cycle.

See our full analysis for Patria Investments.With the latest figures on the table, the next step is to see how this earnings profile lines up with the widely followed narratives around Patria Investments, and where the numbers challenge some of those existing views.

Net income and margins look stronger on a 12 month view

- On a trailing 12 month basis, Patria has US$106.3 million in net income and a 26.2% net margin compared with 19.4% in the prior year, which lines up with a 67.2% rise in earnings over that same period.

- What stands out for a bullish take is that this profitability is coming through even with a US$61.3 million one off loss in the last 12 months. This means:

- Earnings of US$106.3 million and EPS of US$0.67 over the trailing period are being reported after absorbing that loss, so bulls can point to the 26.2% margin as support for the business model even when results include a sizeable drag.

- At the same time, the presence of that one off item gives you a clear reminder to separate ongoing fee and investment income from exceptional charges when judging how repeatable that 26.2% margin might be.

Quarterly performance steadies after very weak 2024 mid year

- Comparing individual quarters, net income moved from US$0.7 million in Q2 2024 to US$0.5 million in Q3 2024, then to US$55.3 million in Q4 2024, and has since been in the US$12.9 million to US$22.6 million range across Q1 to Q3 2025, with basic EPS between roughly US$0.08 and US$0.14 in those 2025 quarters.

- For a more cautious or bearish angle, critics often worry that private markets earnings can be uneven, and the recent data gives them a few talking points alongside some pushback:

- The very small net incomes of US$0.5 million and US$0.7 million in Q3 and Q2 2024 compared with US$22.6 million in Q3 2025 show how sensitive reported profits can be quarter to quarter, which fits the concern that performance fees and one offs can create lumpiness.

- On the other hand, three straight 2025 quarters with net income between US$12.9 million and US$22.6 million suggest that, at least over this recent stretch, results have been more consistent than those weak 2024 mid year figures alone might imply.

Valuation, growth forecasts and dividend coverage are pulling in different directions

- The shares trade at US$14.27 with a trailing P/E of 21.4x, compared with a peer average P/E of 14.6x and a US Capital Markets industry average of 23.8x, while a DCF fair value of US$12.48 and a 4.2% dividend yield that is flagged as not well covered by earnings round out the picture.

- What creates a clear tension for both bullish and bearish views is how the growth, valuation and dividend data intersect:

- Supporters can point to earnings growth of 67.2% over the last year and forecasts in the data for earnings and revenue to grow around 24.7% and 14.5% per year, which helps explain why the P/E of 21.4x sits above peers even though the current price is above the DCF fair value of US$12.48.

- Skeptics, however, are likely to focus on the note that the 4.2% dividend yield is not well covered by earnings and that the shares trade above the DCF fair value, which together suggest income focused investors may want to look closely at how much of those projected growth numbers might already be reflected in today’s valuation.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Patria Investments's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Patria’s quarterly earnings have been quite uneven and the dividend is flagged as not well covered by earnings, which may worry income focused investors.

If that payout gap feels uncomfortable, shift your attention to these 1789 dividend stocks with yields > 3% to quickly zero in on companies offering yields backed by stronger earnings support today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.