Please use a PC Browser to access Register-Tadawul

Patterson-UTI Energy, Inc. (NASDAQ:PTEN) Surges 25% Yet Its Low P/S Is No Reason For Excitement

Patterson-UTI Energy, Inc. PTEN | 8.41 | -1.06% |

Patterson-UTI Energy, Inc. (NASDAQ:PTEN) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 18% in the last twelve months.

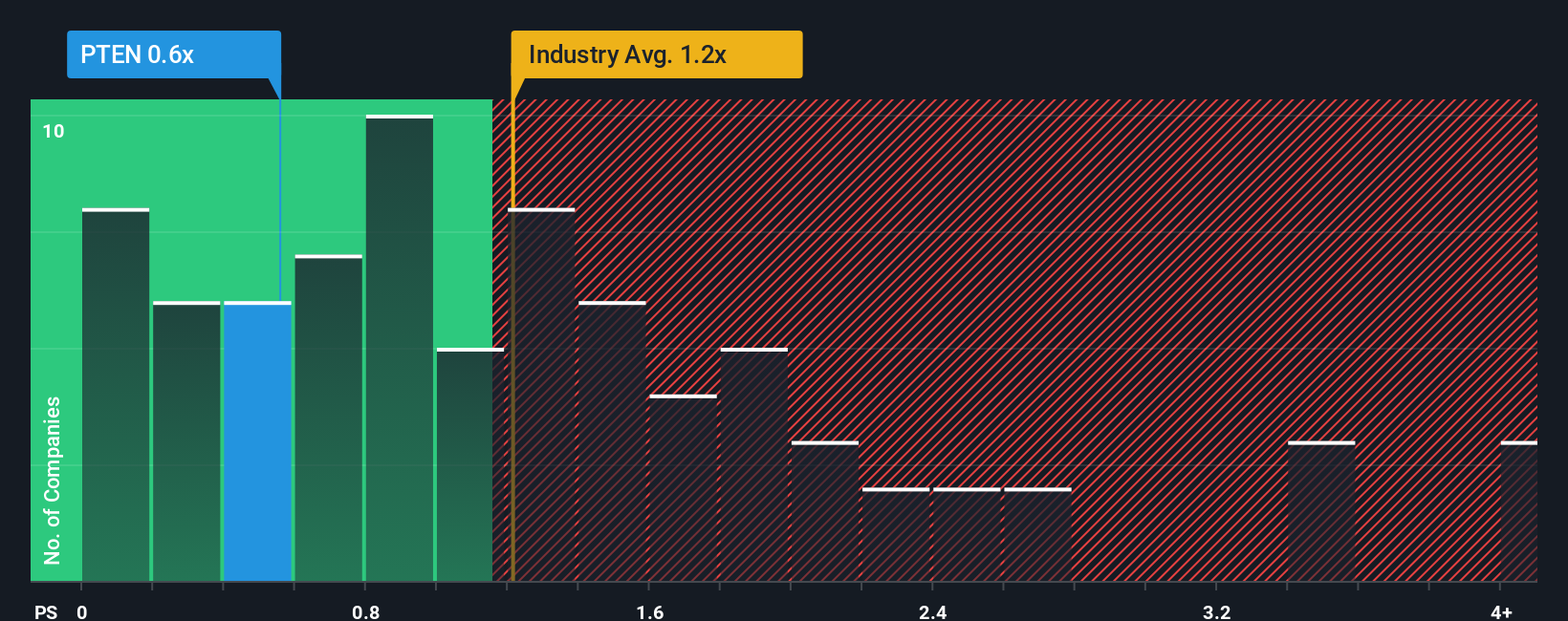

Although its price has surged higher, given about half the companies operating in the United States' Energy Services industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Patterson-UTI Energy as an attractive investment with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Patterson-UTI Energy Performed Recently?

Patterson-UTI Energy hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Patterson-UTI Energy will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Patterson-UTI Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 108% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 1.1% per year as estimated by the twelve analysts watching the company. With the industry predicted to deliver 4.1% growth each year, that's a disappointing outcome.

With this in consideration, we find it intriguing that Patterson-UTI Energy's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Patterson-UTI Energy's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's clear to see that Patterson-UTI Energy maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.