Please use a PC Browser to access Register-Tadawul

Patterson-UTI Energy (PTEN) Is Up 5.9% After Narrower 2025 Net Loss Despite Softer Sales

Patterson-UTI Energy, Inc. PTEN | 8.41 | -1.06% |

- Patterson-UTI Energy, Inc. has reported its fourth-quarter and full-year 2025 results, with quarterly sales of US$1,150.81 million and a quarterly net loss of US$9.09 million, and full-year sales of US$4,826.62 million alongside a full-year net loss of US$93.64 million, all for the period ended December 31, 2025.

- While revenue for both the quarter and the full year declined compared with the prior period, the company’s net loss narrowed substantially, and loss per share from continuing operations improved to US$0.02 for the quarter and US$0.24 for the year.

- Now we’ll examine how this narrowing full-year net loss, despite softer sales, may influence Patterson-UTI Energy’s existing investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 31 best rare earth metal stocks of the very few that mine this essential strategic resource.

Patterson-UTI Energy Investment Narrative Recap

To be a shareholder in Patterson-UTI Energy, you need to believe that its scale, technology and integrated drilling and completions offering can translate into more resilient profitability, even in choppy activity levels. The latest results show sales easing for both the quarter and full year, but losses narrowing sharply. That improves the near term picture around earnings quality, yet does not materially change the key short term swing factor, which remains customer activity levels, or the central risk of prolonged softness in drilling and completions demand.

Against this backdrop, the company’s steady affirmation of a quarterly dividend of US$0.08 per share across 2024 and 2025 stands out as particularly relevant. Maintaining the dividend while still loss making underlines management’s confidence in Patterson-UTI’s cash generation and balance sheet, but it also sharpens the risk that high ongoing capital expenditure and shareholder returns could strain free cash flow if activity and pricing weaken further, limiting financial flexibility at a time when the industry is still normalizing.

But while the improving loss profile looks encouraging on the surface, investors should be aware that prolonged drilling softness could still...

Patterson-UTI Energy's narrative projects $4.8 billion revenue and $337.4 million earnings by 2028. This requires a 1.3% yearly revenue decline and an earnings increase of about $1.4 billion from -$1.1 billion today.

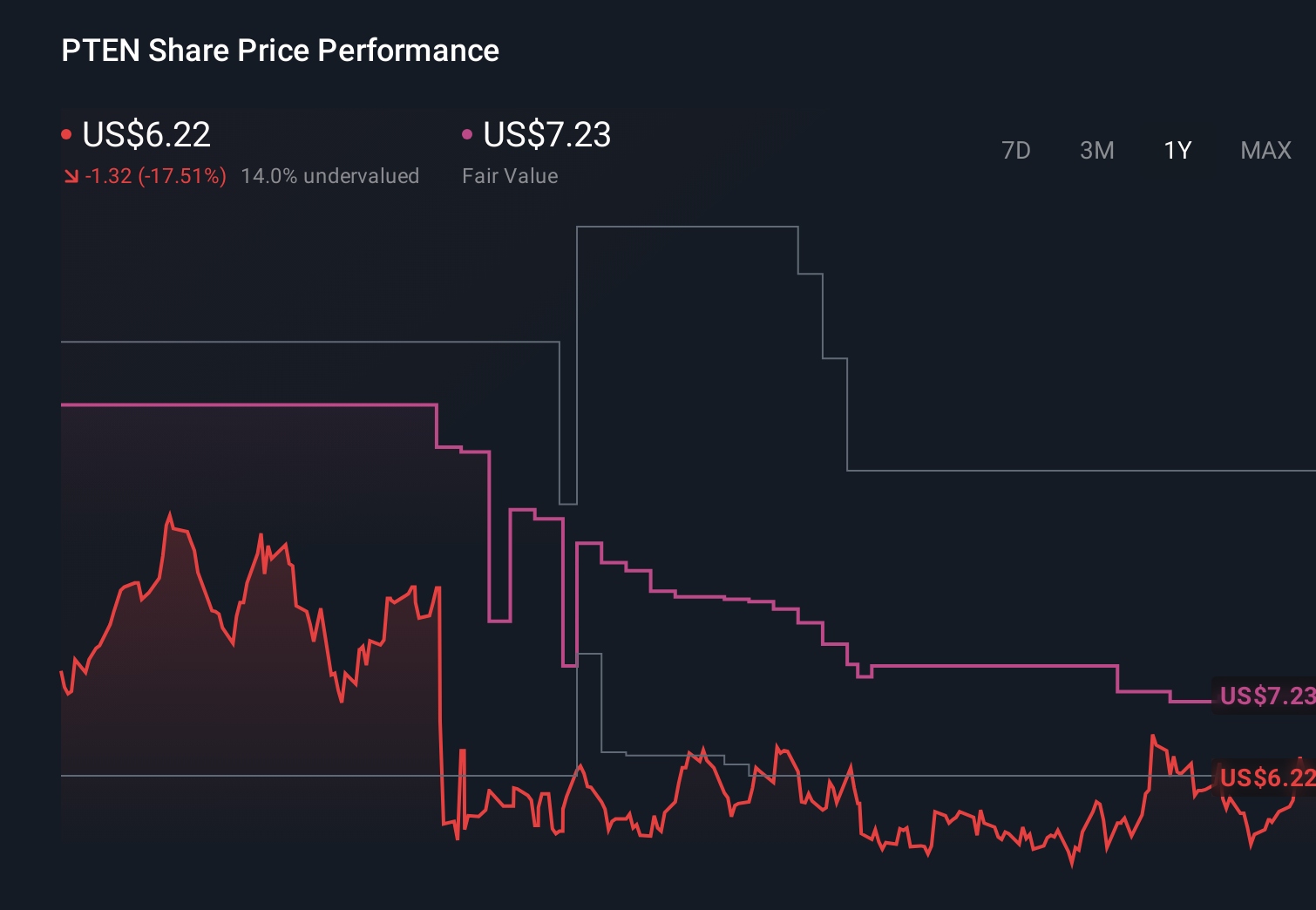

Uncover how Patterson-UTI Energy's forecasts yield a $7.88 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were assuming revenues around US$5.0 billion and a swing to roughly US$348.3 million in earnings by 2028, which is a far more bullish margin story than the consensus baseline. In light of the latest year’s US$4,826.62 million in sales and continued net loss, it will be important for you to compare these upbeat expectations on automation driven margin gains with your own view of the risks around high ongoing capital needs and see how both narratives might shift after this report.

Explore 5 other fair value estimates on Patterson-UTI Energy - why the stock might be worth over 3x more than the current price!

Build Your Own Patterson-UTI Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patterson-UTI Energy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Patterson-UTI Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patterson-UTI Energy's overall financial health at a glance.

No Opportunity In Patterson-UTI Energy?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

- Invest in the nuclear renaissance through our list of 87 elite nuclear energy infrastructure plays powering the global AI revolution.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.