Please use a PC Browser to access Register-Tadawul

Paycom (PAYC) Is Down 6.3% After AI-Driven Layoffs Reshape Workforce—Has The Bull Case Changed?

Paycom Software, Inc. PAYC | 166.61 | +0.32% |

- In recent days, Paycom Software announced it will lay off more than 500 employees as automation and artificial intelligence make back-office roles redundant.

- This move underscores the accelerating impact of AI-driven technologies on workforce structure and operating efficiencies in the human capital management sector.

- We'll now explore how Paycom's AI-driven job cuts reshape its investment narrative and future operating model.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Paycom Software Investment Narrative Recap

To be a shareholder in Paycom Software means believing in the long-term ability of automation and AI to drive recurring revenue through human capital management, while maintaining a competitive edge in service and technology. The recent announcement of over 500 job cuts due to AI efficiencies has brought workforce restructuring to the forefront; however, this does not appear to materially impact the biggest near-term catalyst of activating broad client adoption of Paycom’s “IWant” AI feature, nor the largest risk of rapid industry-wide commoditization of similar solutions.

This theme of AI-driven operational transformation aligns closely with Paycom’s July 2025 launch of the “IWant” command-driven AI engine, designed to enhance enterprise productivity and client retention. As the company seeks to balance product innovation with cost control, investors continue to focus on its ability to generate strong recurring revenues while preserving pricing power and differentiation.

By contrast, investors should also be aware of the risk that accelerating AI adoption across the human capital management industry could...

Paycom Software's narrative projects $2.5 billion in revenue and $586.5 million in earnings by 2028. This requires 8.1% yearly revenue growth and a $170.8 million earnings increase from $415.7 million today.

Uncover how Paycom Software's forecasts yield a $249.25 fair value, a 24% upside to its current price.

Exploring Other Perspectives

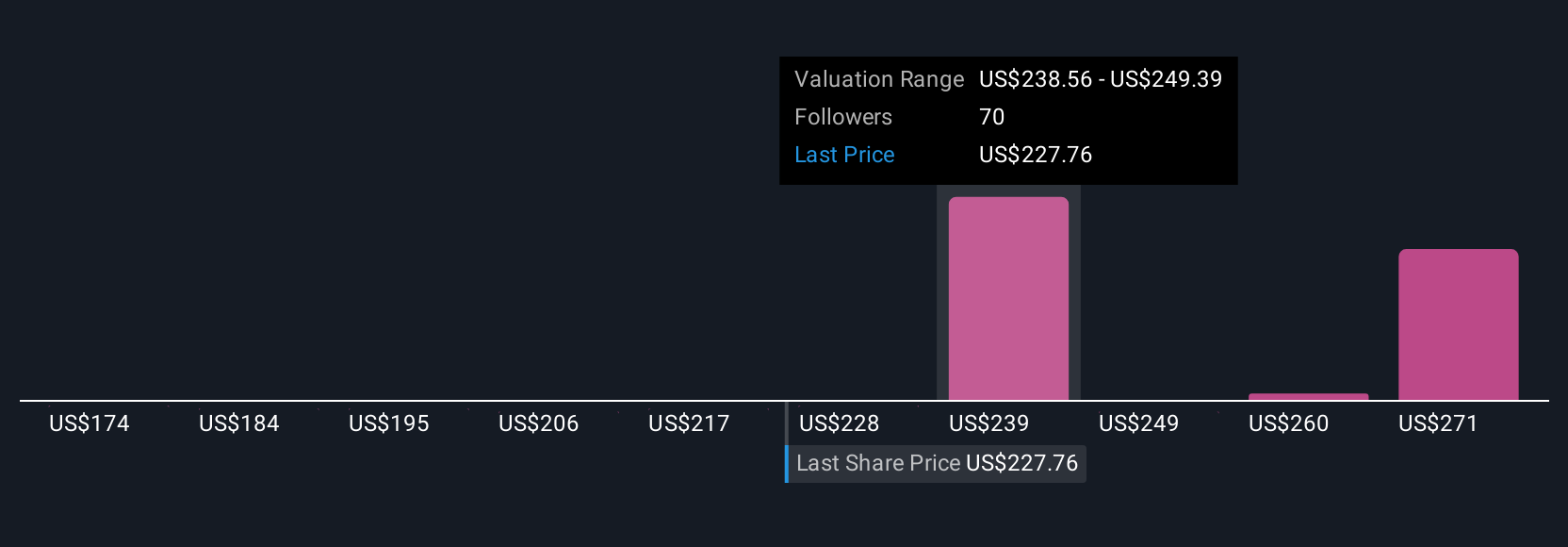

Ten members of the Simply Wall St Community placed fair value estimates for Paycom between US$173.58 and US$388.69 per share, with a wide spread of expectations. Against this range, the prospect of AI commoditization remains a key concern that may sway the company’s long-term pricing power and earnings stability, highlighting why wider perspectives matter for your view.

Explore 10 other fair value estimates on Paycom Software - why the stock might be worth as much as 93% more than the current price!

Build Your Own Paycom Software Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Paycom Software research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Paycom Software research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Paycom Software's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.