Please use a PC Browser to access Register-Tadawul

Paycom Software (PAYC): Assessing Valuation After Analyst Upgrades and Strong AI-Driven Outlook

Paycom Software, Inc. PAYC | 166.61 | +0.32% |

Paycom Software (PAYC) is clearly in the spotlight after a string of positive news that has caught the attention of anyone tracking workplace tech stocks. The big headlines this month have come from the analyst community, with Guggenheim launching coverage and TD Cowen bumping up their view on Paycom. What is behind the enthusiasm? Analysts are pointing to Paycom’s edge in AI-powered features, its unique platform design, and the company’s decision to lift its outlook for the year after a stronger-than-expected quarter. All of these factors are stirring new conversations about the stock’s real potential.

This wave of upbeat analyst calls follows a period where Paycom’s shares have climbed roughly 30% over the past year, building on growing optimism about both its business model and financial resilience. Over the past month, however, momentum has moderated, with the stock pulling back slightly after a strong earlier run. Still, investors have not lost sight of the outperformance versus peers or the company’s solid history of launching products that resonate with today’s HR challenges, especially as more businesses seek AI-driven solutions.

With Wall Street’s confidence mounting and Paycom’s stock still well below its highs from prior years, some investors may be weighing whether this moment presents an attractive opportunity or if the growth potential is already reflected in today’s price.

Most Popular Narrative: 16.5% Undervalued

According to rynetmaxwell, Paycom Software is currently undervalued by 16.5% versus its estimated fair value, with a discount rate included in the analysis. The widely discussed narrative highlights the company’s future growth prospects and points to how recent strategic decisions could drive further upside in the stock price.

"Improve revenue retention rate over the next four quarters as transition to Beti begins to finalize among existing clients. 90% retention as of Q1 2024; has been as high as 94% pre-COVID. Reacceleration of growth in total employees serviced, aiming for a return to double digit growth. This figure was 5% in FY2023. High single to double digit growth in this area will indicate that the company's book of business is growing quickly even if revenue is not, which could continue to be temporarily affected by CRR's and management's focus on the Beti transition."

Why are investors buzzing about Paycom's valuation? The answer is tied to several aggressive forecasts: double-digit expansion, a bold outlook on recurring revenues, and a profit multiple that signals real confidence in Paycom's upward path. Want to know which surprising financial lever might soon change the game for this software leader? The answer can be found by examining the numbers behind this narrative’s fair value claim.

Result: Fair Value of $260.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower-than-expected adoption of Beti or persistent revenue deceleration could present challenges to Paycom’s pathway to upside and reduce optimism around its valuation.

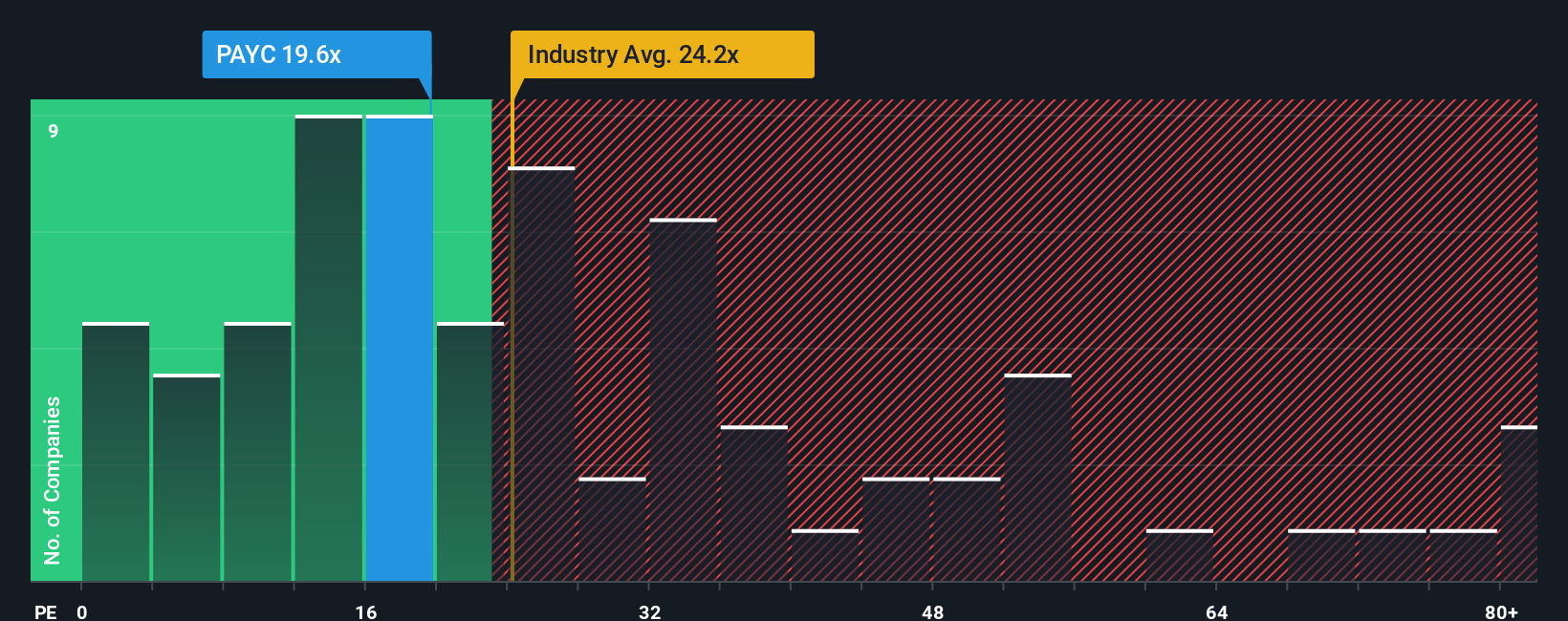

Find out about the key risks to this Paycom Software narrative.Another View: Comparing to Industry Averages

Not everyone sees the same upside. When compared to the industry average on its earnings multiple, Paycom actually looks a bit pricey, which challenges the idea that the shares are a bargain. Which approach will prove right?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Paycom Software Narrative

If you see things differently or want to dig deeper into the numbers, crafting your own narrative takes just a few minutes. Do it your way

A great starting point for your Paycom Software research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let great opportunities pass you by. The smartest moves go to those who actively seek out fresh possibilities. Use Simply Wall Street’s powerful research tools to spot the next breakthrough companies before everyone else.

- Unlock potential in up-and-coming companies backed by robust fundamentals by scanning through penny stocks with strong financials and see which hidden gems could fuel your portfolio’s growth.

- Pursue long-term gains and steady income by tracking firms that deliver dividend stocks with yields > 3% and find out which ones offer yields above 3% with consistent payout histories.

- Target tomorrow’s biggest tech winners by plugging into AI penny stocks to uncover which innovative businesses are at the forefront of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.