Please use a PC Browser to access Register-Tadawul

Paylocity (PCTY): Assessing Valuation After Recent 11% Share Price Decline

Paylocity Holding Corp. PCTY | 150.89 | +1.12% |

Paylocity’s recent 11% slide over the past month comes after a steady fade in share price momentum throughout 2024, with the latest share price closing at $155. Despite periods of annual revenue and profit growth, the longer-term picture shows total shareholder returns down more than 7% over the last year. This suggests that while growth potential remains, the market’s risk perception has shifted lately.

If you’re curious about finding companies with compelling growth stories and strong insider backing, it could be the perfect moment to discover fast growing stocks with high insider ownership.

With Paylocity shares now well below analyst targets and trading at a notable discount, the question for investors is whether the recent drop signals an undervalued opportunity or if future growth is already reflected in the price.

Most Popular Narrative: 29.6% Undervalued

With Paylocity’s last close at $155 and a widely held consensus fair value near $220, there is a significant discrepancy in how analysts interpret its potential. Investors are watching to see if recent technology enhancements will translate into market leadership and margin expansion.

Expansion of Paylocity's unified HR and finance platform, coupled with advanced AI-powered features, is enhancing automation and streamlining complex workflows for clients. This positions the company to capture growing demand from businesses undergoing digital transformation, which could drive higher recurring revenue and an increase in average revenue per client over time.

What is the recipe behind this attention-grabbing fair value? The projections are bold, hinging on recurring growth and powerful future margins. Can this automated HR engine deliver on such optimistically modeled earnings and a future price multiple that stands out from the industry crowd? Unpack the assumptions and see what drives the narrative’s ambitious target.

Result: Fair Value of $220 (UNDERVALUED)

However, slowing recurring revenue and tougher competition from established rivals could limit Paylocity’s ability to maintain rapid growth and margin expansion.

Another View: What Do The Numbers Say?

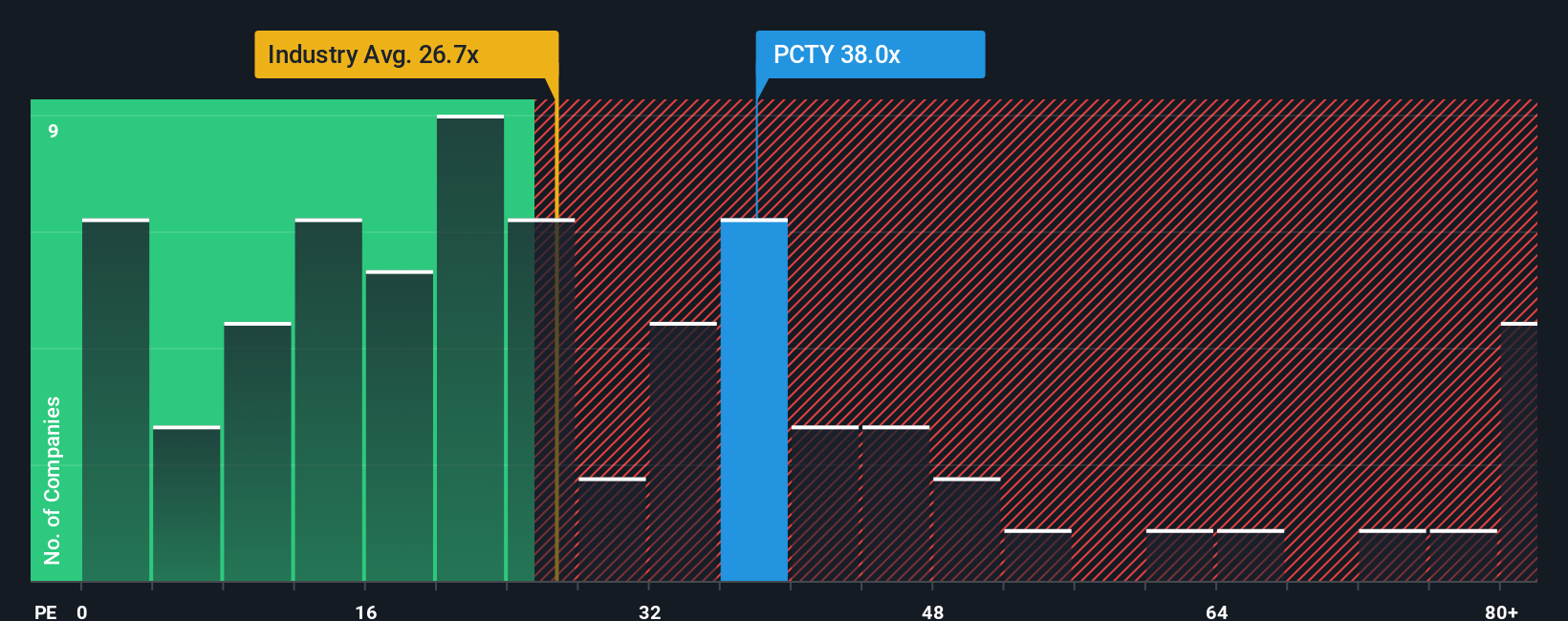

While analyst forecasts and discounted cash flow suggest Paylocity is undervalued, the current price-to-earnings ratio paints a more expensive picture. At 37.6x, it is noticeably above both its industry peers (26.7x) and the 27.4x fair ratio. Does this premium signal justified confidence in future growth, or is the bar set too high if business momentum slows?

Build Your Own Paylocity Holding Narrative

For those who want to dig deeper or approach the numbers from a different angle, you can shape your own conclusions quickly and easily by using Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Paylocity Holding.

Looking for more investment ideas?

Great investments do not wait on the sidelines. Take action now and find your next portfolio standout by using powerful tools designed to surface hidden gems and trends.

- Uncover high-yield opportunities by scanning for those offering strong returns with these 19 dividend stocks with yields > 3% right now.

- Tap into emerging tech by searching for innovation leaders making advances with artificial intelligence using these 24 AI penny stocks.

- Spot value before it is obvious to the crowd and get ahead with insights from these 910 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.