Please use a PC Browser to access Register-Tadawul

PBF Energy (PBF): Assessing Valuation Following UBS Upgrade and CFO Transition

PBF Energy, Inc. Class A PBF | 34.38 | +1.42% |

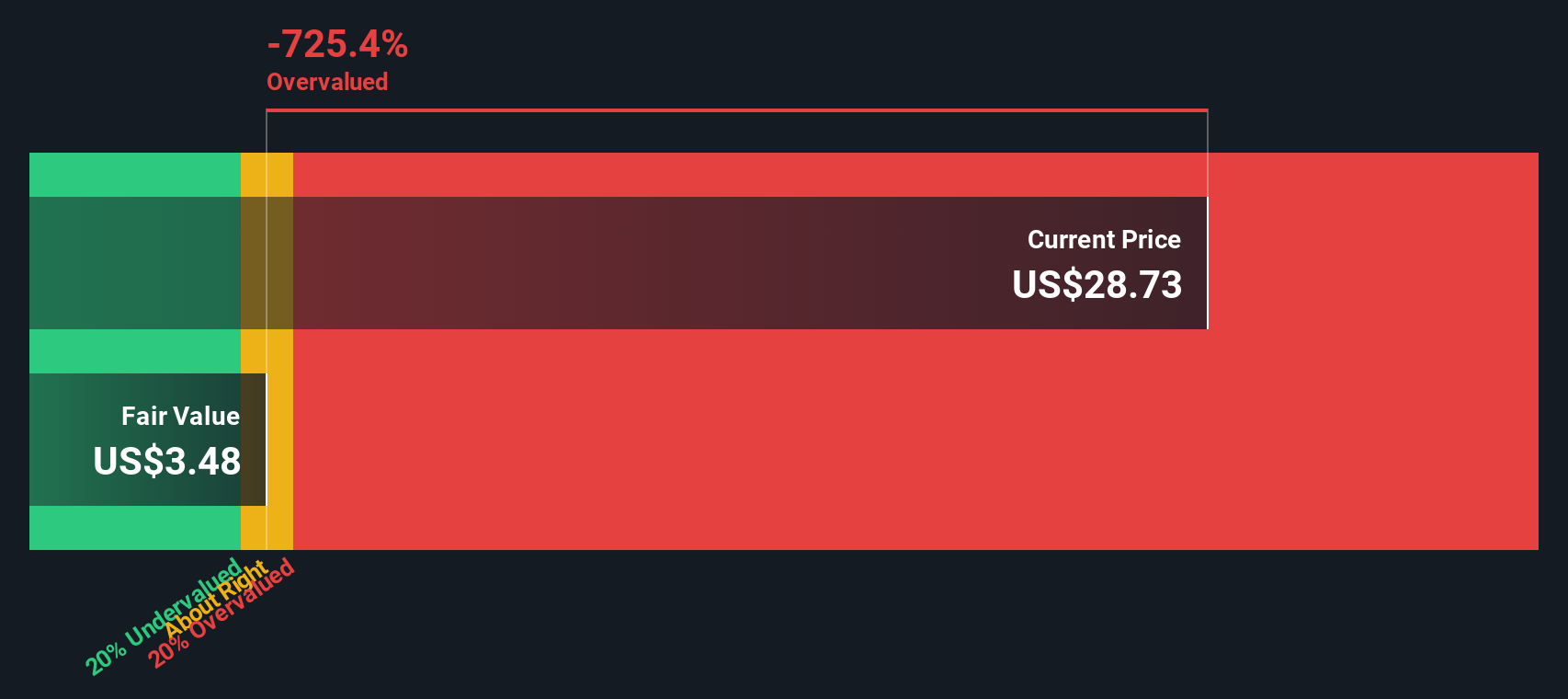

Most Popular Narrative: 36.9% Overvalued

The prevailing analysis suggests that PBF Energy is trading well above its estimated fair value, with current prices exceeding what the most widely followed narrative deems justified based on future prospects and risks.

Net global demand for refined products is expected to exceed net refining capacity additions in the coming years. Driven by ongoing population growth and underinvestment in new refining capacity outside North America, this tightening supply backdrop should support strong utilization, pricing power, and higher revenues for efficient U.S. refiners like PBF.

Think analysts are just being conservative? Their story relies on a bold earnings comeback, surging revenues, and a profit margin shift that would surprise skeptics. Want to see what numbers power this valuation? How close is PBF to a dramatic turnaround?

Result: Fair Value of $23.83 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent operational complications at key facilities and accelerating trends toward electrification could quickly undermine the bullish case for PBF Energy.

Find out about the key risks to this PBF Energy narrative.Another View: What Does Our DCF Say?

The SWS DCF model offers a different perspective, suggesting PBF may be trading above its estimated fair value even though some multiples indicate otherwise. Could this mean the market is overlooking hidden risks?

Build Your Own PBF Energy Narrative

If you have a different take or prefer diving into the numbers firsthand, you can quickly craft your own analysis in just a few minutes. Do it your way

A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More High-Potential Ideas?

Don't let opportunity pass you by. Level up your investment game now by using our tools to uncover unique stocks and accelerate your strategy before the crowd catches on.

- Unlock steady portfolio income by searching for dividend stocks with exceptional yields through our selection of dividend stocks with yields > 3%.

- Tap into game-changing tech trends by seeking out AI-focused companies using our handpicked AI penny stocks.

- Spot the hidden gems trading below their true worth and uncover promising opportunities using our collection of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.