Please use a PC Browser to access Register-Tadawul

PBF Energy (PBF) Valuation Check After Q4 Profit Return And Martinez Refinery Restart Progress

PBF Energy, Inc. Class A PBF | 34.38 | +1.42% |

PBF Energy (PBF) returned to profitability in the fourth quarter of 2025, helped by stronger refining margins, higher throughput, cost savings and insurance recoveries, while preparing to restart its Martinez refinery in early March.

The recent quarterly profit, dividend affirmation and progress at Martinez come against a backdrop of mixed trading, with a 21.07% year to date share price return, a 55.59% one year total shareholder return and a 180.90% five year total shareholder return. This suggests momentum has been stronger over the long run than in recent months.

If this refining story has your attention and you want to see what else is moving around energy infrastructure, it could be worth scanning 25 power grid technology and infrastructure stocks as a starting list of potential ideas.

With PBF shares last closing at $34.54, a value score of 3, and trading at a small premium to the average analyst target of $32.23, you have to ask: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 8.2% Overvalued

With PBF Energy last closing at $34.54 against a most followed fair value estimate of $31.92, the current price sits above that narrative view while still reflecting the recent recovery story.

Company-wide cost reduction and business improvement initiatives (RBI) are on track to deliver $230 million of annualized savings by end-2025 and $350 million by end-2026, mainly through lower OpEx and CapEx, these are expected to sustainably improve net margins and free cash flow over the next several years.

Curious what kind of revenue path and margin rebuild would support this fair value, even with modest growth expectations and a tempered future earnings multiple baked in?

Result: Fair Value of $31.92 (OVERVALUED)

However, there are still real pressure points, especially if Martinez faces fresh delays or if regulatory shifts on the coasts squeeze margins harder than expected.

Another Angle: Sales Multiple Says “Cheap” While DCF Says “Full”

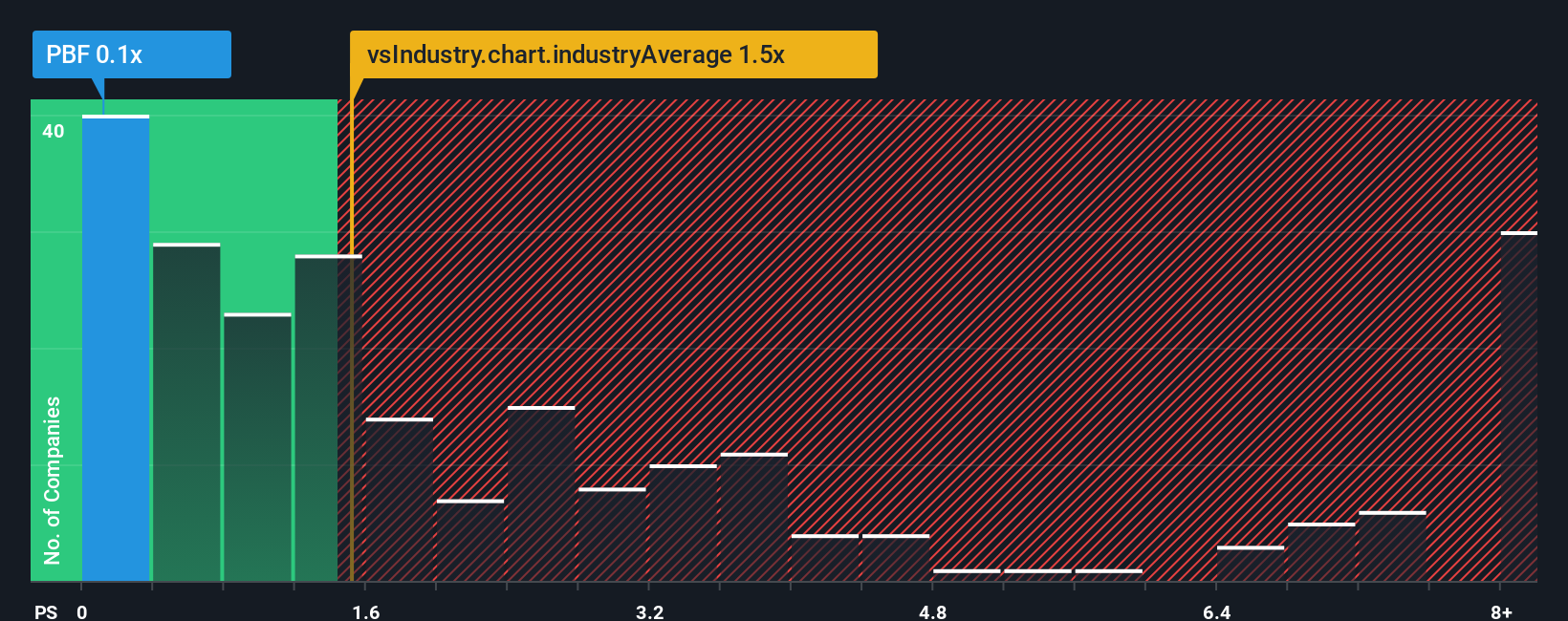

While the most followed fair value of $31.92 suggests PBF Energy looks about 8% overvalued at $34.54, the picture changes when you look at sales. On a P/S of 0.1x, the company screens far cheaper than peers at 0.3x, the US Oil and Gas industry at 1.6x, and even its own fair ratio of 0.5x. This points to a market that could shift closer to that level over time.

That kind of gap can signal valuation risk if earnings do not materialize, or potential upside if sentiment and fundamentals eventually line up with those lower sales multiples. Which story do you think the market is really trading on?

Build Your Own PBF Energy Narrative

If you see this differently, or simply prefer to test your own assumptions, you can pull the numbers together and build a custom view in just a few minutes, then Do it your way.

A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If PBF has sparked your interest, do not stop here. Broaden your watchlist with other ideas that could fit different roles in your portfolio.

- Target potential value opportunities by scanning our list of 53 high quality undervalued stocks that pair solid fundamentals with prices that may not fully reflect them.

- Strengthen your income stream by checking out 13 dividend fortresses, focused on companies offering higher yields alongside an emphasis on resilience.

- Add stability to your watchlist by reviewing 85 resilient stocks with low risk scores, highlighting businesses that score better on key risk measures.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.