Please use a PC Browser to access Register-Tadawul

PDF Solutions, Inc.'s (NASDAQ:PDFS) Shares Climb 30% But Its Business Is Yet to Catch Up

PDF Solutions, Inc. PDFS | 32.43 | -0.03% |

PDF Solutions, Inc. (NASDAQ:PDFS) shareholders have had their patience rewarded with a 30% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 28%.

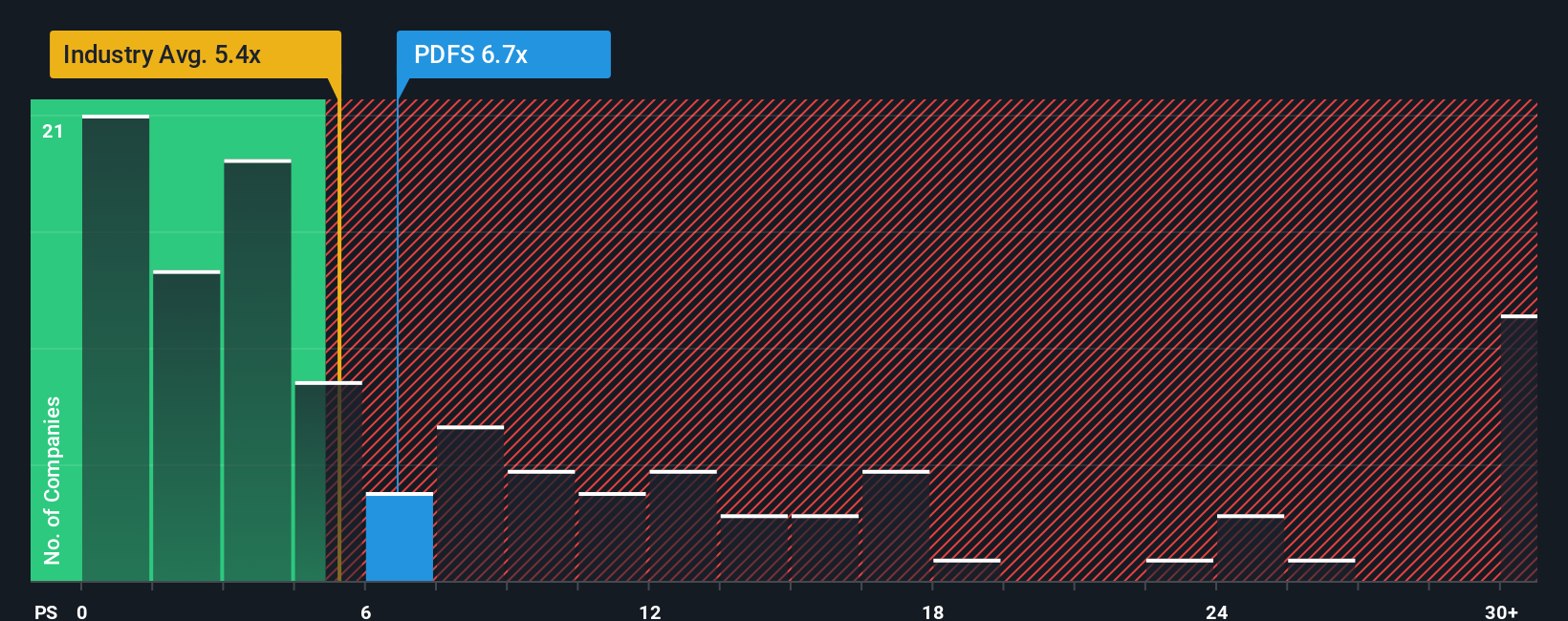

Following the firm bounce in price, PDF Solutions may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 6.8x, since almost half of all companies in the Semiconductor in the United States have P/S ratios under 5.6x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How PDF Solutions Has Been Performing

With revenue growth that's inferior to most other companies of late, PDF Solutions has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PDF Solutions.How Is PDF Solutions' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as PDF Solutions' is when the company's growth is on track to outshine the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 21%. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 21% during the coming year according to the four analysts following the company. That's shaping up to be materially lower than the 45% growth forecast for the broader industry.

With this information, we find it concerning that PDF Solutions is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On PDF Solutions' P/S

The large bounce in PDF Solutions' shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for PDF Solutions, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for PDF Solutions with six simple checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.