P/E Ratio Insights for Pfizer

Pfizer Inc. PFE | 0.00 |

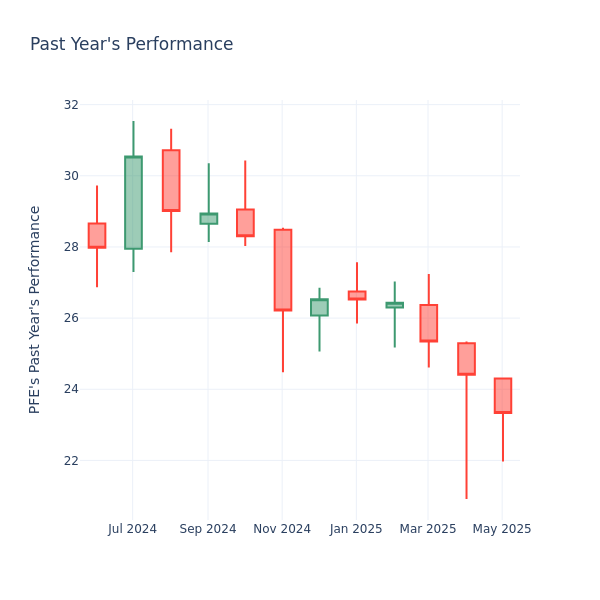

Looking into the current session, Pfizer Inc. (NYSE:PFE) shares are trading at $23.35, after a 1.52% increase. Moreover, over the past month, the stock spiked by 3.64%, but in the past year, decreased by 21.11%. Shareholders might be interested in knowing whether the stock is undervalued, even if the company is performing up to par in the current session.

Pfizer P/E Compared to Competitors

The P/E ratio measures the current share price to the company's EPS. It is used by long-term investors to analyze the company's current performance against it's past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

Compared to the aggregate P/E ratio of the 25.27 in the Pharmaceuticals industry, Pfizer Inc. has a lower P/E ratio of 16.67. Shareholders might be inclined to think that the stock might perform worse than it's industry peers. It's also possible that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

Recommend

- Sahm Platform 19/11 08:29

Apollomics Enters Into Settlement Agreement With TWVC Goldlink Partners Investment And TWVC Panglin Group Investment; To Pay $5M In Cash And $879,757.78 In Associated Legal expenses

Benzinga News 19/11 21:11Entero Therapeutics Q3 EPS $(0.64) Up From $(1.77) YoY

Benzinga News 20/11 00:19Does Recent Pipeline Progress Signal Opportunity for Pfizer Investors in 2025?

Simply Wall St 20/11 04:40AIxCrypto Renames From Qualigen To AIxCrypto Holdings; Begins Trading Under New Ticker AIXC

Benzinga News 20/11 17:41How Will Wave Life Sciences' (WVE) Enhanced RNA Platform Shape Its Investment Appeal?

Simply Wall St 20/11 21:26BioAtla Secures $7.5M Advance And Up To $15M Standby Equity Commitment To Support Strategic Transaction

Benzinga News Today 07:44Option Signals | U.S. Stocks on a Roller Coaster: Top 10 Options by Volume Surge; One RKLB Put Option Soars 280%, Signaling Bets on Short-Term Decline

Sahm Platform Today 09:46