Please use a PC Browser to access Register-Tadawul

Peabody Energy (BTU) Is Up 30.5% After Trump Administration Opens 13 Million Acres to Coal Mining

Peabody Energy Corp. BTU | 27.76 | -1.39% |

- In late September 2025, Peabody Energy welcomed sweeping support from the Trump administration, including the opening of 13 million acres of federal land for coal mining, hundreds of millions in new funding for coal power generation, and regulatory rollbacks extending the life of coal plants.

- This action, combined with Peabody's move to walk away from a multibillion-dollar international acquisition, highlights a renewed emphasis on capital returns and U.S.-focused coal operations.

- We'll explore how expanded federal land access and relaxed regulations reshape Peabody's investment narrative and future competitiveness.

Find companies with promising cash flow potential yet trading below their fair value.

Peabody Energy Investment Narrative Recap

To be a Peabody Energy shareholder, you need to believe that recent U.S. policy support, including expanded federal land access, regulatory rollbacks, and new coal funding, can power a sustained “coal comeback” despite ongoing global trends toward renewables. These tailwinds have been the most important short-term catalyst, reflected in Peabody's sharp share price surge, while the biggest risk remains the enduring threat of long-term coal demand decline and policy shifts if political priorities change. The latest news materially strengthens the short-term narrative but long-term risks tied to decarbonization persist. The company's completed buyback, retiring over 17% of its outstanding shares, stands out against this backdrop. Increased federal support may boost near-term cash flow, supporting capital returns like buybacks and dividends, but long-term revenue visibility still hinges on domestic coal demand and regulatory certainty. However, investors should also consider the potential for abrupt changes in political support for coal...

Peabody Energy's narrative projects $4.9 billion revenue and $468.2 million earnings by 2028. This requires 6.4% yearly revenue growth and a $327.3 million earnings increase from $140.9 million today.

Uncover how Peabody Energy's forecasts yield a $23.28 fair value, a 27% downside to its current price.

Exploring Other Perspectives

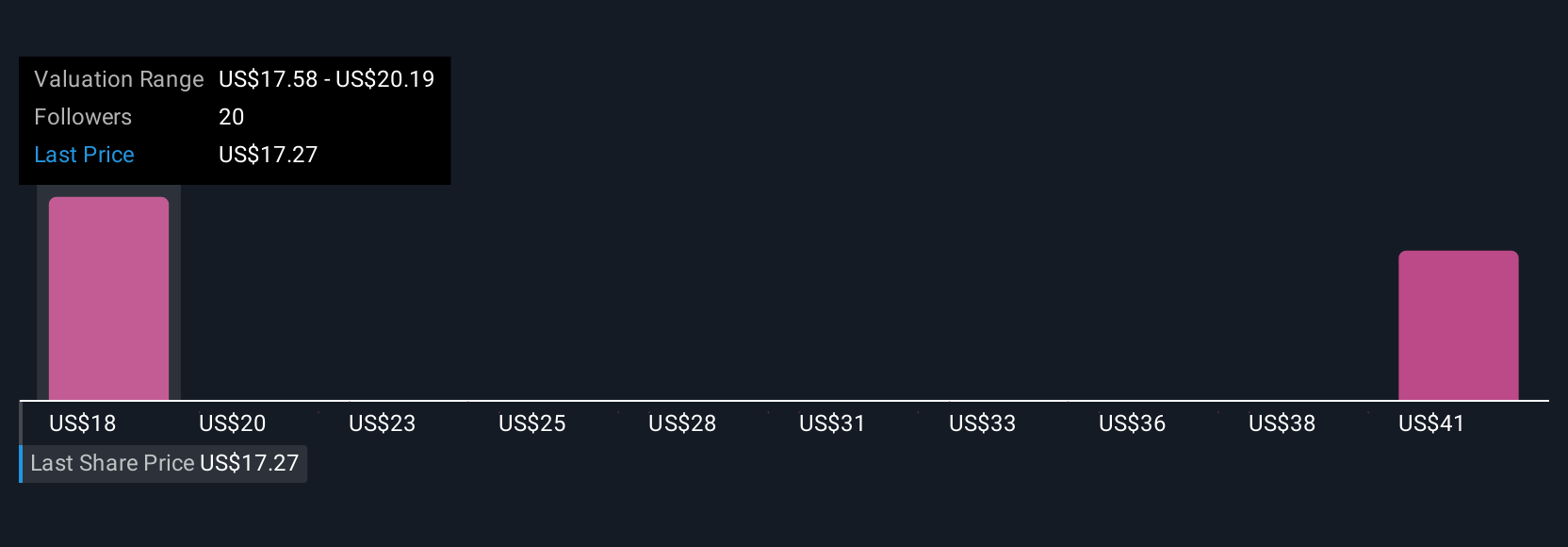

Peabody Energy’s fair value estimates from six Simply Wall St Community members span US$20 to US$45.76, revealing wide-ranging views on future performance. While policy tailwinds are driving positive sentiment now, diverse community outlooks suggest the risks around market shifts and regulatory changes remain top of mind, review other perspectives before making up your mind.

Explore 6 other fair value estimates on Peabody Energy - why the stock might be worth as much as 43% more than the current price!

Build Your Own Peabody Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peabody Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Peabody Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peabody Energy's overall financial health at a glance.

No Opportunity In Peabody Energy?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.