Please use a PC Browser to access Register-Tadawul

PennyMac Mortgage Investment Trust (PMT): Exploring Valuation Potential After Recent Share Price Pause

PennyMac Mortgage Investment Trust PMT | 12.70 | +0.32% |

PennyMac Mortgage Investment Trust (PMT) shares pulled back slightly over the past month, losing around 1%. Investors have been watching the stock’s performance as broader financial sector trends, including fluctuating mortgage rates, continue to affect the market.

Zooming out, PennyMac Mortgage Investment Trust’s share price has generally stayed in a holding pattern over the past year. This reflects cautious optimism as investors weigh market uncertainties and changing sentiment toward mortgage REITs. Even with muted recent share price moves, the longer-term story still points to a three-year total shareholder return of 60.7%, suggesting that those who held on weathered some ups and downs for strong cumulative gains.

If you’re curious what else the market is rewarding beyond mortgage REITs, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With this backdrop in mind, the big question facing investors now is whether PennyMac Mortgage Investment Trust’s stock is undervalued and due for a rebound, or if all potential upside is already reflected in the price. Is there a real buying opportunity here, or has the market already priced in future growth?

Most Popular Narrative: 7.4% Undervalued

The most widely followed narrative values PennyMac Mortgage Investment Trust at $13.43, which is around 7.7% higher than the last close price of $12.44. This sets up a potential opportunity for investors who believe in the growth assumptions and margin improvements underpinning the narrative's fair value calculation.

Ongoing digital transformation and the ability to organically create securitizations through technology-enabled processes are enabling PMT to efficiently structure and retain higher-yielding credit-sensitive non-agency MBS and CRT assets. This could drive net margin expansion as operational efficiencies scale.

Want to know the key drivers of this optimistic valuation? The growth thesis hinges on big jumps in margins and rapid profit growth ahead, powered by some bold operational bets. Curious how much transformation and scale this narrative expects? Find out what assumptions are moving this stock’s fair value beyond today’s price.

Result: Fair Value of $13.43 (UNDERVALUED)

However, persistent interest rate volatility or unsustainable dividend payouts could jeopardize PennyMac Mortgage Investment Trust's positive narrative and put pressure on long-term returns.

Another View: What About Cash Flow?

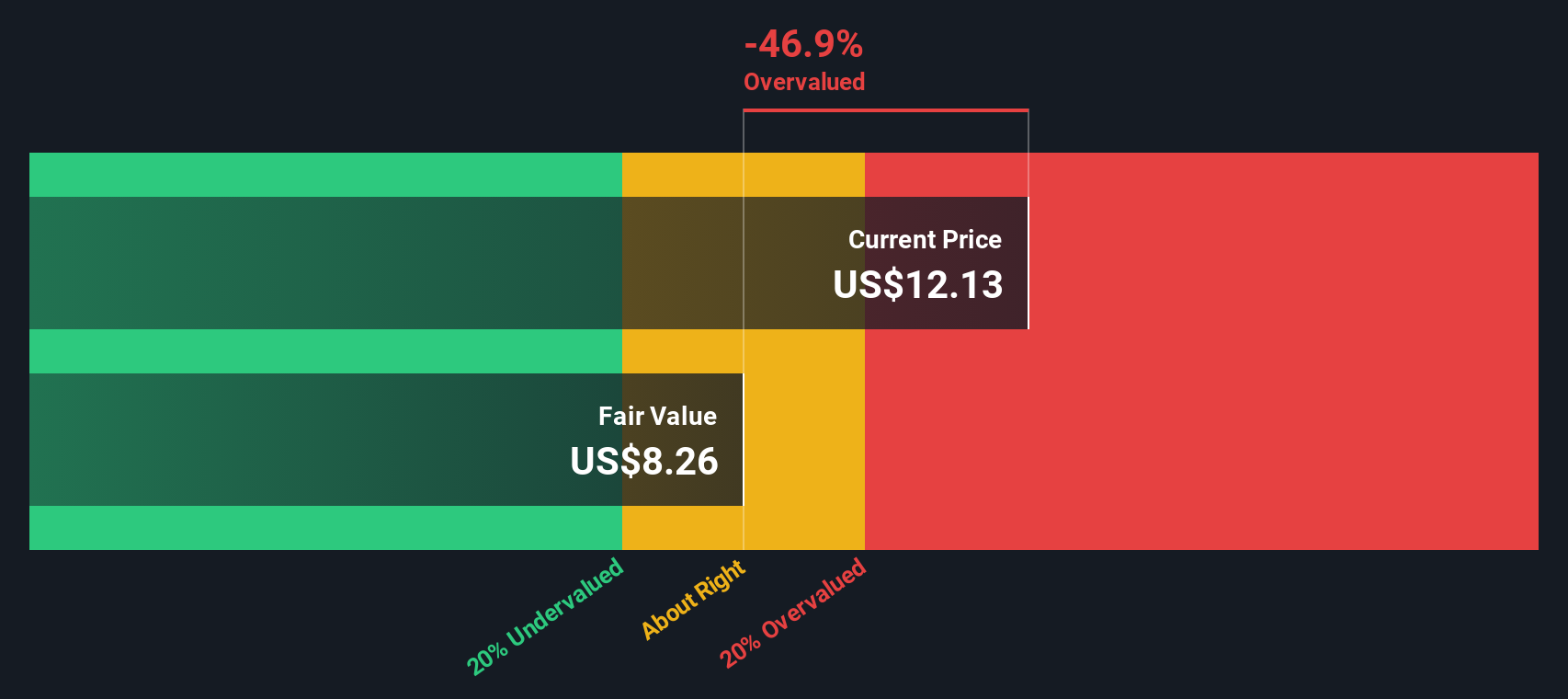

While analysts see potential upside based on growth and margin assumptions, the SWS DCF model tells a very different story. According to our DCF approach, PennyMac Mortgage Investment Trust may actually be overvalued relative to its estimated fair value. This challenges the consensus narrative about hidden value. Which method is closer to the truth?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out PennyMac Mortgage Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own PennyMac Mortgage Investment Trust Narrative

If you see the story differently or want to dig into the numbers yourself, you can test your own assumptions and build a narrative for PennyMac Mortgage Investment Trust in just a few minutes: Do it your way

A great starting point for your PennyMac Mortgage Investment Trust research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know it pays to look beyond the usual names. Widen your search and uncover unique opportunities others may be missing by checking out these handpicked screens:

- Uncover the potential of emerging players by inspecting these 3575 penny stocks with strong financials that demonstrate resilience and robust financials in a field often overlooked by the crowd.

- Capitalize on innovation by tracking these 25 AI penny stocks that are set to redefine industries with groundbreaking advancements in artificial intelligence and automation.

- Boost your income strategy by pursuing these 19 dividend stocks with yields > 3% that could offer stronger yields and the stability every portfolio deserves.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.