Please use a PC Browser to access Register-Tadawul

Permian Resources Board Change And Valuation Gap After Anderson Retirement

Permian Resources Corporation Class A PR | 17.96 | +0.45% |

- Permian Resources (NYSE:PR) has announced that Board member Robert J. Anderson is retiring from its Board of Directors.

- Mr. Anderson had joined the Board only recently, making his departure a meaningful change in the company’s board composition.

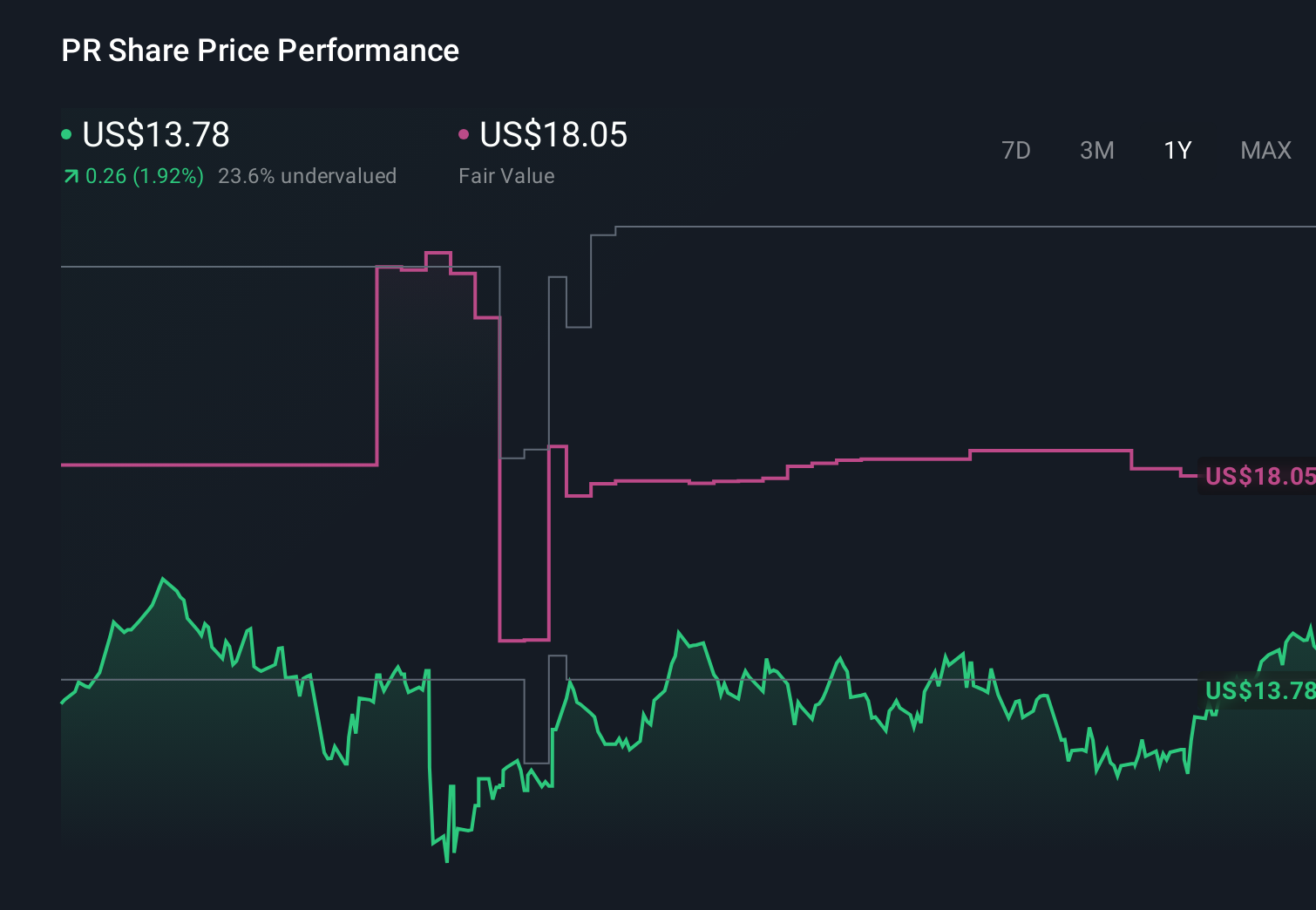

For shareholders, any shift on the Board of Directors at Permian Resources sits alongside how the stock has been trading. NYSE:PR last closed at $14.78, with a return of 54.4% over 3 years and a very large gain over 5 years, while the 1 year return stands at 1.4%. Those numbers provide context for how the market has priced the company over different time frames as this governance update is announced.

Board changes such as this can influence how the company sets priorities, oversees capital allocation and evaluates future opportunities. As the Board adjusts to Mr. Anderson’s retirement, investors may want to pay attention to any updates on committee assignments, succession on the Board and comments from company leadership about governance priorities.

Stay updated on the most important news stories for Permian Resources by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Permian Resources.

Quick Assessment

- ✅ Price vs Analyst Target: At $14.78, the share price sits below the $18.38 analyst target, implying a 24% gap to that consensus level.

- ✅ Simply Wall St Valuation: The stock is described as trading at 77.1% below an estimated fair value, which flags a potential value opportunity.

- ✅ Recent Momentum: A 30 day return of 6.5% shows the price has been moving up recently even as this board change is announced.

Check out Simply Wall St's in depth valuation analysis for Permian Resources.

Key Considerations

- 📊 Robert J. Anderson’s retirement is a governance event, so you may want to watch how board responsibilities and oversight of capital allocation are redistributed.

- 📊 Monitor how the share price behaves relative to the $18.38 analyst target and the P/E of 13.6 compared with the Oil and Gas industry average of 13.6.

- ⚠️ With a flagged risk around significant insider selling in the past 3 months, it is worth tracking any further insider activity after this board change.

Dig Deeper

For the full picture, including more risks and rewards, check out the complete Permian Resources analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.