Please use a PC Browser to access Register-Tadawul

PHINIA (PHIN) Q3 Net Margin Near 2.6% Tests Bullish Expansion Narrative

PHINIA Inc. PHIN | 75.99 | +0.92% |

PHINIA (PHIN) has posted its latest FY 2025 numbers with Q3 revenue of $908 million and basic EPS of $0.34, giving investors a fresh look at how the top and bottom line are holding up through the year. The company has seen quarterly revenue move from $868 million in Q2 2024 to $890 million in Q2 2025 and $908 million in Q3 2025. Over the same period, basic EPS has ranged from $0.31 in Q2 2024 to $1.16 in Q2 2025 and $0.34 in Q3 2025, setting up a story that hinges on how effectively PHINIA can convert this revenue base into steadier margins.

See our full analysis for PHINIA.With the headline figures on the table, the next step is to see how these results line up against the more widely held narratives around PHINIA’s growth potential and earnings quality, and where the numbers start to challenge those views.

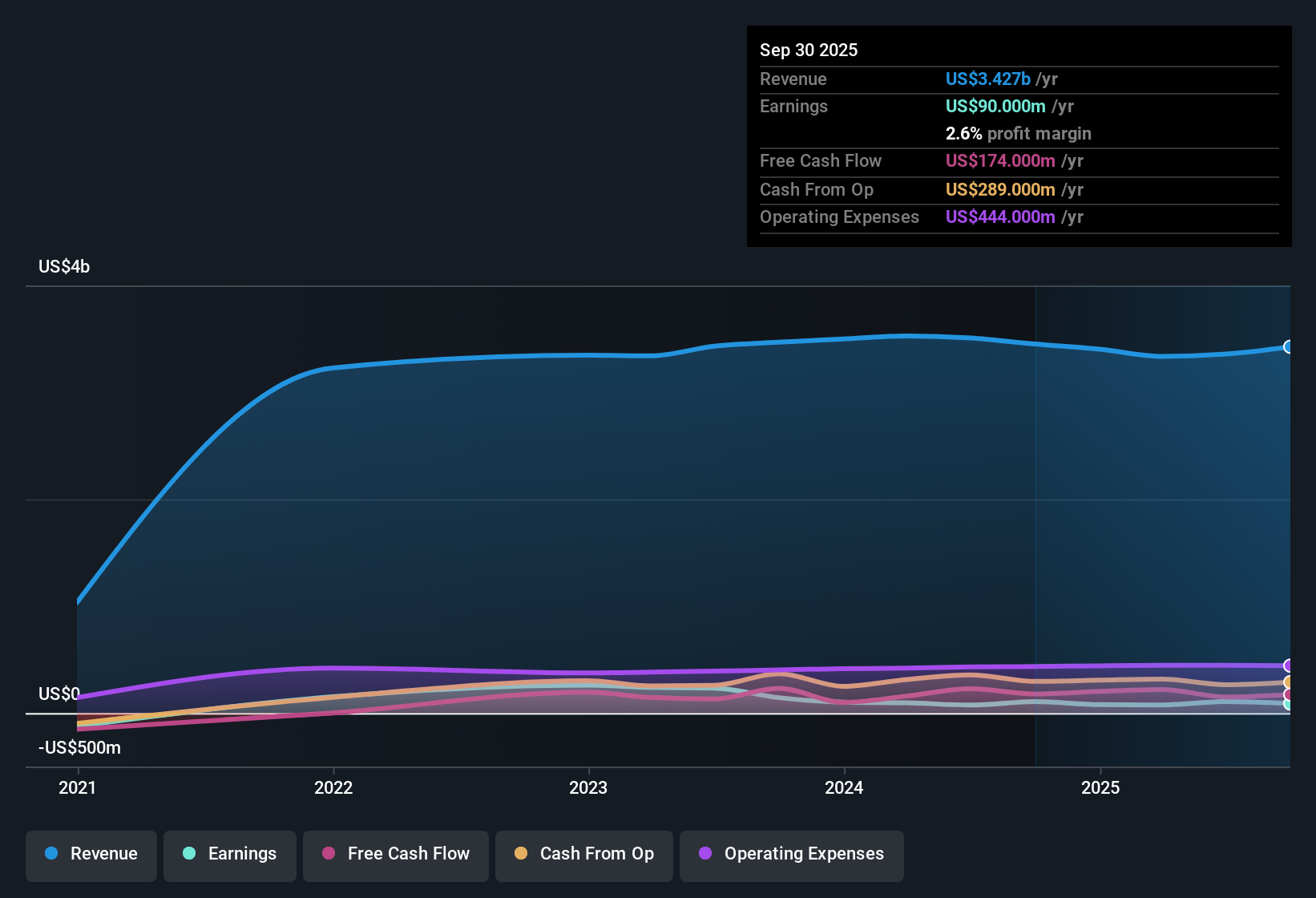

Net margin stuck around 2.6% on a US$3.4b base

- Over the last 12 months, PHINIA generated about US$3.4b of revenue with net income of US$90 million, which works out to a 2.6% net margin compared with 3.1% a year earlier.

- Consensus narrative expects regulatory trends and diversification into alternative fuels to support margin expansion. However, the trailing margin staying at 2.6% with an US$81 million one off loss in the mix shows how much of the current profitability story still depends on lifting returns from a relatively low base.

- Analysts looking for margins to rise from around the low single digits have to reconcile that with recent net income of US$90 million on US$3.4b of sales, which leaves little room for error if costs or pricing move against the company.

- The US$81 million one off charge and the drop from a 3.1% to 2.6% net margin give bears a concrete data point when they argue that margin expansion is not yet visible in reported numbers.

Forecast growth of roughly 3% to 4.7% tests the bullish story

- Forecasts point to revenue growth of about 3.1% per year and earnings growth of about 4.68% per year, against a trailing 12 month net income figure of US$90 million and Basic EPS of US$2.24.

- Bulls argue that SEM, new end markets and cost savings can support much faster progress. However, the mid single digit earnings growth forecasts and current EPS run rate suggest the market is still treating those long term targets as a stretch rather than a base case.

- The optimistic view references earnings potentially reaching US$307.7 million, yet the latest trailing figure is US$90 million and one year earnings turned negative versus the prior year, which is a wide gap for investors to bridge.

- With forecast growth sitting in the low to mid single digits and trailing margins at 2.6%, the bullish call for profit margins to rise meaningfully rests on execution that is not yet reflected in the FY 2025 numbers.

Valuation gap on DCF, but P/E at 31.8x keeps bears engaged

- PHINIA trades at US$74.53 per share versus a DCF fair value of about US$114.18, yet its P/E of 31.8x sits above the US Auto Components industry at 25.4x and a peer average of 23.6x.

- Bears focus on the high P/E and leverage to argue the shares are not obviously cheap. The combination of a 2.6% net margin, an US$81 million one off loss and a richer multiple than peers gives their case plenty of current data to point to even with a DCF model implying upside.

- The roughly 34.7% discount to DCF fair value only matters if earnings grow from the current US$90 million base in line with forecasts, while the premium to industry and peer P/Es is visible today regardless of how forecasts play out.

- The mix of modest forecast growth around 4.7% annually, high relative P/E and a high debt load is exactly what skeptics highlight when they question whether the DCF fair value should be trusted at face value.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PHINIA on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? If the figures point you in another direction, turn that view into a clear, shareable story in just a few minutes. Do it your way

A great starting point for your PHINIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

PHINIA is working with a 2.6% net margin, modest low to mid single digit growth forecasts and a relatively high P/E, which keeps execution risk front and center.

If that mix of thin margins and a richer multiple feels uncomfortable, it is worth balancing your watchlist with 85 resilient stocks with low risk scores that aim to keep risk scores in check while still offering meaningful exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.