Please use a PC Browser to access Register-Tadawul

Photronics (PLAB): Assessing Valuation After AI Chip Partnerships Boost Semiconductor Industry Optimism

Photronics, Inc. PLAB | 34.36 | -6.50% |

Photronics (PLAB) has seen renewed investor interest this week after OpenAI’s announcement of new partnerships with SK Hynix and Samsung for its major AI infrastructure project. The development has lifted sentiment across semiconductor suppliers, especially those positioned for growth in advanced chip technologies.

Photronics is riding a wave of positive momentum after the excitement around OpenAI’s AI chip partnership news, adding to gains seen across semiconductor peers. While the year’s 1-year total shareholder return is flat, the stock has recently broken above its 20-day moving average and boasts a strong 3-year total shareholder return of 57%. This suggests momentum is building for this specialist in advanced chip tech.

If the latest AI-driven rally has sparked your curiosity, take the next step and explore fast growing stocks with high insider ownership.

But with shares rallying on AI optimism and the stock still trading well below analyst targets, the key question is whether the recent excitement leaves room for further upside or if future growth is already fully reflected in the price.

Most Popular Narrative: 26.1% Undervalued

With Photronics trading notably below the narrative’s fair value estimate, the gap between the current share price and future projections is hard to ignore. Investors are clearly weighing whether this discount reflects untapped opportunity or underappreciated risks.

"Strategic investments in U.S. capacity and cutting-edge production (multi-beam mask writer and Texas facility expansion) position Photronics to benefit as major semiconductor fabrication and reshoring initiatives are realized. This supports future revenue growth and margin expansion."

What is the secret behind this undervalued call? The narrative hinges on a combination of bold earnings growth, margin expansion, and a future multiple that breaks away from industry norms. Ready to see how these electrifying assumptions drive the target price? The full narrative reveals the numbers that could power Photronics to its next milestone.

Result: Fair Value of $33.00 (UNDERVALUED)

However, ongoing trade tensions and high capital spending could quickly dampen Photronics’ outlook if industry demand or global conditions shift unexpectedly.

Another View: A Second Take on Valuation

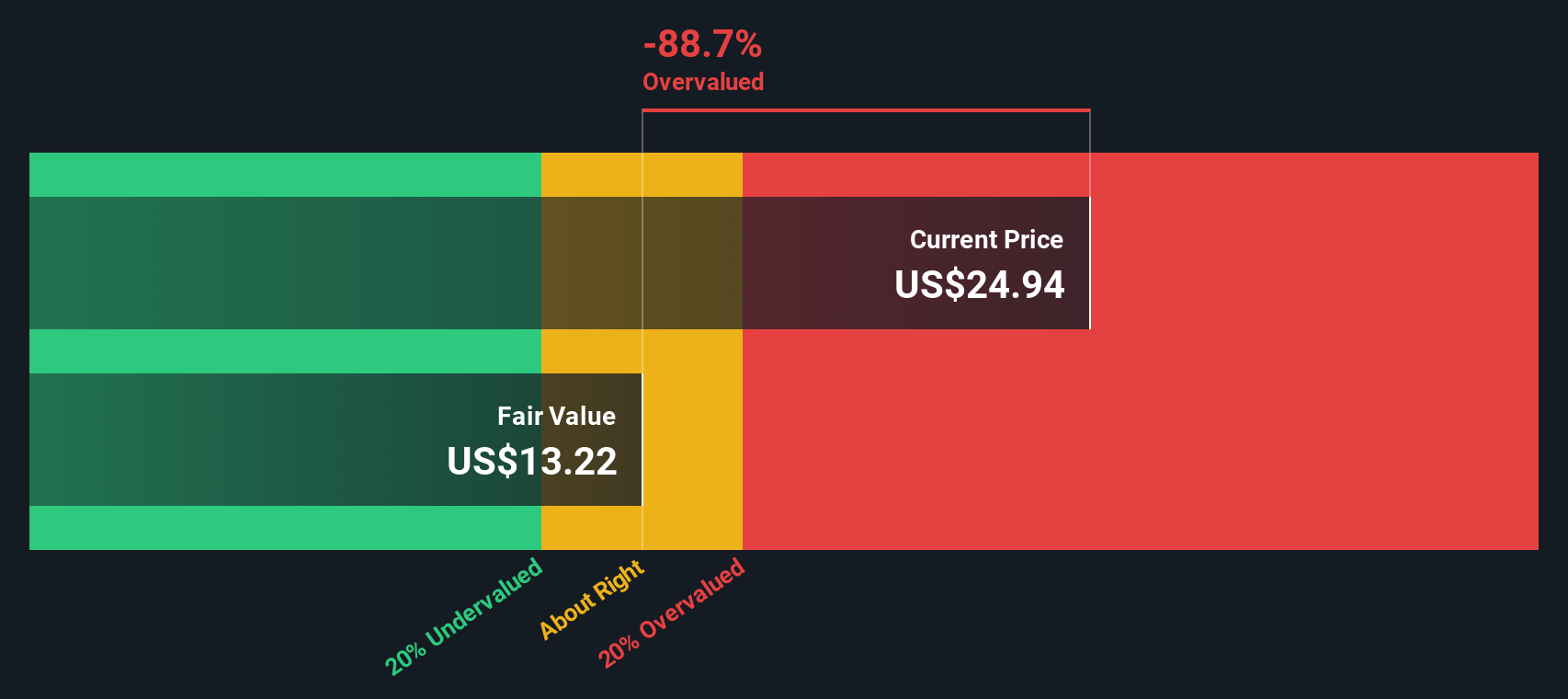

While analyst projections suggest Photronics is undervalued, our DCF model offers a more cautious outlook. According to the SWS DCF analysis, Photronics is actually trading above its fair value. This challenges the bullish narrative and suggests the margin for error may be thin. Is the market’s optimism ahead of the fundamentals?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Photronics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Photronics Narrative

If you want to challenge these assumptions or prefer hands-on research, dive into the data and build your own story in just a few minutes. Do it your way.

A great starting point for your Photronics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at one stock. Expand your opportunities now and seize an edge by researching powerful trends shaping tomorrow’s markets before everyone else notices.

- Unlock income potential by checking out these 19 dividend stocks with yields > 3% with yields above 3%, designed for investors seeking steady cash flow.

- Supercharge your portfolio by targeting breakout opportunities with these 3566 penny stocks with strong financials that feature strong financials and solid business momentum.

- Get ahead of innovation waves by scanning these 26 quantum computing stocks for companies leading the way in quantum computing and future-proof technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.