Please use a PC Browser to access Register-Tadawul

Piedmont Realty Trust (PDM): Evaluating Valuation Following Major Q3 Leasing Surge and Improved Occupancy

Piedmont Office Realty Trust, Inc. Class A PDM | 8.71 | +0.81% |

Most Popular Narrative: 2.1% Overvalued

The current narrative views Piedmont Realty Trust as slightly overvalued, with the stock trading just above what analysts see as its fair value. Expectations for moderate growth and improved profitability drive this assessment.

The "flight to quality" trend is accelerating, with large, creditworthy tenants moving into best-in-class buildings. Piedmont's execution of several full-floor and large leases, often at record or above-market rents, is expected to significantly lift portfolio occupancy and revenue as these leases commence in late 2025 and 2026.

What happens when market optimism meets bold projections for revenue growth, profit margin expansion, and future lease-up rates? One quantitative assumption stands at the center of this value story. The real kicker lies in how future expectations are being discounted today. Want the full valuation playbook, including the numbers and hurdles needed for this fair value call? The narrative reveals all.

Result: Fair Value of $8.67 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as delayed lease commencements and persistent high office vacancies could quickly challenge the current optimism and threaten earnings momentum.

Find out about the key risks to this Piedmont Realty Trust narrative.Another View: Discounted Cash Flow Tells a Different Story

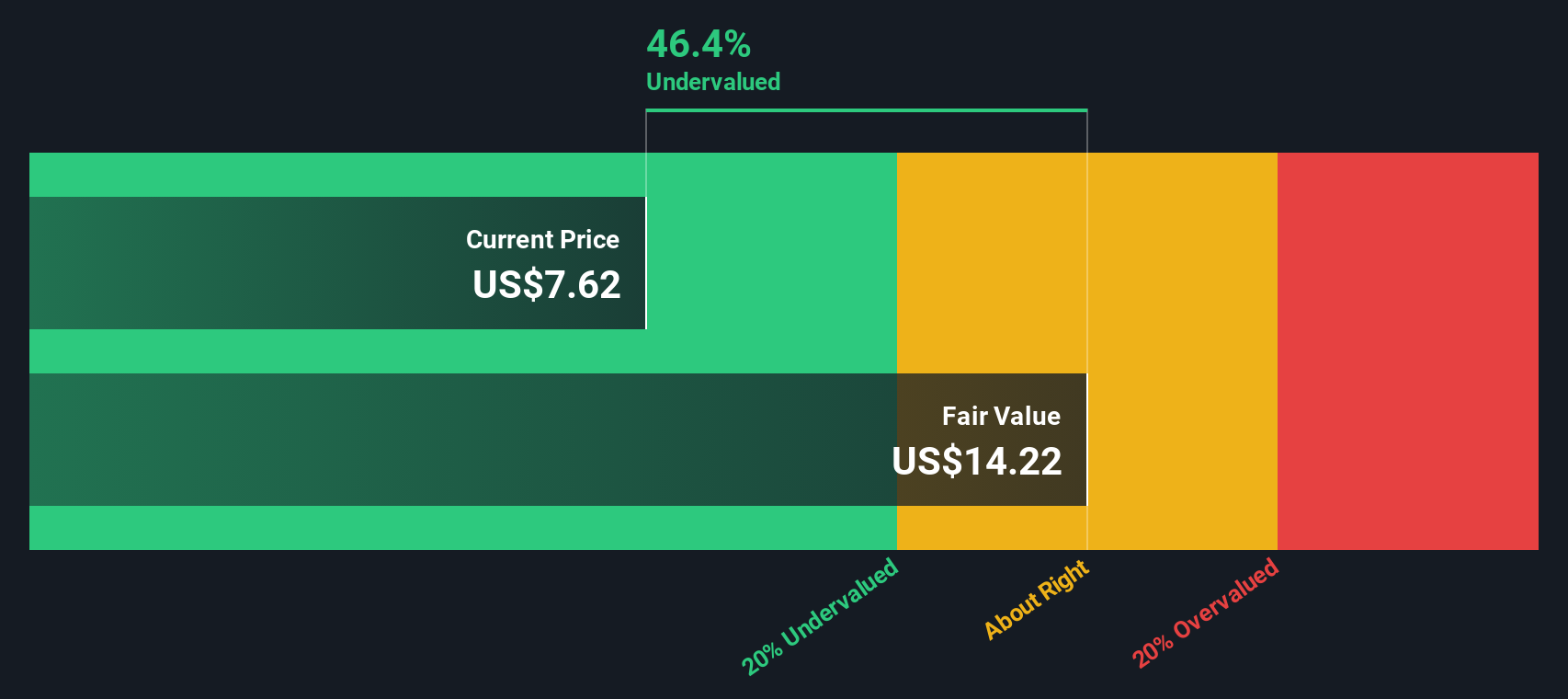

While the market and analysts see Piedmont Realty Trust as slightly overvalued based on current expectations, our DCF model comes to the opposite conclusion and suggests the shares may actually be trading at a steep discount. Which narrative will prove true as new data emerges?

Build Your Own Piedmont Realty Trust Narrative

If you see the story differently or want a hands-on look at the data, you can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Piedmont Realty Trust research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Give yourself an edge by seeking out fresh sectors and themes other investors might overlook. The screener can uncover potential gems you would never have found alone.

- Uncover stocks with strong returns, like dividend stocks with yields > 3%, to benefit from reliable income even as markets shift.

- Snap up exciting market disruptors by checking out cutting-edge AI penny stocks for a front-row seat to technological breakthroughs.

- Target value hidden in plain sight using undervalued stocks based on cash flows and find companies whose cash flows signal a growth story the market hasn't priced in yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.