Please use a PC Browser to access Register-Tadawul

Piper Sandler (PIPR): Assessing Valuation After Recent Share Price Gains

PIPER SANDLER COMPANIES PIPR | 356.19 | -2.75% |

The recent lift in Piper Sandler Companies’ share price builds on a consistent run this year, with a 13.4% year-to-date gain keeping momentum firmly in positive territory. Looking back, investors have enjoyed a 19.6% total shareholder return over the past twelve months and a remarkable 376% total return over five years, which highlights the stock’s strong long-term performance.

If you’re keeping an eye out for what’s next in the market, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares not far from analyst targets and having soared over multiple years, the real question is whether there is more value to unlock in Piper Sandler or if the market is already pricing in its future growth potential.

Price-to-Earnings of 28.5x: Is it justified?

Piper Sandler Companies trades at a price-to-earnings (P/E) ratio of 28.5x, noticeably higher than both its peer and industry averages. With the last close at $339.47, this valuation places the stock in an expensive bracket compared to similar firms.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of the company's earnings. It is a widely used tool for comparing relative value and market expectations in the financial services sector.

A higher P/E multiple like this often signals expectations for continued profit growth or perceived stability. However, it can also mean investors are paying a premium for recent performance. For Piper Sandler, the robust run-up in share price and recent profit acceleration may partially justify the lofty valuation. Such a premium also raises the bar for future growth to continue.

Compared to the US Capital Markets industry average P/E of 25.9x and the peer average of 18.1x, Piper Sandler's ratio stands out as expensive. The market is clearly assigning a higher value relative to earnings than most competitors, suggesting elevated expectations or confidence in the company's positioning.

Result: Price-to-Earnings of 28.5x (OVERVALUED)

However, it is worth noting that a slowdown in revenue growth or macroeconomic headwinds could quickly dampen Piper Sandler's premium valuation narrative.

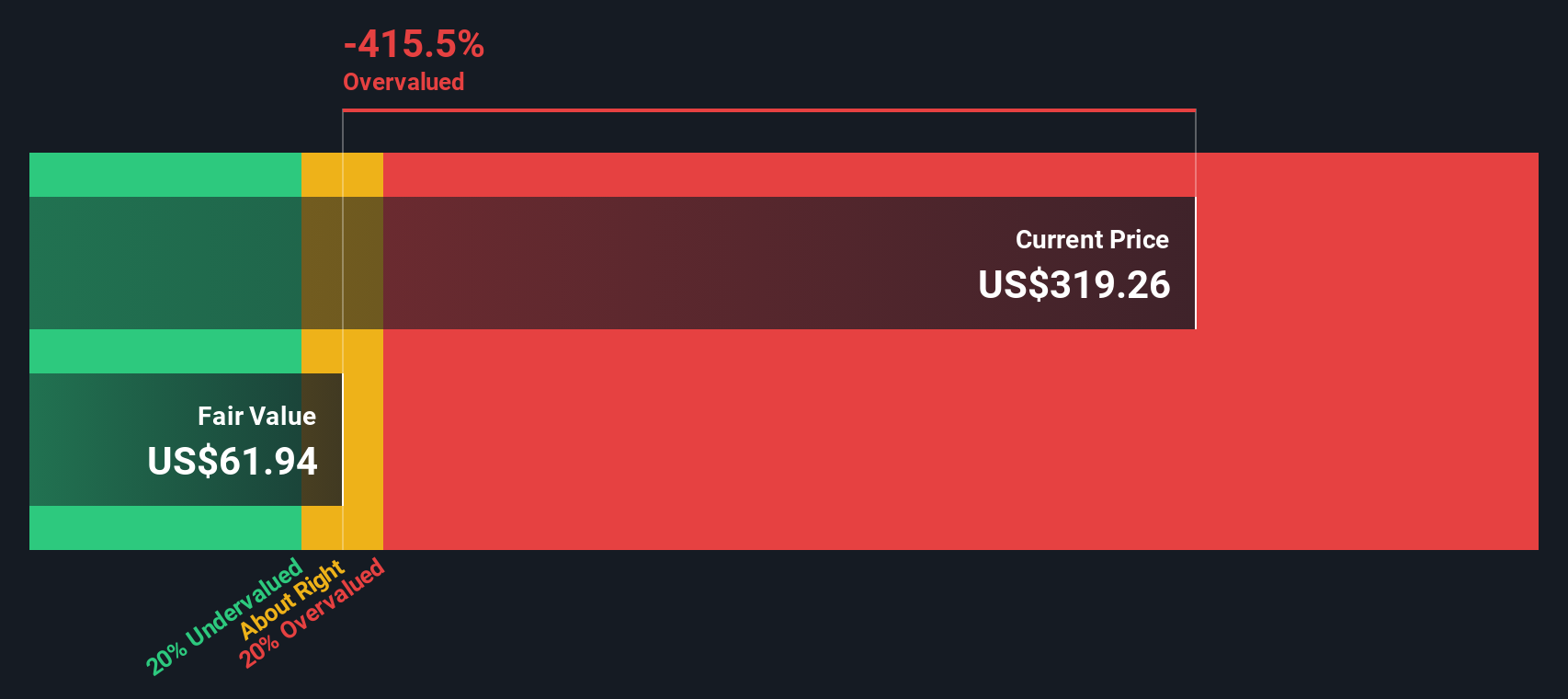

Another View: DCF Model Suggests a Different Story

Looking beyond traditional multiples, our SWS DCF model paints a much less optimistic picture. According to this method, Piper Sandler Companies is trading significantly above its estimated fair value of $63.06 per share. This implies the stock could be overvalued using cash flow fundamentals. With this in mind, does the market see something the numbers miss, or might caution be warranted?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Piper Sandler Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Piper Sandler Companies Narrative

If you have a different perspective or enjoy diving into the numbers yourself, you can assemble your own view with just a few clicks, and Do it your way.

A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let standout opportunities slip by. Now may be the perfect time to strengthen your portfolio with promising picks from fresh market themes.

- Jump into the momentum of cutting-edge artificial intelligence by checking out these 27 AI penny stocks, which offers exposure to transformative tech trends and disruptive innovators.

- Boost your search for stable long-term income by reviewing these 17 dividend stocks with yields > 3%, featuring companies with above-average dividend yields for consistent returns.

- Tap into fast-moving value stocks with these 875 undervalued stocks based on cash flows, highlighting strong fundamentals that are poised for potential upside based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.