Please use a PC Browser to access Register-Tadawul

Piper Sandler (PIPR): Evaluating Valuation After Recent Share Price Gains

PIPER SANDLER COMPANIES PIPR | 356.19 | -2.75% |

Piper Sandler Companies has notched a 24% total shareholder return over the past year, highlighting the strong momentum that has been building behind the stock amid broader positive sentiment in the financial sector. With its recent gains, the company continues to signal confidence to investors looking for both short-term and long-term growth potential.

If you’re interested in surfacing other compelling opportunities, now is a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with Piper Sandler trading close to analyst targets after a strong run, the key question is whether shares remain undervalued or if recent performance means future growth is already fully reflected in the price.

Price-to-Earnings of 28.7x: Is it justified?

Piper Sandler Companies is trading at a price-to-earnings ratio of 28.7 times, which puts its shares at a premium compared to both peers and the wider industry. At the last close price of $341.99, investors are paying well above what is typical for comparable companies in the US Capital Markets sector.

The price-to-earnings ratio measures how much investors are willing to pay for one dollar of the company’s earnings. It is a widely used valuation tool because it quickly reveals whether a stock appears expensive or cheap relative to the earnings it generates. In capital markets, where earnings can be cyclical, a high ratio may signal strong sentiment or future growth expectations.

Piper Sandler’s current multiple suggests the market is pricing in robust future growth. However, with a price-to-earnings ratio higher than the average peer (22.7x) and above the industry average (26.3x), it is difficult to overlook that investors could be paying a significant premium compared to similar firms.

Unless new catalysts emerge, the valuation could revert closer to sector norms. See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 28.7x (OVERVALUED)

However, weaker-than-expected earnings or shifts in the capital markets could quickly challenge the optimistic valuation and recent investor sentiment.

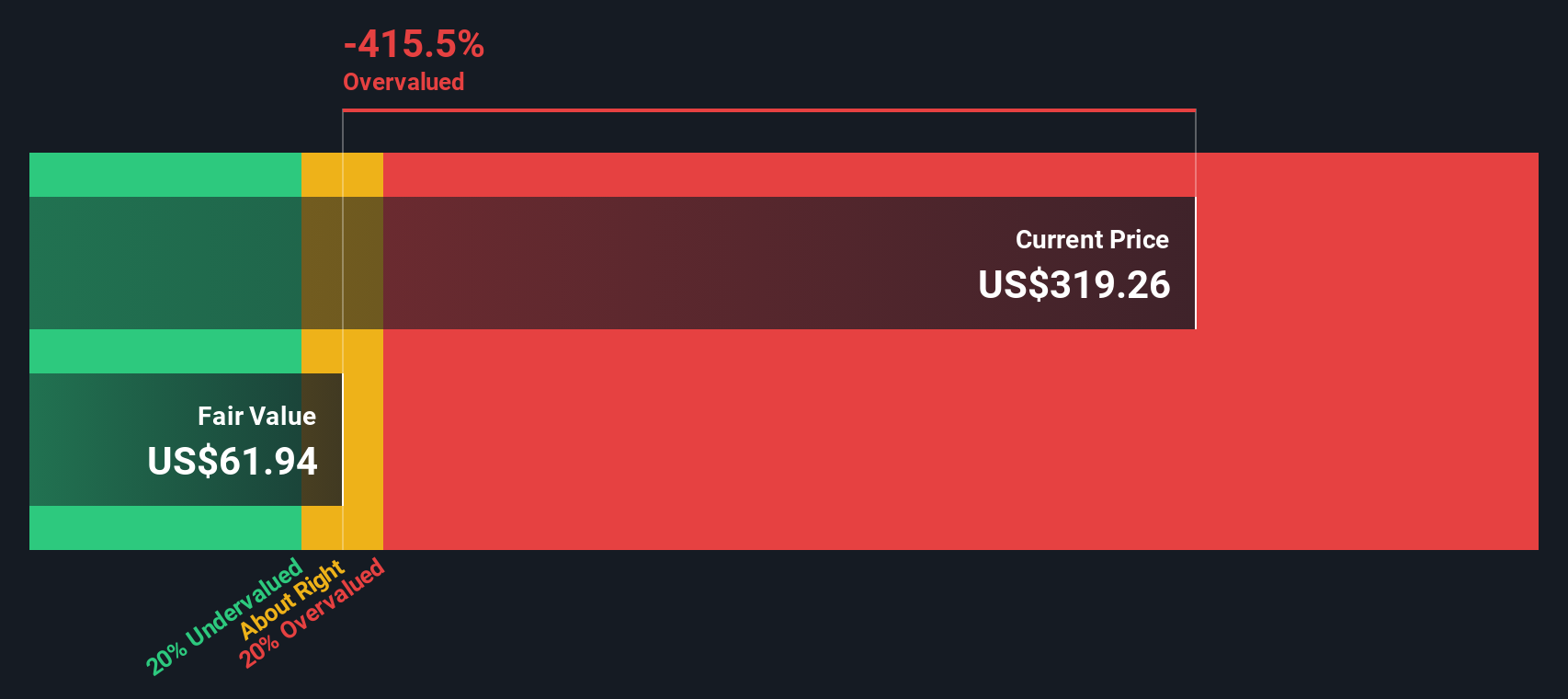

Another View: Discounted Cash Flow Signals Overvaluation

Taking a different perspective, our DCF model suggests that Piper Sandler Companies may be trading far above its intrinsic value, with shares at $341.99 compared to an estimated fair value of just $62.65. This sharp disconnect challenges the optimism reflected by premium multiples. Could recent momentum be overestimating future potential?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Piper Sandler Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Piper Sandler Companies Narrative

If you see things differently or want to take a hands-on approach, you can craft your own analysis in just minutes, so Do it your way.

A great starting point for your Piper Sandler Companies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stop searching for their next opportunity. Don't leave potential gains on the table. Let Simply Wall Street help you identify tomorrow’s winners today.

- Tap into high yield potential by uncovering companies offering these 19 dividend stocks with yields > 3% with robust dividend payouts and solid balance sheets.

- Capitalize on innovation and ride the AI revolution with these 24 AI penny stocks suited for the age of intelligent automation.

- Secure your edge by seeking standout bargains among these 904 undervalued stocks based on cash flows trading below their intrinsic value based on cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.