Please use a PC Browser to access Register-Tadawul

PJT Partners Sees 2026 Secondaries Surge Shaping Capital Solutions Opportunity

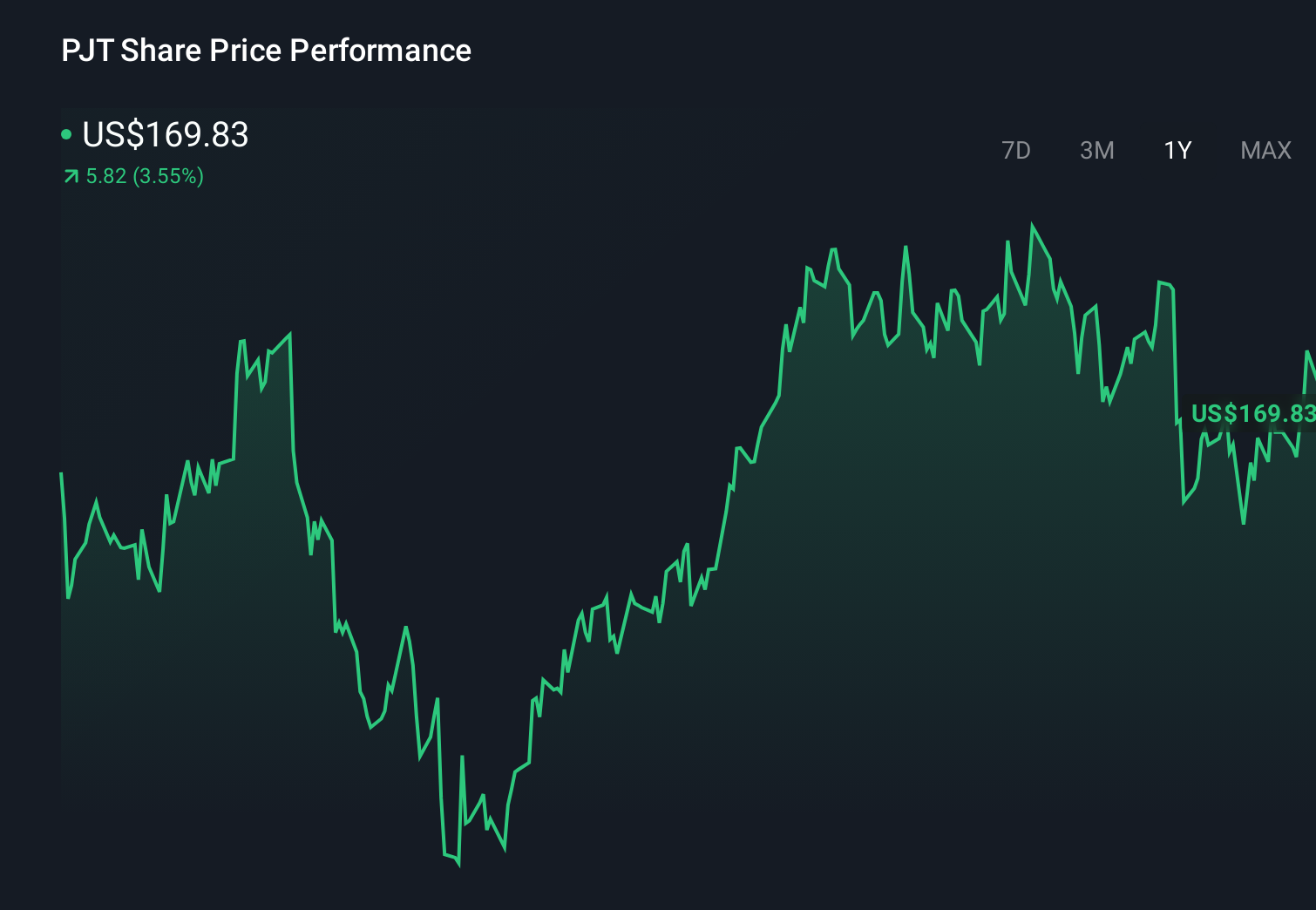

PJT Partners, Inc. Class A PJT | 151.63 | -0.76% |

- PJT Partners (NYSE:PJT) has forecast continued robust growth in global secondaries market volume for 2026.

- The outlook follows what the firm describes as a record year for secondaries activity.

- PJT's global head of Capital Solutions outlined the view, highlighting potential large scale shifts in capital flows.

PJT Partners, trading at $173.03, sits in the spotlight as the firm links its capital solutions franchise to a secondaries market it expects to stay busy into 2026. The stock has returned 122.6% over 3 years and 164.2% over 5 years, which puts recent moves like a 4.7% decline over the past week into a wider context. For investors tracking NYSE:PJT, this mix of long term gains and short term volatility may frame how they think about the latest commentary on market activity.

For you, the key question is how PJT's call on secondaries volume could influence its role across fund restructurings, GP led deals, and liquidity solutions. The firm is signaling that it expects continued demand for complex capital solutions, which may shape how you think about deal flow, fee pools, and where advisory and distribution expertise could be most in demand over the next couple of years.

Stay updated on the most important news stories for PJT Partners by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on PJT Partners.

PJT's call for a 22% increase in 2026 secondaries volume, following a record year at $225b, points to an investor base that is still highly engaged in using secondary transactions to adjust private market exposure. For you, that suggests limited seller fatigue so far and ongoing appetite from buyers for interests in private equity funds, which can support continued activity in areas such as fund recaps, continuation vehicles, and LP stake sales.

PJT Partners narrative, where secondaries sit in the bigger story

This outlook reinforces PJT's position as a specialist adviser in complex secondary and liquidity situations, in a field that also includes players like Evercore, Lazard, and Jefferies. If you see secondaries as a tool that allocators use to manage portfolios more actively, then PJT's commentary can be read as a signal that this kind of deal-making remains central to how institutional investors are repositioning capital.

Risks and rewards investors should weigh

- A 22% volume increase on top of a record $225b year signals a deep pool of potential transactions that could support advisory pipelines.

- PJT highlights strong demand for complex capital solutions, which can be a supportive backdrop for fee-generating work in restructurings and GP led deals.

- If secondaries volumes fall short of these expectations, investor confidence in the deal pipeline could cool, especially after such a strong prior year.

- Competition from other advisers like Evercore and Lazard may limit how much of the forecast market expansion any one firm captures.

What to watch from here

From here, it is worth watching how actual 2026 volumes compare with PJT's 22% forecast and whether upcoming earnings calls give more color on mandate wins and pricing in secondaries transactions. If you want more context on how other investors are thinking about PJT's role in this market, check community narratives on the company’s page at check what other investors are saying about PJT Partners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.