Please use a PC Browser to access Register-Tadawul

Plains GP Holdings (PAGP) Valuation Check After Double Digit Distribution Increase

Plains GP Holdings LP Class A PAGP | 20.55 | +1.88% |

Plains GP Holdings (PAGP) is drawing fresh attention after announcing a higher quarterly distribution of $0.4175 per Class A share, a 10% annualized increase versus November 2025, tied to fourth quarter 2025 results.

Alongside the higher distribution, Plains GP Holdings’ recent share price performance has been firm, with a 90 day share price return of 16.68% and a three year total shareholder return of 94.44%. This suggests momentum has been building rather than fading.

If this income focused midstream story has your attention, it could be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With Plains GP trading at US$20.01, sitting close to analyst targets and with an intrinsic value estimate that appears higher, you have to ask: is the market leaving some value on the table or already pricing in future growth?

Most Popular Narrative: 3.8% Undervalued

Plains GP Holdings' most followed narrative pegs fair value at about US$20.81 per share, slightly above the last close of US$20.01. This frames a modest valuation gap for investors to weigh.

The planned divestiture of the NGL segment and redeployment of ~$3 billion in proceeds into core crude oil operations and bolt-on acquisitions are expected to streamline operations, reduce commodity price exposure, and enhance financial flexibility, supporting growth in core revenue and improved net margins via higher-return investments and potential buybacks.

Curious what kind of revenue path and margin rebuild supports that fair value? The narrative leans on higher earnings quality, a richer future earnings multiple, and a lower discount rate. The exact mix of those ingredients is where the real story sits.

Based on this narrative, analysts use a 9.29% discount rate and assume Plains GP can grow into stronger profitability over time, with the market willing to place a higher P/E multiple on those future earnings than on the wider US oil and gas group today.

Result: Fair Value of $20.81 (UNDERVALUED)

However, this hinges on crude focused growth playing out as expected. Weaker contract renewals or underused Permian assets could easily knock that story off course.

Another View: Earnings Multiple Sends A Different Signal

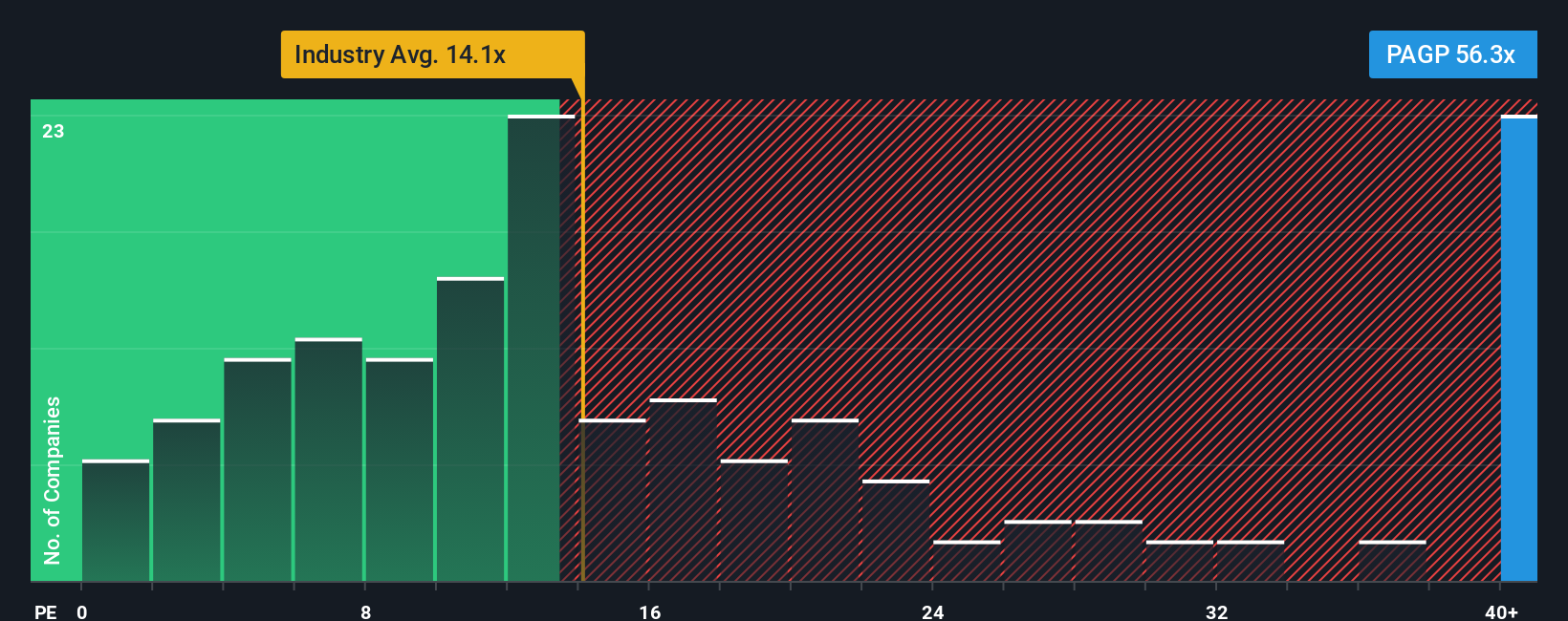

Our DCF work suggests a very large gap to fair value, with PAGP trading about 83% below the model estimate. However, the current P/E of 63.9x looks rich versus the US Oil and Gas group at 13.3x, peers at 29.9x, and a fair ratio of 22.8x. Is this a mispricing or a warning that the cash flow model may be too optimistic?

Build Your Own Plains GP Holdings Narrative

If you see the numbers differently or prefer to test your own assumptions, it is quick to build a custom view, starting with Do it your way.

A great starting point for your Plains GP Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If Plains GP has sharpened your interest, do not stop here. Put a few more quality candidates on your radar now so you are not reacting later.

- Chase potential mispricing by scanning these 880 undervalued stocks based on cash flows that might offer attractive cash flow profiles at current prices.

- Spot fast moving themes by screening these 26 AI penny stocks that are tied to artificial intelligence trends across sectors.

- Build a cash focused watchlist by checking out these 12 dividend stocks with yields > 3% that currently offer income above 3% yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.